EchoStar's Strategic Moves: From Spectrum Transfer to Merger Exploration

TL;DR Summary

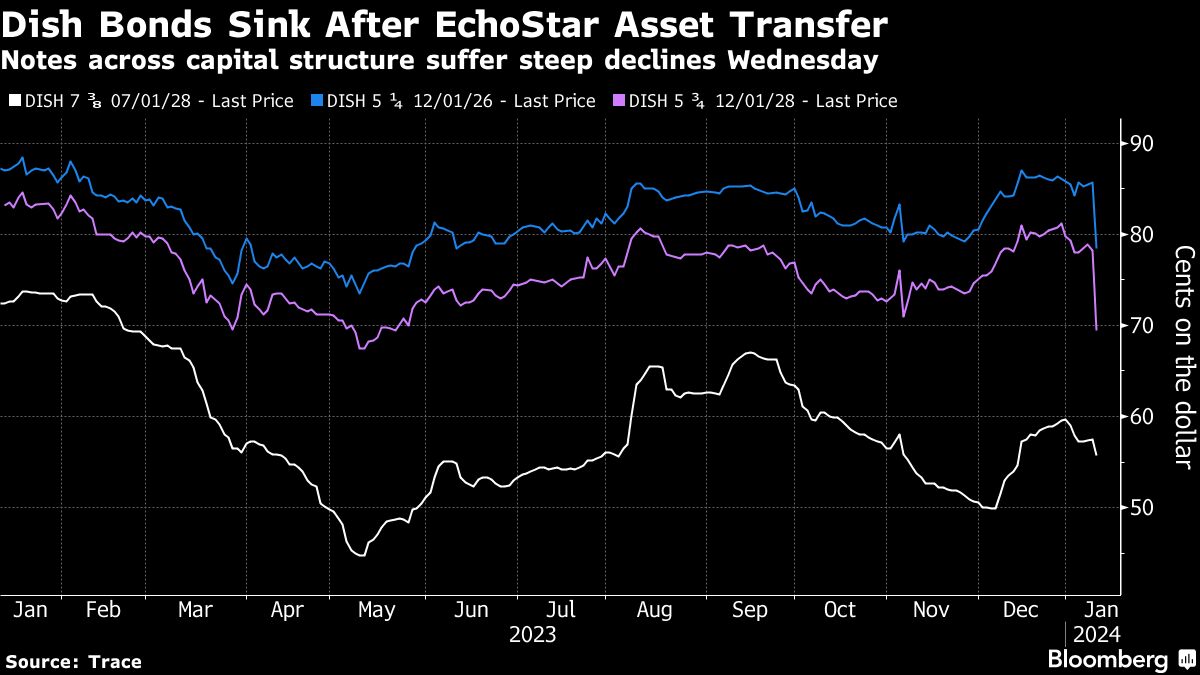

Dish Network Corp. bonds plunged after the company transferred valuable spectrum licenses into new subsidiaries, raising concerns among holders of its $20 billion debt. The move, which also involved freeing a unit holding 3 million television subscribers from debt covenants, is often seen as a precursor to money-raising deals that can weaken existing creditors' claims to collateral. This maneuver caused more of Dish's debt to fall into distressed levels, with $11.9 billion of its bonds trading at over 10 percentage points above Treasuries. Dish's merger with EchoStar earlier this year is part of its pivot from satellite television to wireless service.

- Dish Bonds Plummet on EchoStar Spectrum Transfer Maneuver Yahoo Finance

- EchoStar Stock Climbs After Hiring Advisers to Evaluate Options The Wall Street Journal

- Is EchoStar a buy after the Dish Network buyout? MarketBeat

- ECHOSTAR CORPORATION UNLOCKS INCREMENTAL STRATEGIC, FINANCIAL AND OPERATING FLEXIBILITY FOLLOWING COMPLETION OF MERGER WITH DISH NETWORK CORPORATION Yahoo Finance

- Dish Network Owner, After Sealing Merger, Exploring More Deal Options Hollywood Reporter

Reading Insights

Total Reads

0

Unique Readers

1

Time Saved

2 min

vs 3 min read

Condensed

76%

417 → 101 words

Want the full story? Read the original article

Read on Yahoo Finance