TSMC bets on an endless AI wave after record Q4 results

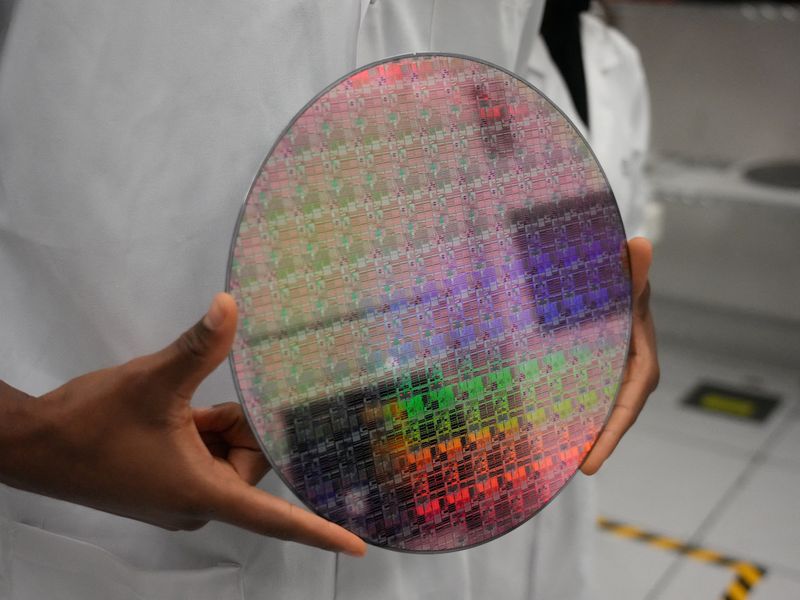

TSMC posted a record Q4 with net income of NT$505.7 billion (~$16 billion) and revenue of $33.7 billion, and CEO C.C. Wei said AI chip demand will persist for years. The company projects about 30% revenue growth in 2026 and plans $52–$56 billion in capital expenditure, backed by checks with cloud providers confirming real demand amid AI-market chatter. The results underscore TSMC’s central role in the AI chip supply chain and come as US-Taiwan trade ties push expansion, including Arizona fabs.