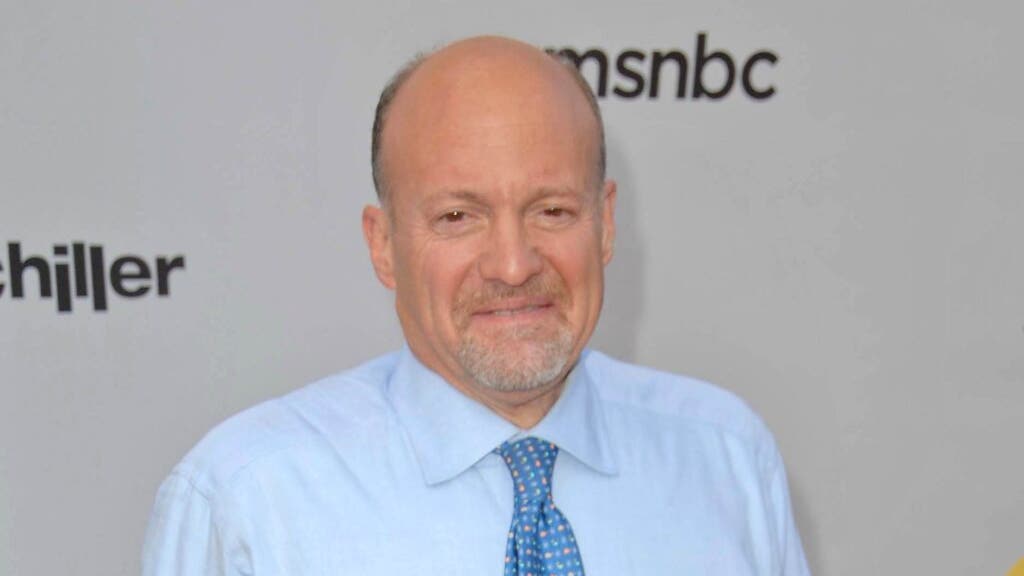

Jim Cramer's Investment Strategy Amidst Shifting Focus from Mega-Caps to New Market Leaders

Jim Cramer, the financial expert and host of "Mad Money," has a positive economic outlook for 2024, suggesting that the Federal Reserve's policies will favor a bullish market. He debunks recession predictions and advises investors to consider real estate for passive income and high-yield investments. Cramer recommends investing in JPMorgan Chase and General Motors, citing their strong performance and potential for growth. JPMorgan Chase has seen a significant increase in net interest income and has successfully integrated clients from the acquired First Republic Bank. General Motors is focusing on the electric vehicle market and has increased its dividend payouts, signaling confidence in its financial strategy.

- Jim Cramer's Economic Outlook: Recession Predictions Debunked, Here's Where To Invest Yahoo Finance

- Jim Cramer says new leaders will catch Wall Street's eye in January CNBC

- As Mega-Caps Become Less 'Magnificent', My Focus Is on a Group Less Traveled RealMoney

- Jim Cramer Tells Investors To 'Wait..For Sell-Off' As Buyers Temporarily Move Away From Magnificent Seven Benzinga

- Jim Cramer makes sense of the recent action in the Magnificent 7 MSN

Reading Insights

0

10

3 min

vs 4 min read

87%

801 → 105 words

Want the full story? Read the original article

Read on Yahoo Finance