Chinese Stocks Tumble Amid Disappointing Economic Announcements

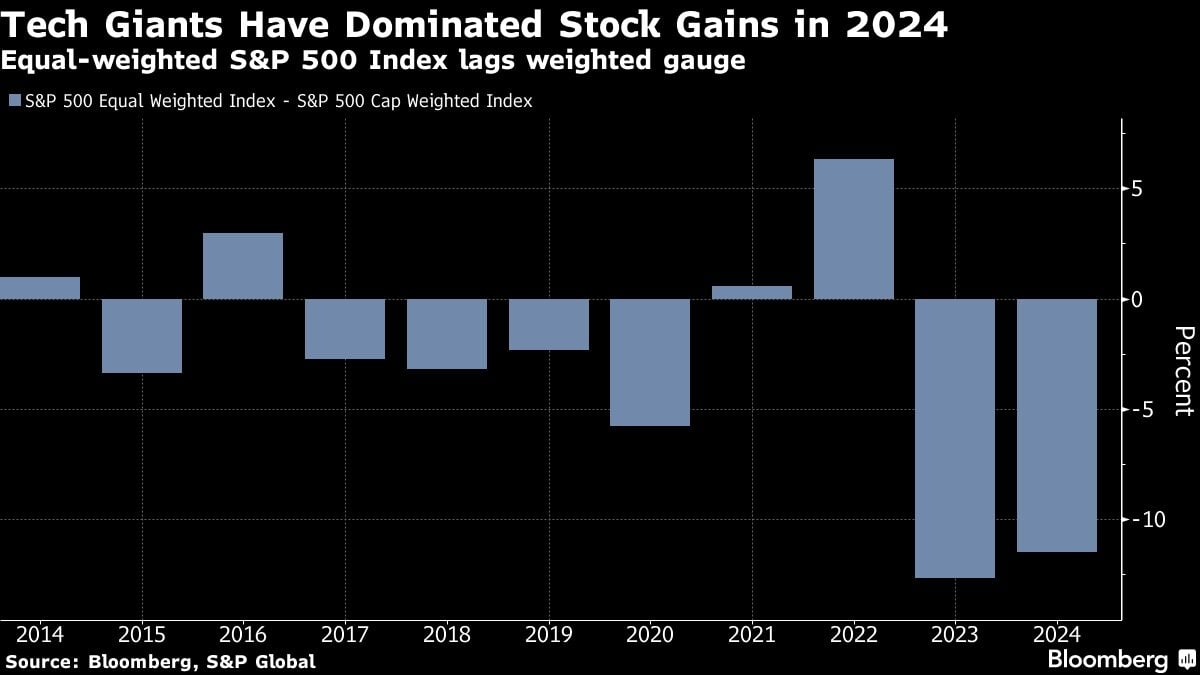

Tech stocks led gains in US equity futures, indicating a positive end to the week on Wall Street as traders anticipate the Federal Reserve's final interest-rate decision of the year. Despite a slight dip in European and Asian markets, US markets showed resilience, with Nasdaq 100 contracts rising 0.5%. The pound weakened following unexpected economic contraction in the UK, while global markets remained cautious after China's Central Economic Work Conference ended without detailed fiscal stimulus plans. European stocks are expected to underperform US stocks in 2025, amid political and economic challenges.