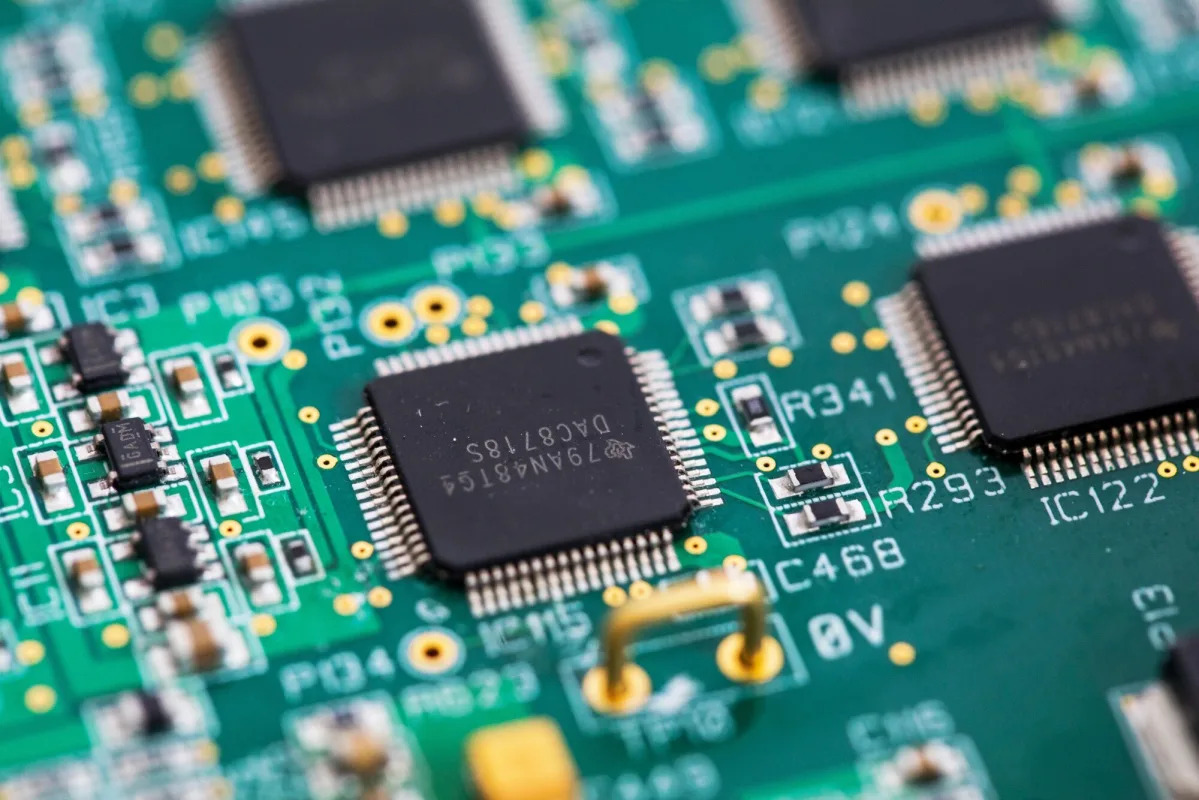

TI to buy Silicon Labs for $7.5B to boost analogue-chip portfolio

Texas Instruments is acquiring Silicon Laboratories in an all-cash deal valued at about $7.5 billion (including debt), expanding TI's analogue‑chip lineup and wireless connectivity capabilities with a closing expected in the first half of 2027 pending regulatory approval.