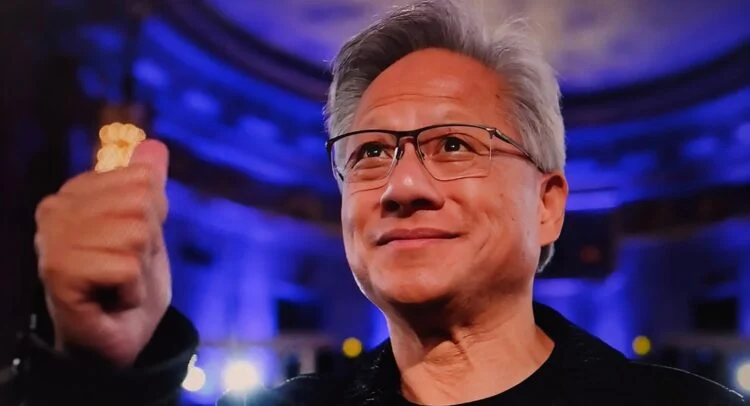

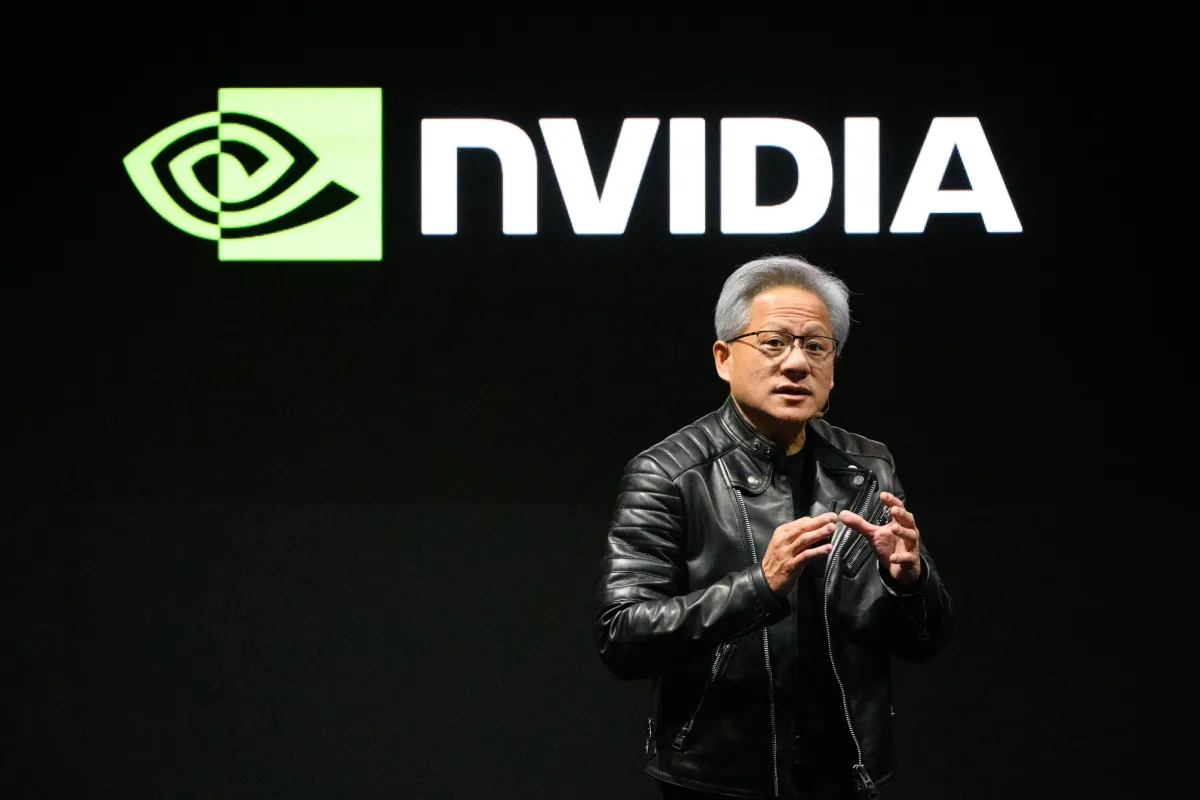

Agentic AI sparks Nvidia’s chip demand, Huang says

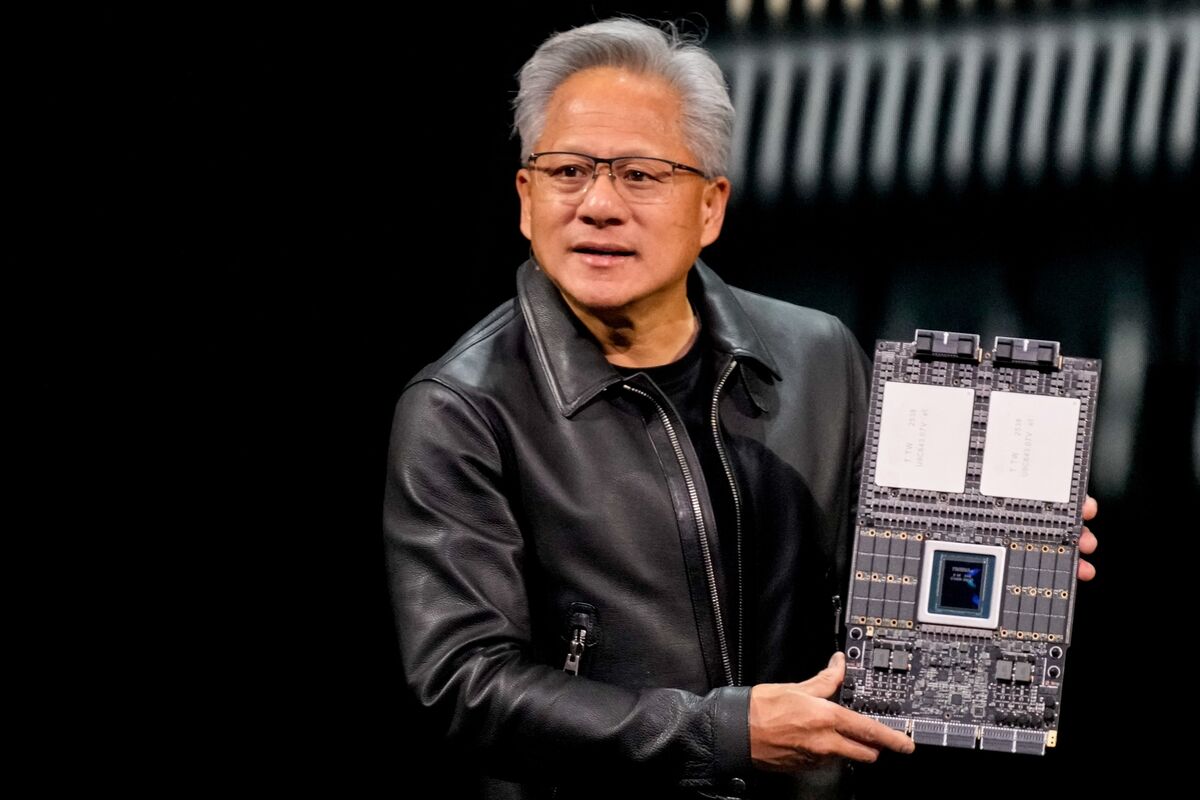

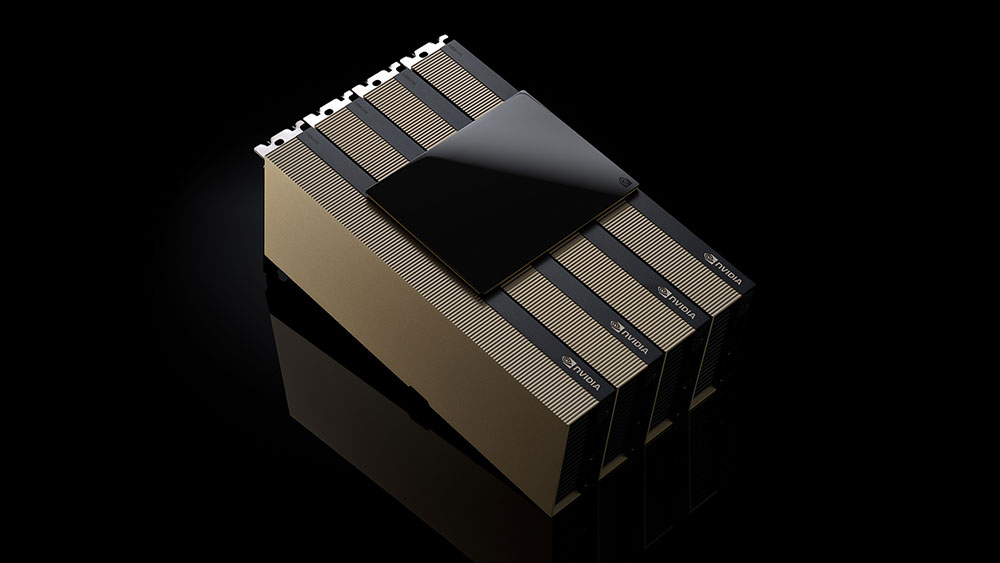

Nvidia CEO Jensen Huang says demand for compute power is growing exponentially as enterprises adopt agentic AI, calling Nvidia’s Blackwell platform and NVLink the current king of inference and signaling that the Rubin platform should deliver similar cost efficiency.