Businesshealthcare News

The latest businesshealthcare stories, summarized by AI

Featured Businesshealthcare Stories

"UnitedHealth Faces Profit Hit and Investor Concerns Amid Cyberattack Fallout"

UnitedHealth Group's CEO Andrew Witty acknowledged that the company underestimated the impact of a cyberattack on its subsidiary Change Healthcare, which has cost the company $1.1 billion in Q2 alone and is now expected to have a total impact of up to $2.3 billion by 2024. Despite the setback, UHG's revenues grew by 7% in Q2, and the company is leveraging AI to improve efficiency.

More Top Stories

"US Pharmacies in Crisis: Closures and Access Issues Nationwide"

Yahoo Finance•1 year ago

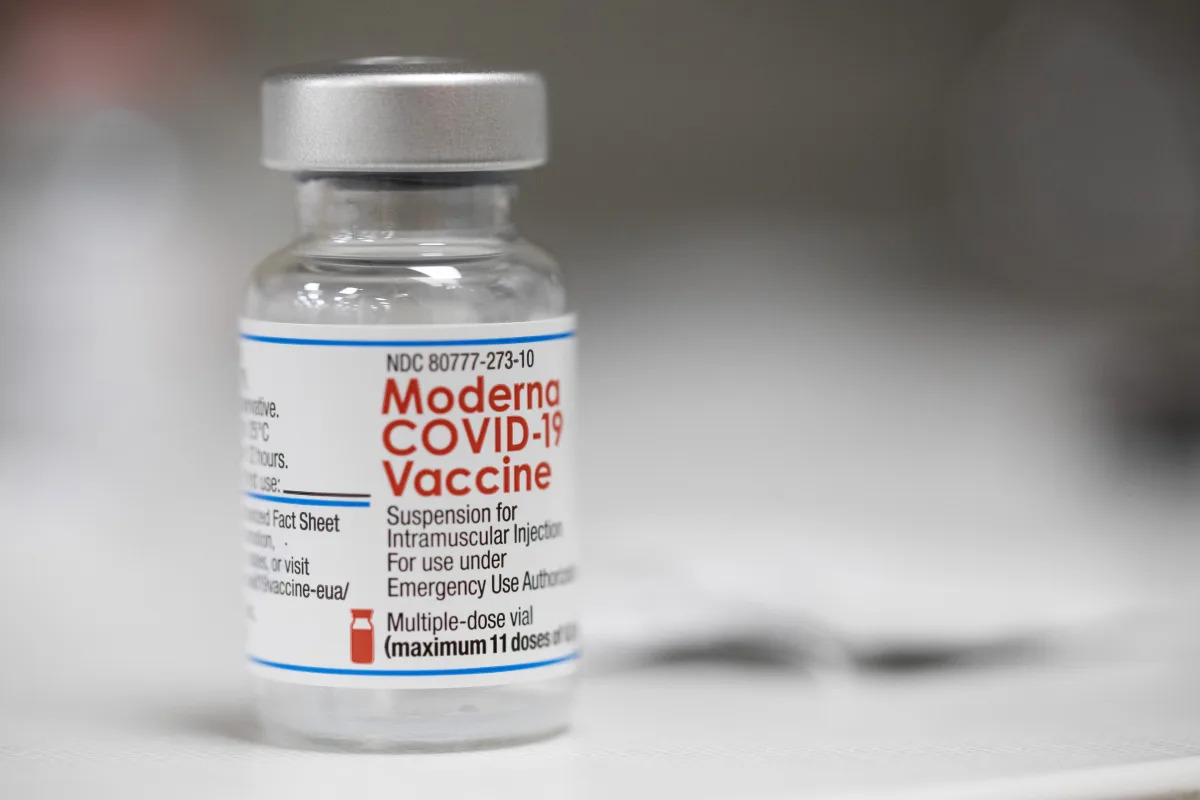

Moderna's RSV Vaccine for Seniors Gains FDA Approval

Investor's Business Daily•1 year ago

More Businesshealthcare Stories

Insmed Stock Skyrockets on Breakthrough Lung Disease Drug Success

Insmed's stock surged 135% after announcing successful Phase 3 trial results for brensocatib in treating non-cystic fibrosis bronchiectasis, showing significant reductions in pulmonary exacerbations. The company plans to file for FDA approval in late 2024, with potential U.S. launch in mid-2025 and subsequent launches in Europe and Japan.

"Vir Biotechnology's Struggle: Can Investing in Infectious Disease Pay Off?"

Venture capitalist Bob Nelsen approached industry veteran Vicki Sato nearly a decade ago with the idea of launching a company dedicated to combating infectious diseases, a concept that seemed financially risky given the trend of biotech companies pulling out of infectious disease research. Sato, who had worked on HIV and hepatitis C drugs at Biogen and Vertex, was initially skeptical but ultimately joined the venture, leading to the formation of Vir Biotechnology, which has since faced the challenges of balancing financial viability with the pursuit of infectious disease treatments.

