TSMC Surges on Strong Q4 Revenue and Analyst Upgrades

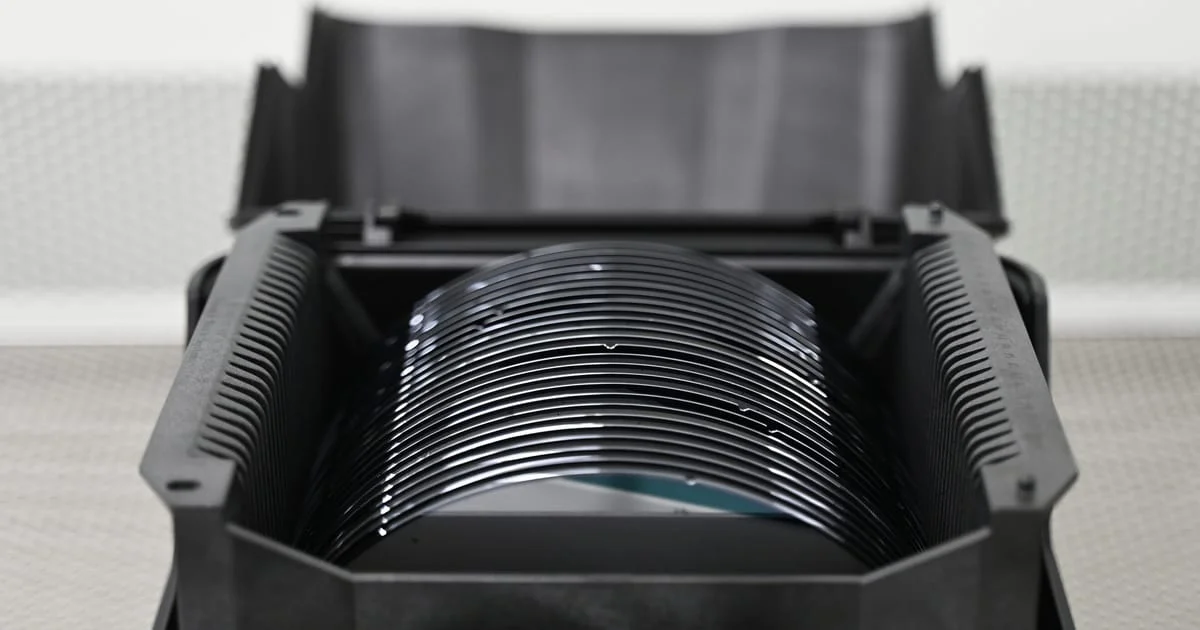

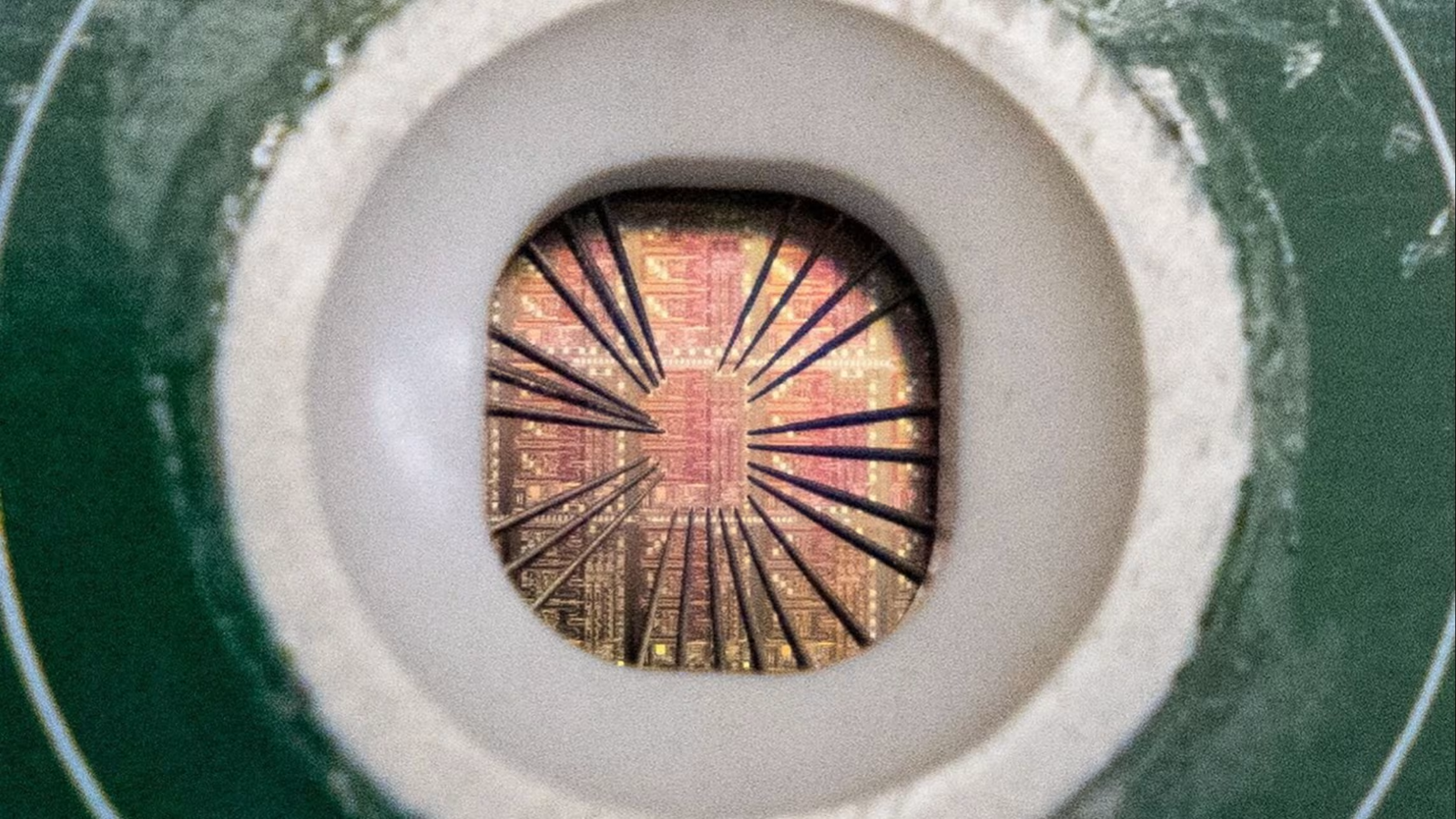

TSMC, the world's largest contract chipmaker, reported a Q4 revenue of T$1,046.08 billion ($33.05 billion), surpassing forecasts and increasing 20.45% year-over-year, driven by rising interest in AI applications.