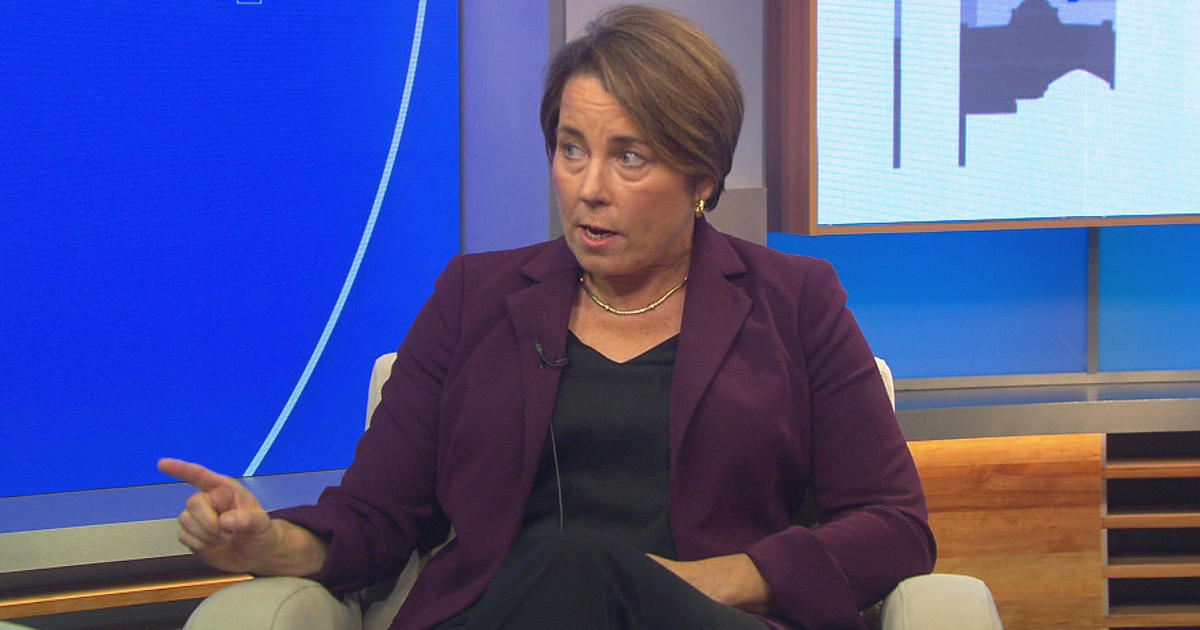

Massachusetts Governor Healey Slashes Budget by $375M Due to Revenue Shortfall

Governor Maura Healey of Massachusetts has announced $375 million in budget cuts to address a $1 billion shortfall in the 2024 fiscal year, attributed to lower-than-projected tax revenues. The cuts will primarily affect Mass Health fee for service payments and earmarks for local non-profits, following the recent signing of $1 billion in tax cuts into law. While Healey's administration insists that the emergency shelter crisis is not the cause of the budget shortfall, some state officials, like Democrat State Senator Jamie Eldridge, are concerned about the potential impact of tax reform changes on revenue reductions.