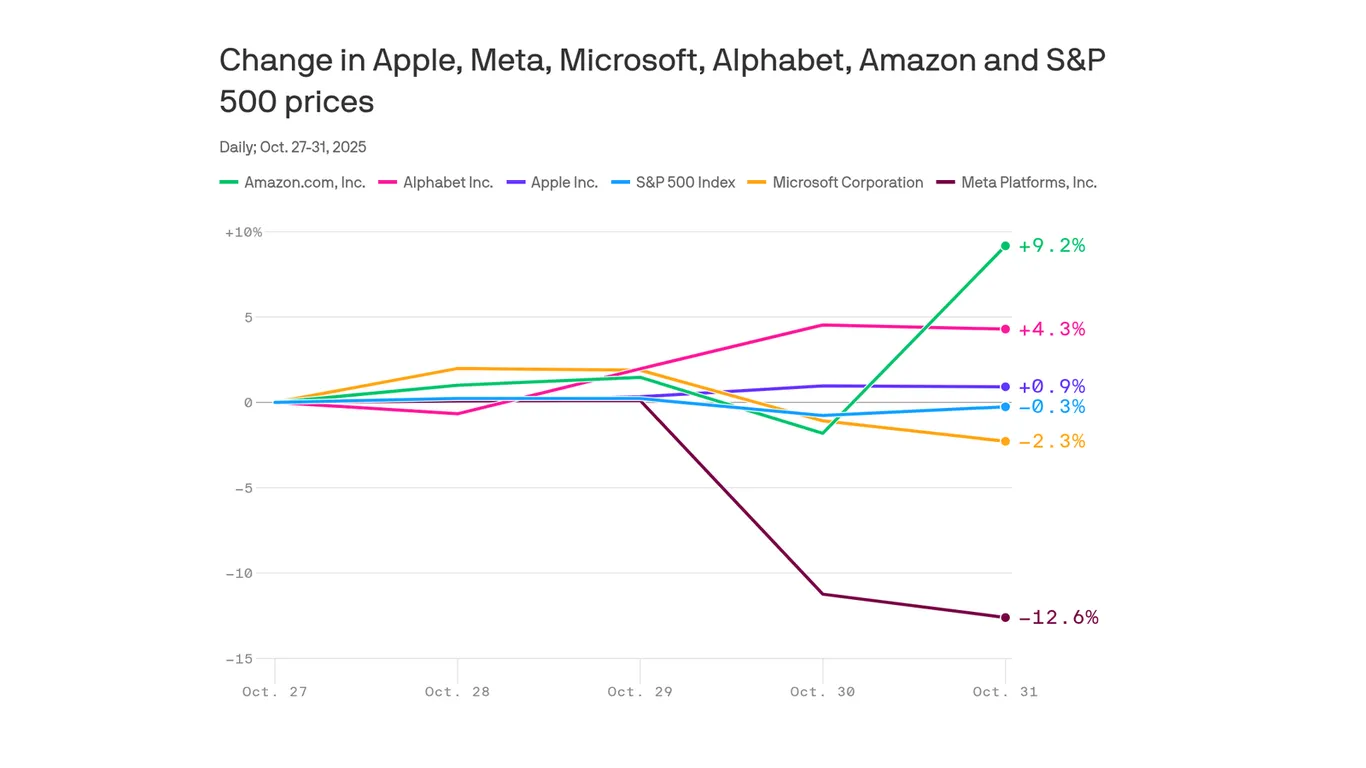

Moody's flags risk in a $662B data-center push led by five giants

Moody's warns that roughly $662 billion in planned data-center expansion is highly concentrated among five firms, creating material concentration risk for lenders and investors if demand weakens, financing tightens, or supply chains falter; the piece emphasizes potential impacts on project financing, asset valuations, and the broader tech infrastructure buildup.