Starwood REIT Limits Withdrawals Amid Cash Crunch

TL;DR Summary

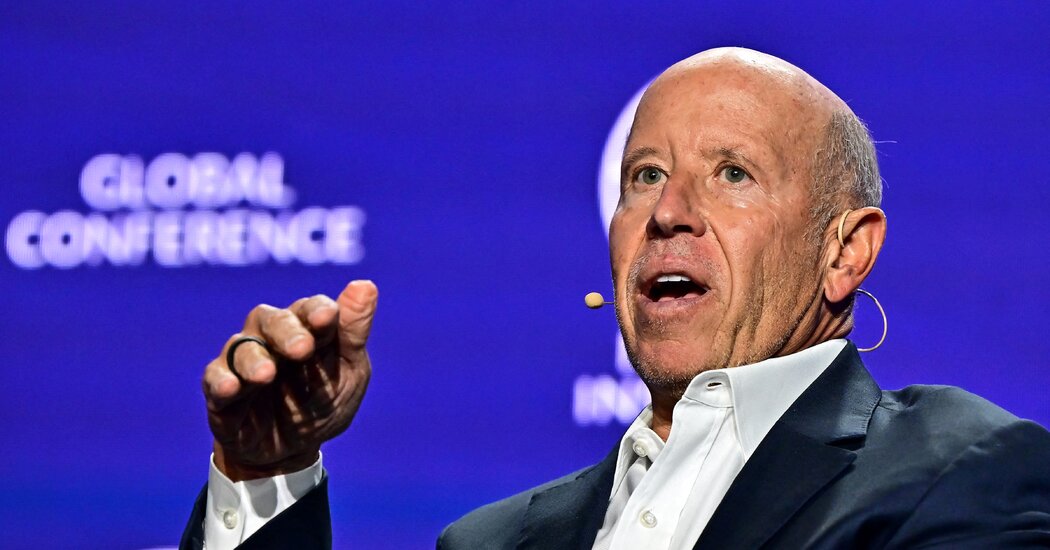

Starwood Real Estate Income Trust, managed by Barry Sternlicht's Starwood Capital Group, is limiting investor withdrawals to 1% of the fund's assets per quarter due to a potential cash crunch caused by high interest rates and declining commercial property values. This move aims to avoid selling properties at discounted prices and reflects the challenges faced by real estate investment trusts in the current market.

- Starwood REIT, Facing a Possible Cash Crunch, Limits Withdrawals The New York Times

- Starwood REIT Tightens Investor Redemption Limits to Preserve Liquidity Bloomberg

- Starwood Capital limits redemptions in struggling $10bn property fund Financial Times

- A $10 Billion Real-Estate Fund Is Bleeding Cash and Running Out of Options The Wall Street Journal

- One Of America's Biggest REITs Is Seriously Strapped For Cash Yahoo Finance

Reading Insights

Total Reads

0

Unique Readers

1

Time Saved

2 min

vs 3 min read

Condensed

86%

474 → 64 words

Want the full story? Read the original article

Read on The New York Times