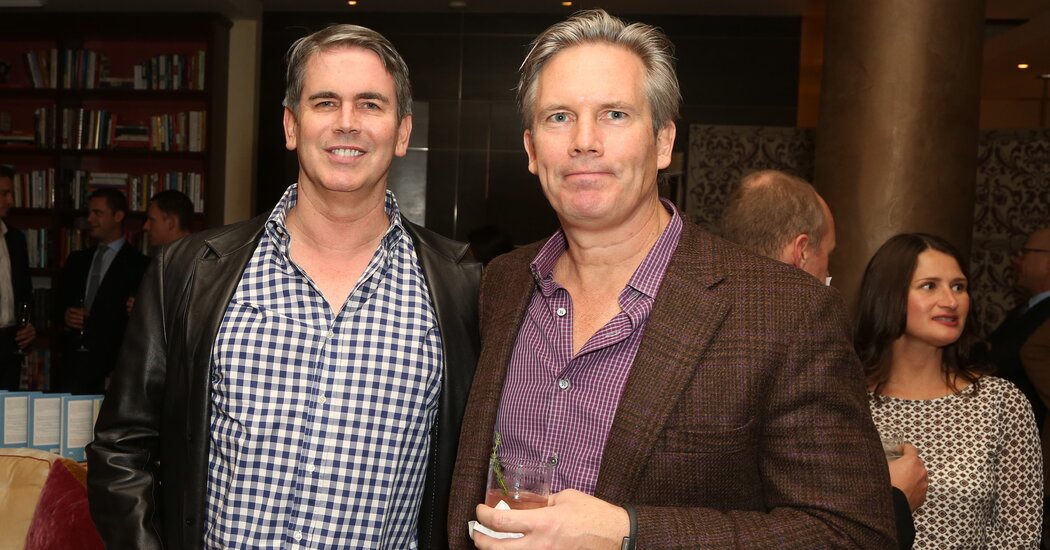

IRS Leadership Turmoil: The Clash and the Ouster of Key Officials

Billy Long's brief tenure as IRS commissioner ended quickly after he began to assert his authority, with Treasury Secretary Scott Bessent seeking greater control over the agency, highlighting internal power struggles shortly after Long's appointment by President Trump.