Black Unemployment Rates Rise Amid Workforce Resegregation and Economic Challenges

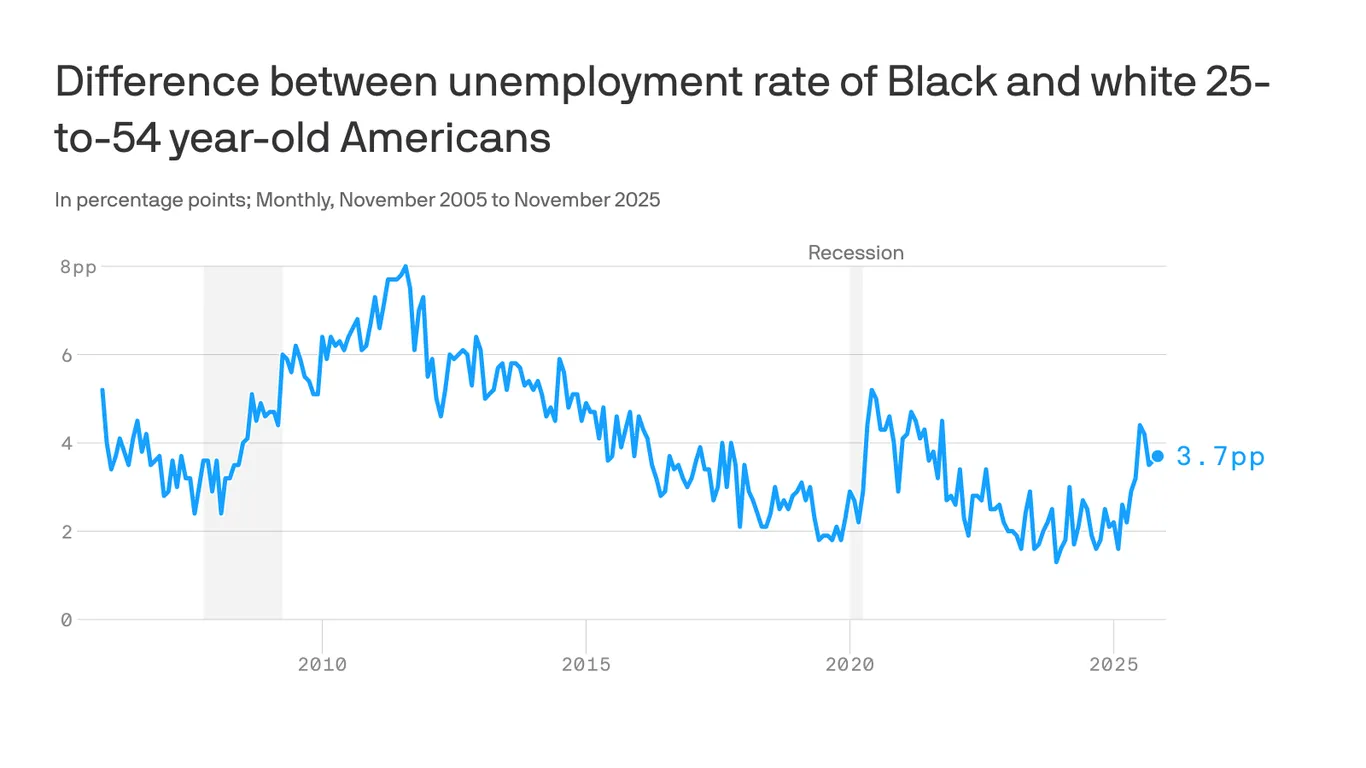

Black Americans are experiencing a worsening in employment conditions, with their unemployment rate rising sharply due to factors like shrinking federal jobs, reversing previous gains where Black-white employment gaps were at record lows, and highlighting ongoing racial disparities in the labor market.