EchoStar Faces Financial Turmoil Amid FCC Scrutiny and Missed Payments

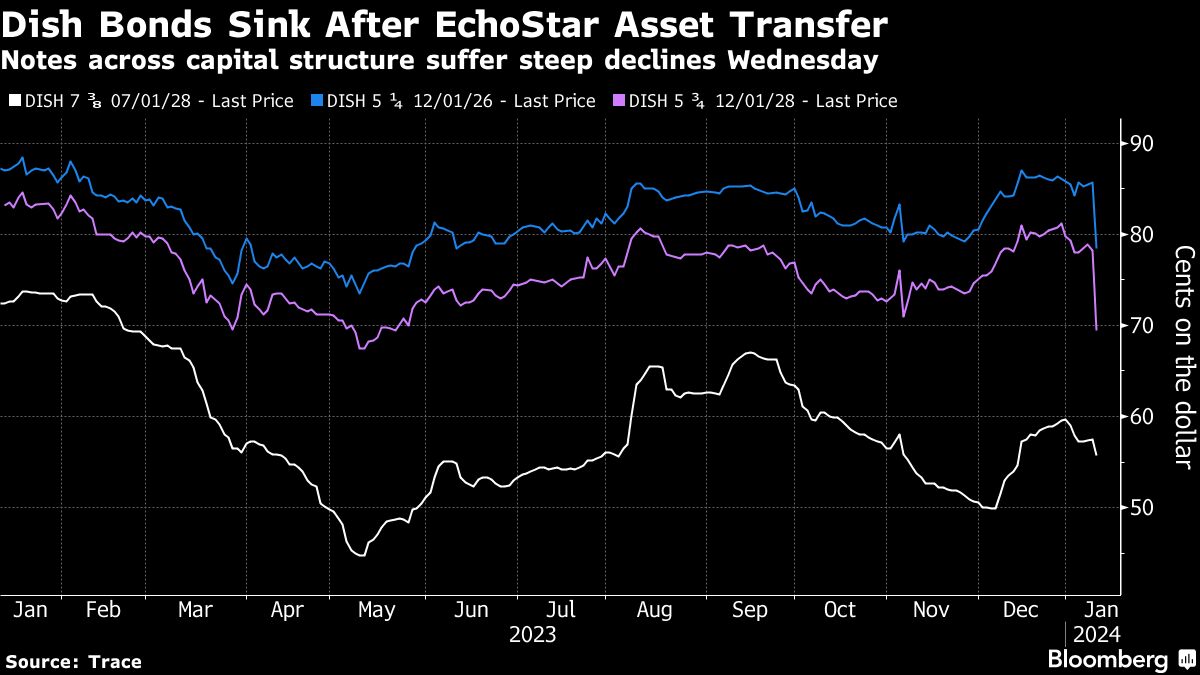

EchoStar Corporation, parent of DISH Network, faces potential bankruptcy after missing a $326 million interest payment amid FCC scrutiny over its 5G compliance, with the company’s future hinging on resolving regulatory issues and its ability to manage a massive $30.1 billion debt load.