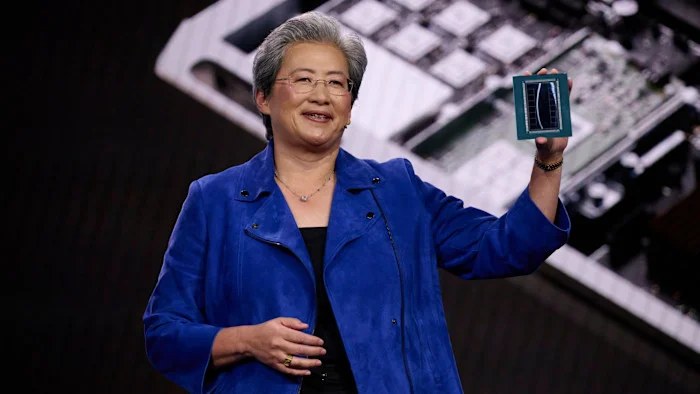

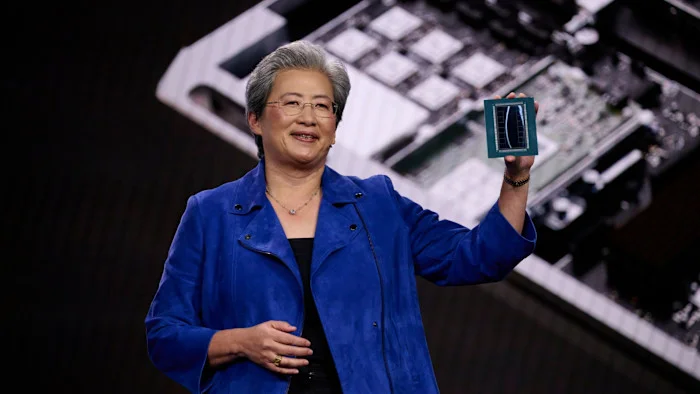

AMD bets on Meta’s clout to power its data-center ambitions

AMD inks a strategic, warrant‑heavy deal with Meta to supply Instinct AI chips for Meta’s data centers and signal a broader push to win over other hyperscalers; the arrangement could help AMD hit a tenfold data‑center revenue target by 2030, but the upside relies on Meta’s adoption and on rival AI‑chip demand amid competition and the cost of warrants.