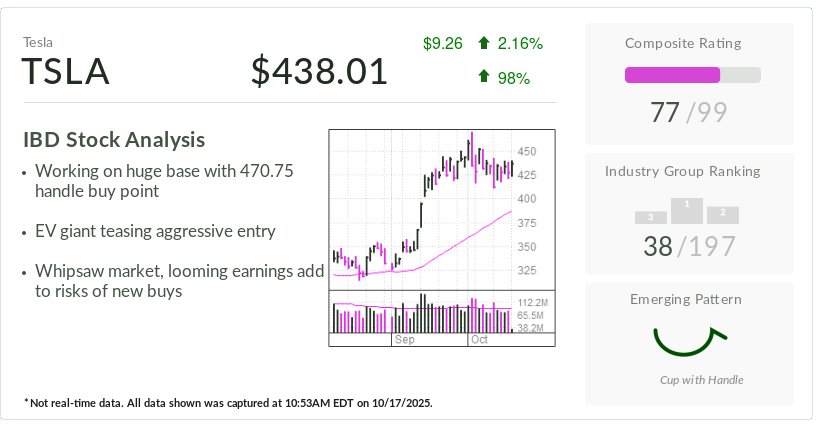

Tesla Plans Sub-$30K Cybercab by 2027, First Unit Produced at Giga Texas

Elon Musk announced that Tesla plans to sell a consumer version of the Cybercab for under $30,000 by 2027, with the first unit produced at Giga Texas and early output expected to be slow before a ramp-up. The news follows Burned skepticism from tech influencer MKBHD, and Wall Street analysts mostly rate TSLA as a Hold with a ~$396.80 target.