Texas Instruments Faces Industrial Chip Slump, Misses Q1 Revenue Estimates

TL;DR Summary

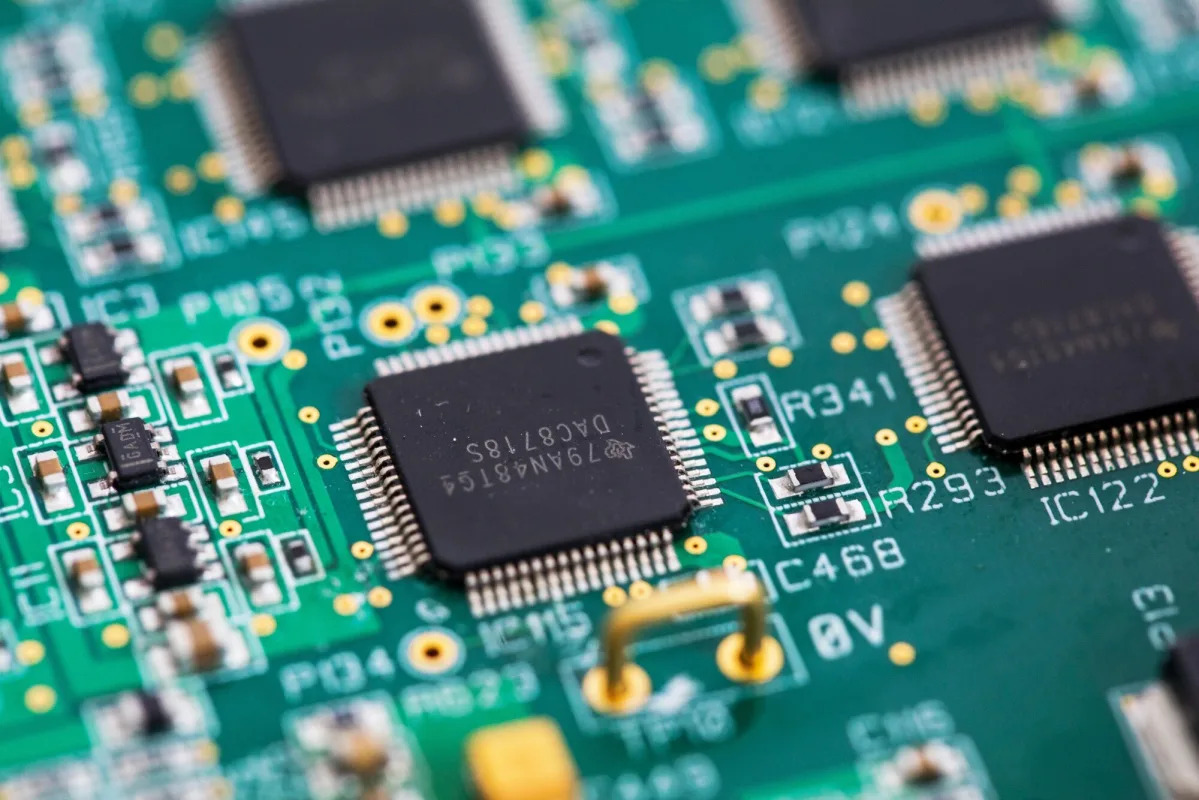

Texas Instruments Inc. shares dropped after the chipmaker issued a disappointing quarterly forecast, reflecting a continued decline in demand for industrial and automotive electronic components. The company's first-quarter sales are projected to be lower than analyst estimates, signaling a prolonged slump in key sectors. While Texas Instruments is the largest maker of analog semiconductors, it faces challenges in profitability due to its ambitious plan to upgrade factories. Despite the downturn, the company remains committed to its long-term strategy and is confident about semiconductor content growth in auto and industrial sectors.

Topics:business#automotive-electronics#industrial-chips#quarterly-forecast#semiconductor-industry#technology#texas-instruments

- Texas Instruments Signals Slump in Industrial Chips Drags On Yahoo Finance

- Texas Instruments drops as industrial weakness impacts Q4 results, guidance Seeking Alpha

- Texas Instruments kicks off chip earnings season with some words of caution MarketWatch

- Texas Instruments Q1 revenue misses estimates Yahoo Finance

- TI reports Q4 2023 and 2023 financial results and shareholder returns PR Newswire

Reading Insights

Total Reads

0

Unique Readers

1

Time Saved

3 min

vs 4 min read

Condensed

87%

679 → 90 words

Want the full story? Read the original article

Read on Yahoo Finance