Trump Media's Nuclear Fusion Ambitions and Market Reactions

Short sellers are increasing their bets against Trump media group amid a nuclear fusion merger, reflecting investor skepticism or concern over the company's prospects in this sector.

All articles tagged with #short sellers

Short sellers are increasing their bets against Trump media group amid a nuclear fusion merger, reflecting investor skepticism or concern over the company's prospects in this sector.

Tech leaders like Sam Altman and Alex Karp have publicly criticized short sellers, viewing them as adversaries, but experts argue that short selling is a vital part of healthy markets, providing checks against fraud, overvaluation, and market euphoria, while also offering liquidity and market insights.

Beyond Meat's stock surged over 1,300% in four days, causing significant losses for short sellers and sparking a retail trader-driven trading frenzy reminiscent of meme-stock phenomena like GameStop, with some traders covering shorts while others doubled down amid volatile swings.

Short sellers have bet against AI stocks with a total of $5.6 billion, indicating significant bearish sentiment in the AI sector among investors.

Palantir's six-session losing streak has wiped out $73 billion in market value, benefiting short sellers despite the stock's 106% rise in 2025. The decline is part of a broader tech selloff, with short interest gradually increasing again as the stock shows signs of weakness, suggesting potential further volatility.

Short-sellers are giving up as the S&P 500 Index continues to reach record highs, marking its best performance since 2021, according to Citigroup strategists. Investor positioning in S&P 500 futures is heavily skewed, with short-sellers increasingly capitulating as the index sets new highs for the fourth consecutive week.

Short sellers betting against Trump Media & Technology Group lost $420 million as the company's stock surged nearly 200% following Donald Trump's election victory. The stock, associated with Trump's social media platform Truth Social, saw significant volatility and was described as a 'meme stock' due to its retail investor following and potential for a short squeeze. Despite a post-election drop, Trump's stake in the company remains substantial, reflecting the stock's role as a proxy for his political fortunes.

Arbor Realty, a mortgage real estate investment trust, is facing scrutiny due to potential investigations into its lending and disclosure practices, causing its stock to drop significantly. Despite a high dividend yield of over 13%, concerns about the safety of this dividend and the company's loan portfolio have emerged. The stock's future performance may hinge on upcoming Q2 earnings and management's response to these negative headlines. Both long and short positions carry significant risks, and the stock is currently rated as a hold.

Trump Media's share price surged by as much as 21% on Thursday, marking the second consecutive day of strong gains for the owner of the Truth Social app. The stock rose above $31 in early trading, posing a challenge for short sellers who had bet on its decline. The company also updated its website to provide shareholders with tips on preventing their stock from being loaned to short sellers.

Shares of Donald Trump's media and technology firm, Truth Social, fell 12% on Monday, extending a selloff that has reduced the value of his stake to $2.9 billion. The company's stock closed 8.4% lower at $37.17, down about 40% in April, following disclosures of significant losses and financial struggles. Trump, who owns about 78.75 million shares, has seen the valuation of his stake drop sharply from around $6 billion last month, potentially impacting his ability to raise funds for his 2024 presidential campaign and legal expenses. Short-sellers have made about $16 million in market-to-market profits from the decline, despite still being down 69% for the year.

