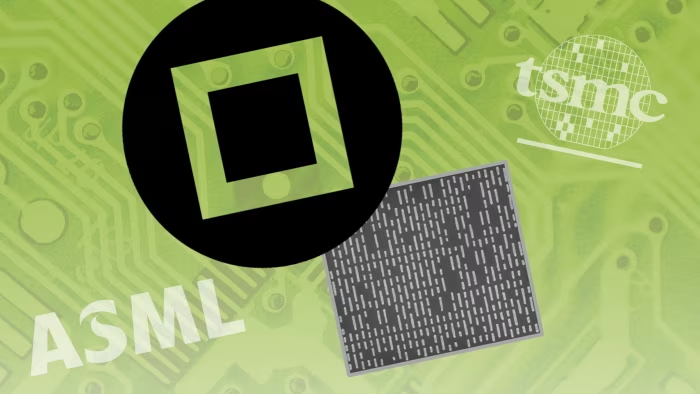

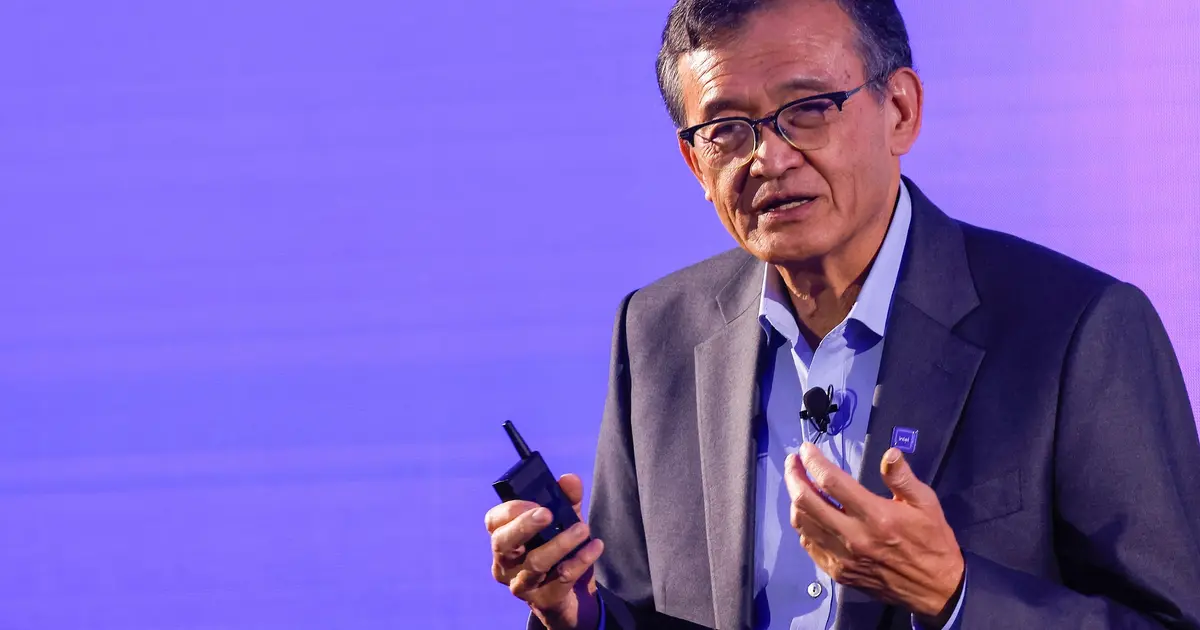

U.S. Extends TSMC's Import License for China

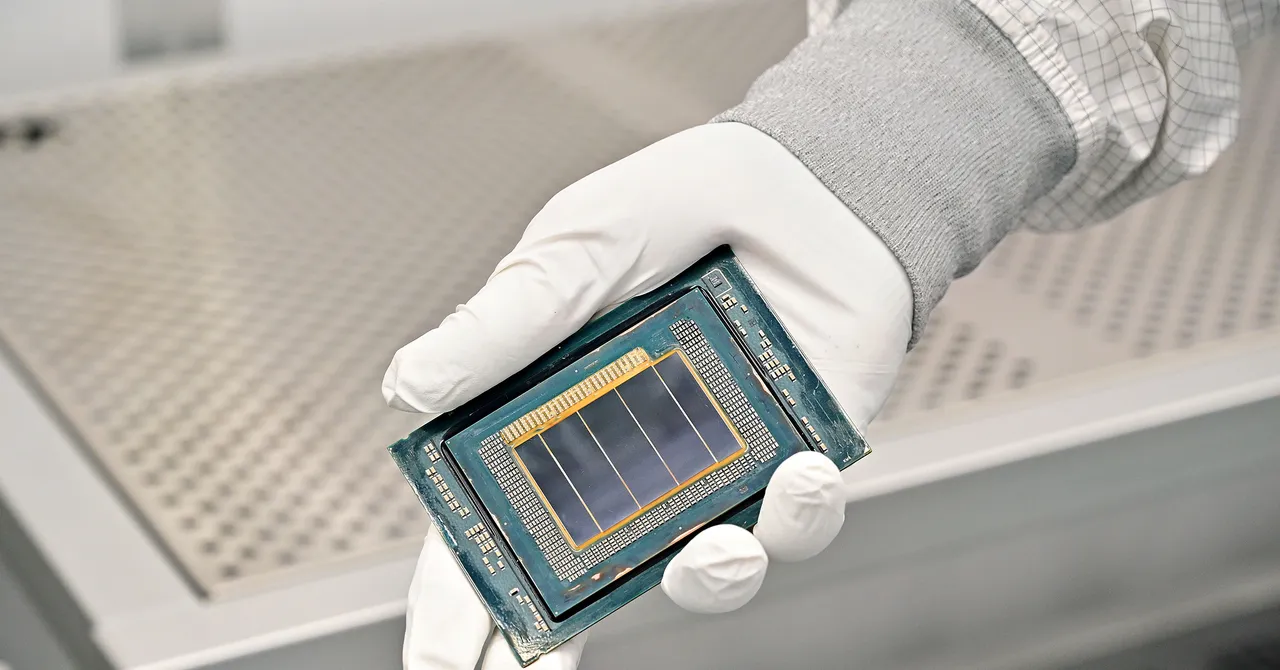

The U.S. government has granted TSMC an annual license to import U.S. chipmaking tools into its Nanjing facility in China, ensuring uninterrupted operations and deliveries, as part of a shift from previous exemptions that expired at the end of 2023. This license allows TSMC to continue producing chips, including mature node chips, at its Nanjing plant, which contributes about 2.4% to its revenue.