AI Stock Index Signals Potential Bubble Amid Market Turmoil

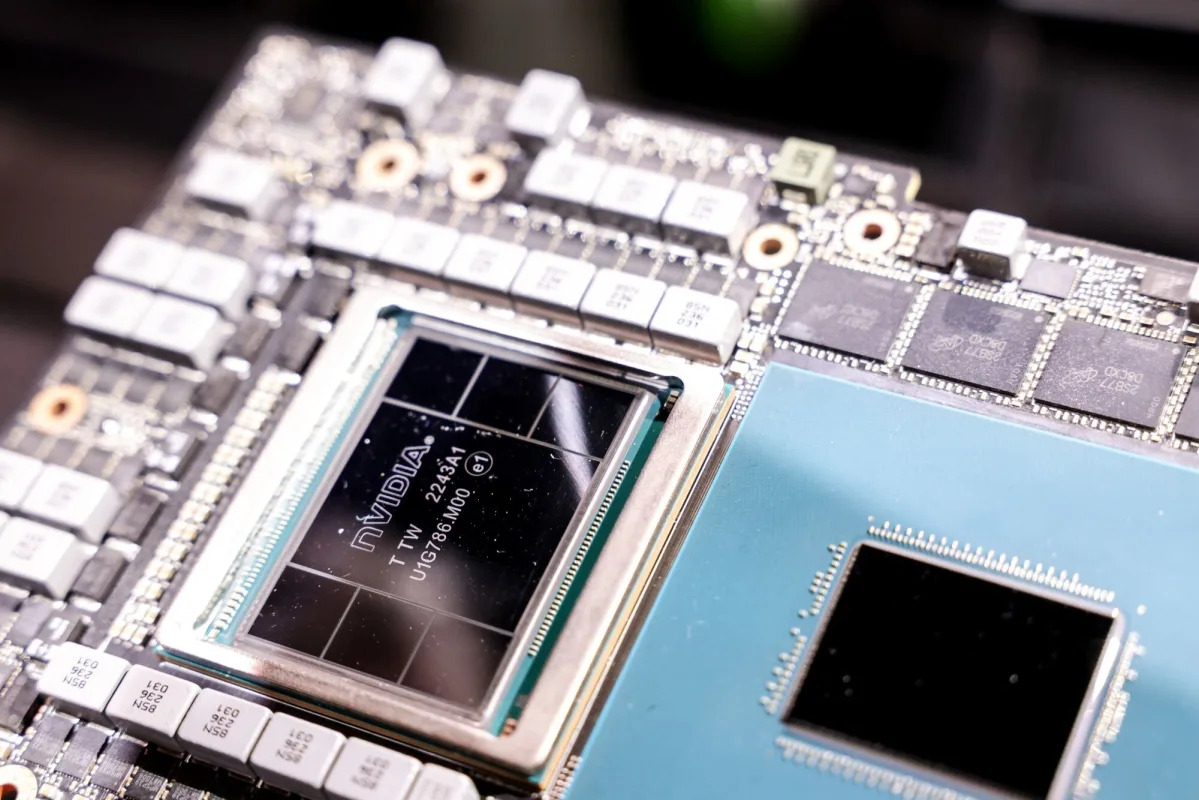

A market strategist warns that the AI-driven rally in stocks may be creating a bubble, especially as semiconductor stocks lag behind the broader market, and economic signals suggest a late-cycle phase with potential recession risks, indicating the rally could be unsustainable.