Private debt fund vows withdrawals won’t reopen, echoing Bear Stearns era concerns

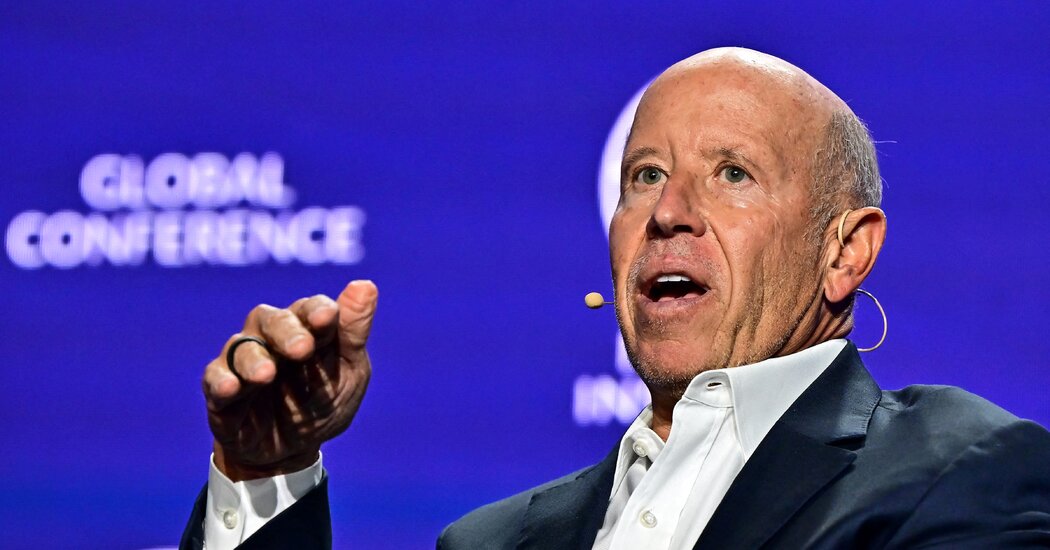

Blue Owl Capital Corp. II, a $1.6 billion private-debt fund, has abandoned plans to resume withdrawals and will return about 30% of NAV this quarter after its manager sold $1.4 billion of loans to large pension and insurance buyers (including $600 million from the fund). Mohamed El-Erian weighed in on the development, drawing Bear Stearns parallels and warning of broader risks in private credit, even as related Blue Owl vehicles trade well below NAV and the parent’s stock has tumbled.