First Brands Faces Financial Crisis and Restructuring Challenges

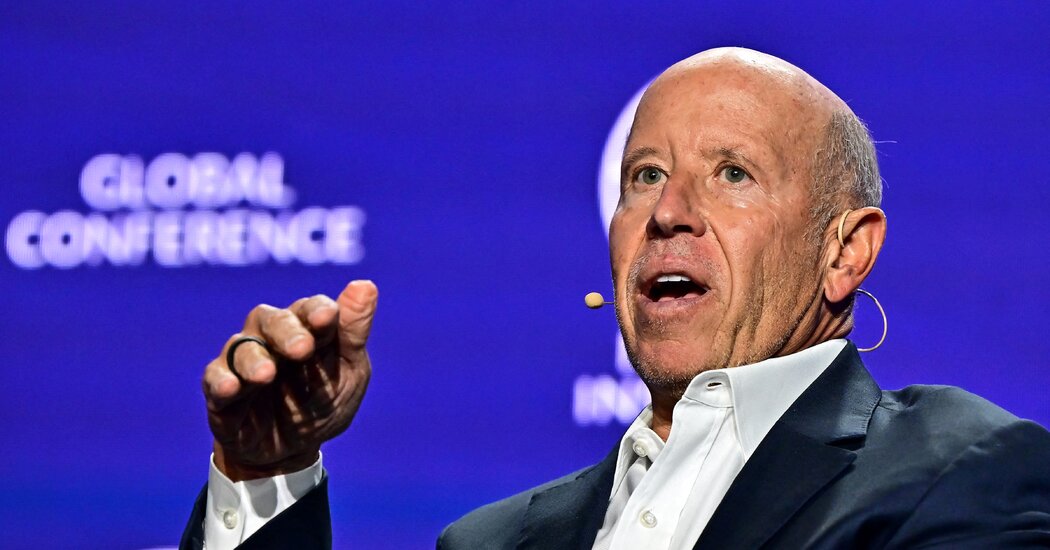

First Brands Group's financial situation has worsened significantly after funds were seized during a bank transfer, pushing the US auto parts supplier closer to bankruptcy. The company, which has amassed up to $10 billion in debt and off-balance-sheet funding, is negotiating a large rescue loan amid chaotic debt trading and scrutiny over its collateral and financing practices. The situation is further complicated by investigations and the involvement of major banks like Wells Fargo and Truist, with the company's owner, Patrick James, having a controversial history.