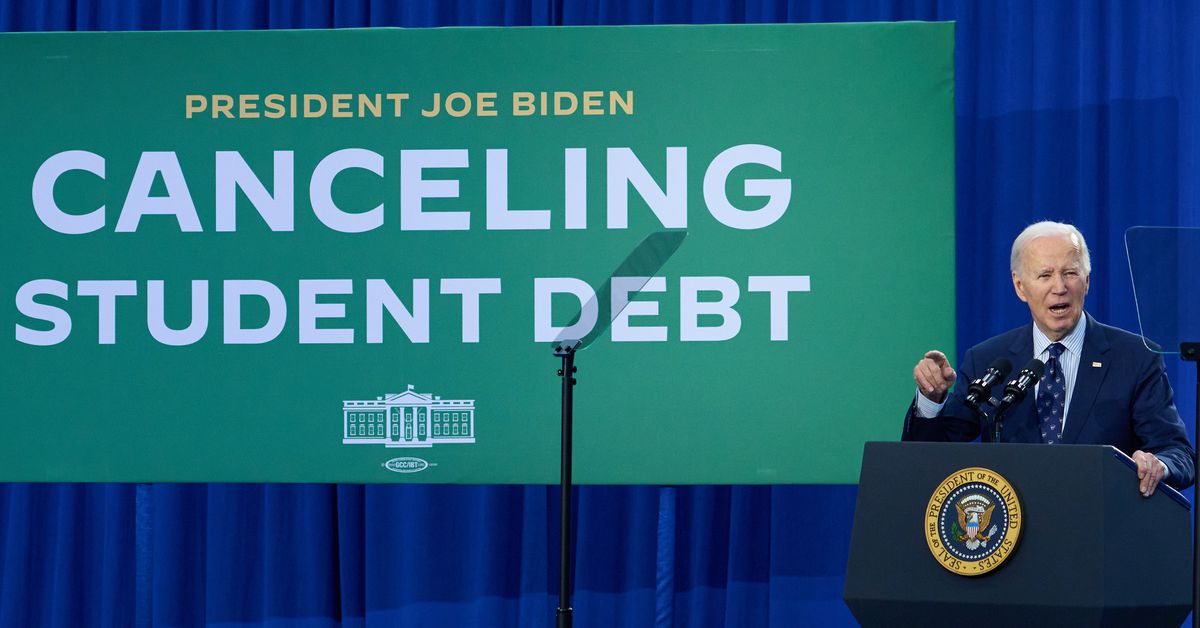

Lawsuits Challenge Trump Admin's Student Loan Forgiveness Changes

Nearly two dozen attorneys general sued the Education Department over a new rule that limits eligibility for the Public Service Loan Forgiveness Program by deeming certain activities 'substantially illegal,' arguing it violates the law and politicizes student loan forgiveness, while the Department defends it as a measure against organizations involved in illegal activities.