Stock Market Echoes of 1987 Crash: SocGen Strategist Warns of Devastating Blow

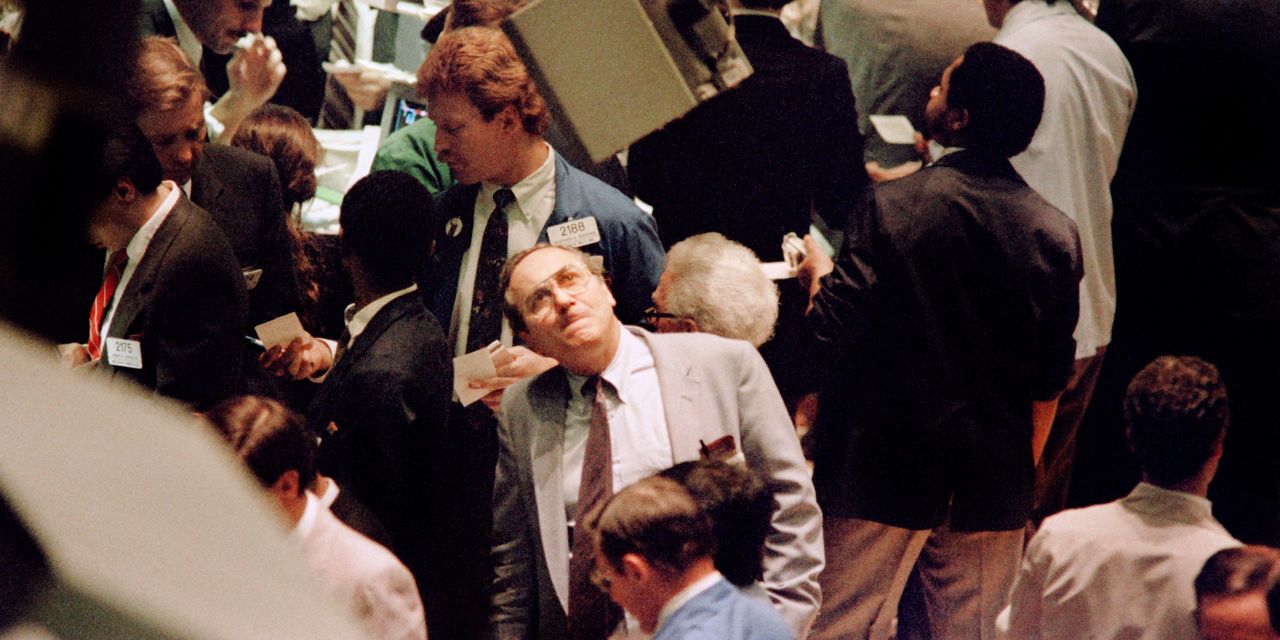

Société Générale strategist Albert Edwards warns that surging bond yields could deliver a "devastating blow" to stock markets, drawing parallels to the 1987 crash. He highlights the resilience of the equity market in the face of rising bond yields but cautions that any hint of a recession could be disastrous for stocks. Edwards points to recessionary signals such as falling trucking jobs, surging bankruptcies among smaller companies, and contracting money supply. He also emphasizes the importance of monitoring money supply weakness, which he believes has been disregarded by economists. J.P. Morgan Asset Management also warns of a potential "financial accident" caused by the yield rampage.

- 'Just like in 1987.' Here's what could deliver a 'devastating blow' to stocks, says SocGen strategist Albert Edwards. MarketWatch

- Stock Market Has 'Echoes' of 1987 Crash, Equities Risk Massive Blow Markets Insider

- Notes on “the face of fiscal dysentery” Financial Times

- Black Monday Echoes Scare Investors, While Japan Defends Yen Like Verdun Bloomberg

- Société Générale strategist Albert Edwards said sharemarket had 'echoes of 1987' crash The Australian Financial Review

- View Full Coverage on Google News

Reading Insights

0

0

2 min

vs 3 min read

81%

558 → 105 words

Want the full story? Read the original article

Read on MarketWatch