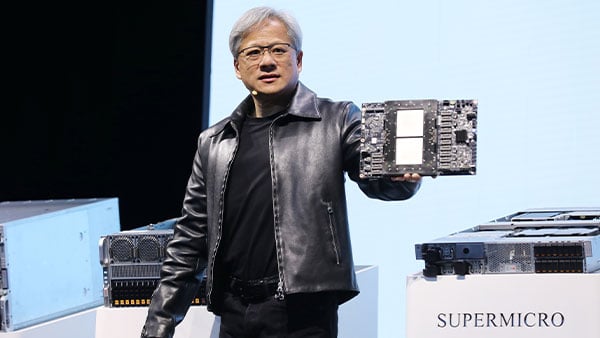

Nvidia Eyes a Route to $300 on AI-Chip Momentum

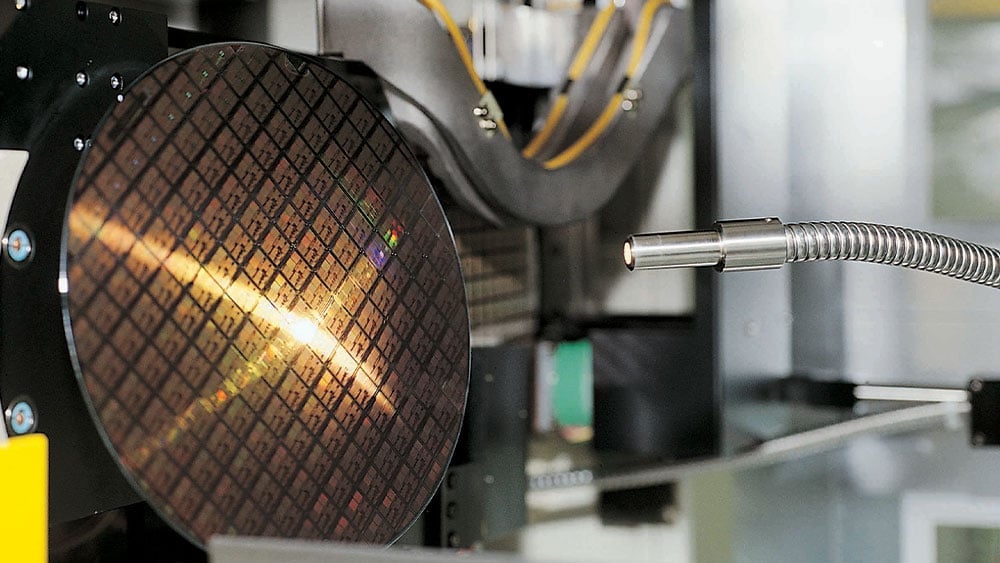

NVDA has been flat over six months but remains positioned for upside thanks to rising AI-chip demand, a growing backlog, and targeted gross margins in the mid-70s% for fiscal 2027. Analysts expect roughly 65% EPS growth in FY2027 and about 28% in FY2028, aided by next-gen Vera Rubin chips; if the stock maintains around a 30x earnings multiple, a move toward $300 is possible. The shares, around $183, come ahead of the Feb. 25, 2026 earnings release.