Johnson & Johnson's $13.1 Billion Shockwave Medical Acquisition Strengthens MedTech Business

Johnson & Johnson has agreed to acquire Shockwave Medical for $12.5 billion, expanding its portfolio of medical devices for treating heart diseases. The deal gives J&J access to Shockwave's catheter-based treatment using shockwaves to break down calcified plaque in heart vessels, complementing its focus on building its cardiac health business. This acquisition follows J&J's previous purchases in the heart device sector and is expected to close by mid-2024, financed through a combination of cash and debt.

"Viking Therapeutics' Weight-Loss Pill Shows Promising Phase 1 Results, Stocks Soar"

Viking Therapeutics' stock surged over 25% after reporting positive Phase 1 results for its oral weight-loss drug, showing up to 5.3% weight loss in patients with minimal side effects. The company plans to launch the drug into Phase 2 trials later this year, following strong results from its injectable version. Analysts view the data as a "clear win" and believe the drug has best-in-class potential, positioning it to compete with current market leaders in the weight-loss drug space.

Viking Therapeutics' Weight-Loss Drug Trial Results Propel Stock to Soar

Viking Therapeutics' stock surged 80% after positive results from a mid-stage trial of its experimental weight loss drug, VK2735, which showed significant weight loss in patients with obesity or overweight. The drug, targeting GLP-1 and GIP hormones, demonstrated promising initial results with encouraging safety and tolerability. Analysts suggest potential acquisition interest from larger pharmaceutical companies, as the weight loss drug market is projected to grow into a $100 billion industry.

"Moderna's Transition Year Leads to Profit Despite Decline in COVID Vaccine Sales"

Moderna CEO Stéphane Bancel anticipates a year of growth in 2024 after a transition year in 2023, which saw COVID-19 vaccine sales of $6.8 billion. Despite a decrease from the prior year's $18 billion, ongoing demand for the vaccine is expected to drive revenues of $4 billion in 2024. Bancel emphasizes the importance of increasing vaccination rates, particularly among the elderly, and highlights the potential for COVID vaccines in preventing long-term unemployment due to long COVID effects. Moderna is also awaiting FDA decision on its RSV vaccine for older adults and continuing research on a combination flu and COVID vaccine, as well as a cancer vaccine in partnership with Merck.

"FDA Greenlights Revolutionary Cell Therapy for Advanced Melanoma"

Iovance Biotherapeutics' stock surged after the FDA granted accelerated approval to its T cell immunotherapy, Amtagvi, for treating advanced melanoma. Amtagvi is the first one-time T cell therapy approved for solid tumor cancer and the first treatment option for advanced melanoma that has progressed after prior anti-PD-1/L1 therapy. The approval addresses the unmet needs of melanoma patients and provides a significant commercial opportunity for Iovance. The company is also evaluating Amtagvi for frontline advanced melanoma and other solid tumors. However, the approval comes with a boxed warning for treatment-related risks.

"Moderna's RSV Vaccine Efficacy Decline Sparks Stock Slide"

Moderna's shares dropped 7% as analysts expressed concerns over the faster decline in efficacy of its RSV vaccine compared to competitors GSK and Pfizer, with data showing a drop from 84% to 63% after 8.6 months. Moderna cautioned against direct comparisons, citing different trial methodologies, but analysts raised questions about the competitive profile of its vaccine. GSK and Pfizer's vaccines also showed declines in efficacy over time, with both companies exploring the possibility of at least two years of efficacy.

"Oakland Employers Implement Safety Measures for Workers Amid Crime Surge"

Blue Cross/Blue Shield and Kaiser Permanente in Oakland have implemented safety measures for employees due to a surge in crime, including staying inside for lunch and arranging rides to work. The move comes after a 21% increase in violent crime in Oakland last year, prompting concerns among residents and business owners. The city has seen a rise in robberies, burglaries, and car thefts, leading to businesses like In-N-Out Burger closing due to safety concerns. Oakland's mayor denies that her policies are the sole cause of rising crime rates, while police officers express frustration with restrictive rules that limit their ability to curb crime.

"The Decline of Wall Street's Concern Over Weight Loss Drug Craze Impact"

Wall Street's fears of weight loss drugs impacting medical device and food and beverage stocks have subsided, with analysts noting a lack of concern at recent conferences. The popularity of GLP-1 drugs like Novo Nordisk's Wegovy and Eli Lilly's Zepbound continues to grow, but concerns about their long-term impact on industries have eased. Medical device sales have actually surged due to increased interest in continuous glucose monitoring devices, while some pharmaceutical companies, like Sanofi, are not pursuing the trend. Food and beverage stocks, including McDonald's, have rebounded, and restaurant demand remains strong, with factors like side effects and limited insurance coverage for weight loss drugs mitigating potential negative impacts.