Taiwan Semiconductor's 2026 Outlook: The Stock to Watch for the Next Decade

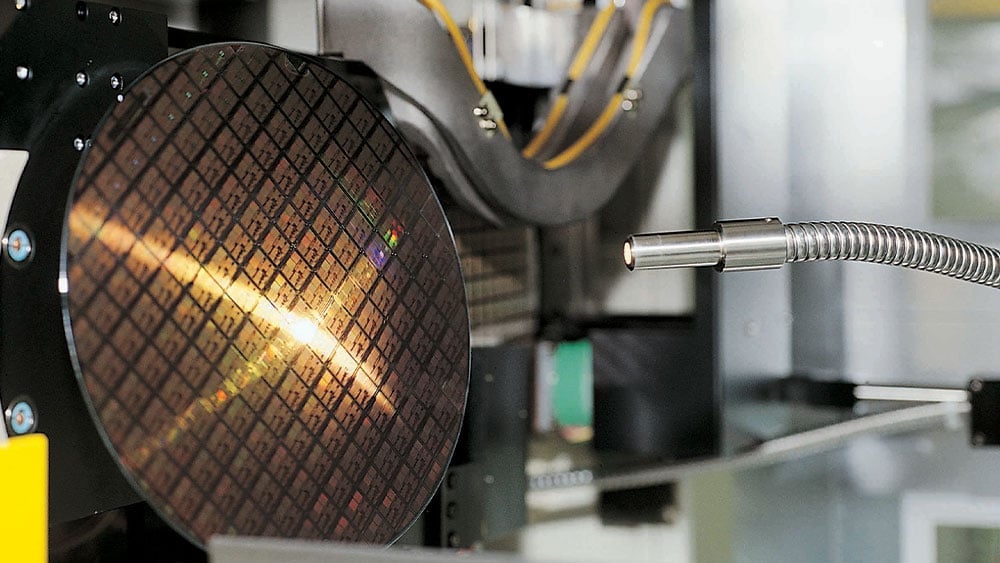

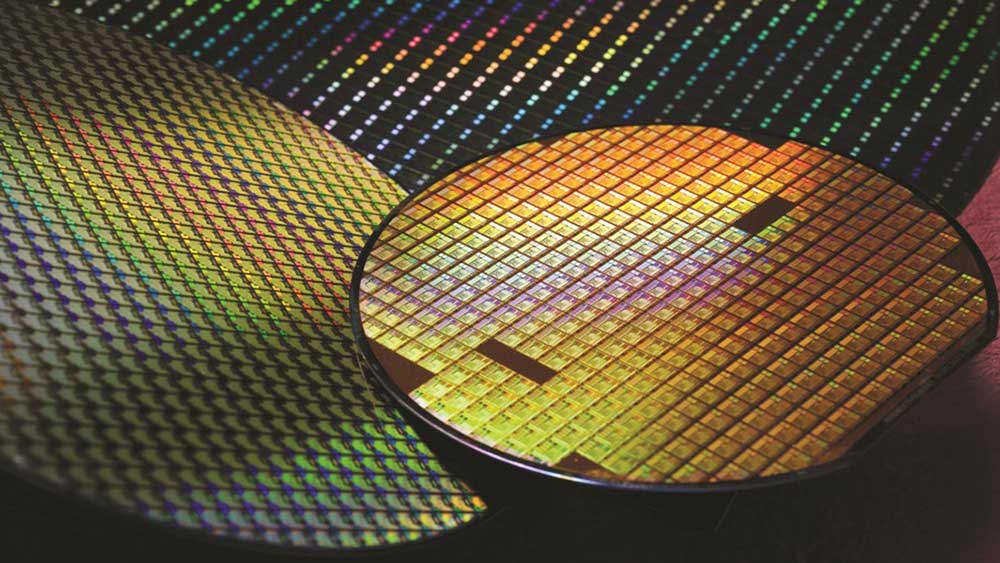

Investors are eyeing Taiwan Semiconductor Manufacturing (TSM) as a key stock for 2026, with its technical pattern indicating potential bullish momentum if it breaks above $311. While U.S. stocks had a quiet end to 2025, TSM's performance and upcoming chip price hikes, amid geopolitical risks, make it a significant indicator for the tech sector's future.