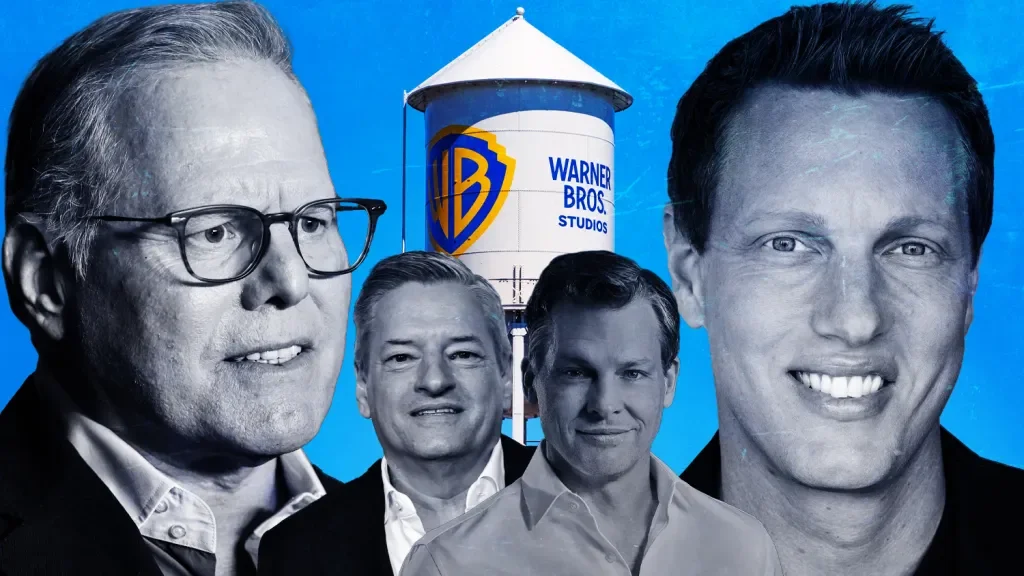

Ellison's High-Stakes Bid: Skydance Eyes Warner Bros. Takeover

Paramount Skydance chief David Ellison has pressed a high-stakes bid to acquire Warner Bros. Discovery, including a hostile tender offer and talks with Netflix; while Skydance’s box-office legacy is anchored by Tom Cruise-led franchises, many films carry big budgets with uneven profitability, making a WBD takeover a potentially transformative move for both studios.