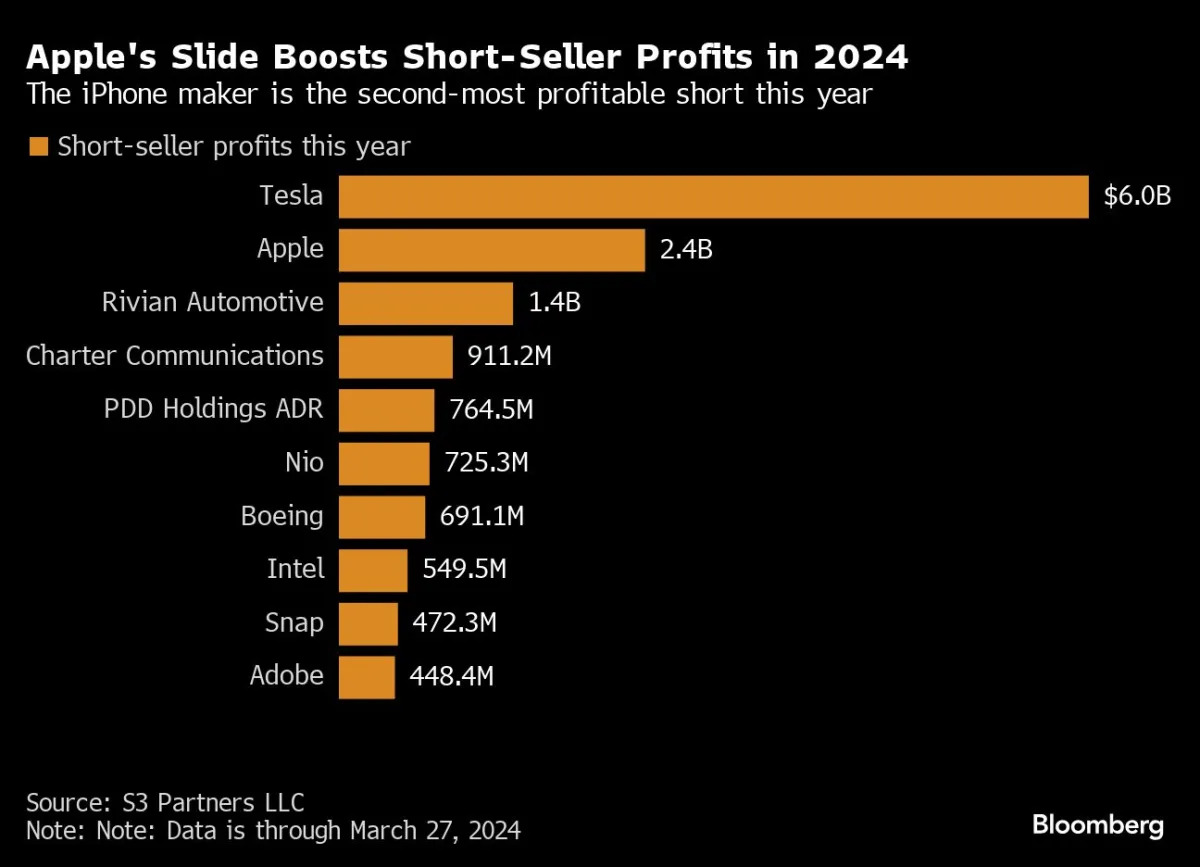

Apple investors are seeking signs of a turnaround after the stock's 12% drop this year, which has been the worst relative performance to the S&P 500 in over a decade. Short sellers have profited from the decline, but technical analysts believe the stock may be nearing a support level, potentially attracting dip-buyers. Despite concerns about regulatory scrutiny and growth outlook, Apple's strong business model and cash generation continue to offer upside potential for long-term investors, with some speculating a potential rotation back into Apple if other tech stocks stumble.

B. Riley Financial Inc. failed to file its audited results after the grace period ended, causing its stock to fall about 6%. The delay adds to pressure on the company, which has been under scrutiny for its relationship with Brian Kahn, the founder of Franchise Group Inc. The company attributed the delay to the board’s review of its transactions with Kahn, who was labeled as an unidentified co-conspirator in a US Department of Justice criminal case. B. Riley missed last year’s initial deadline too, citing recent acquisitions, but was able to finish the job within the grace period.

Palantir's CEO, Alex Karp, sparked controversy by suggesting that short sellers are involved in an "immoral" activity and should be investigated. This statement comes as the data analytics company's stock has been a target for short sellers, who bet on its price declining. Karp's remarks have reignited the debate over the role of short sellers in the stock market and their impact on companies like Palantir.

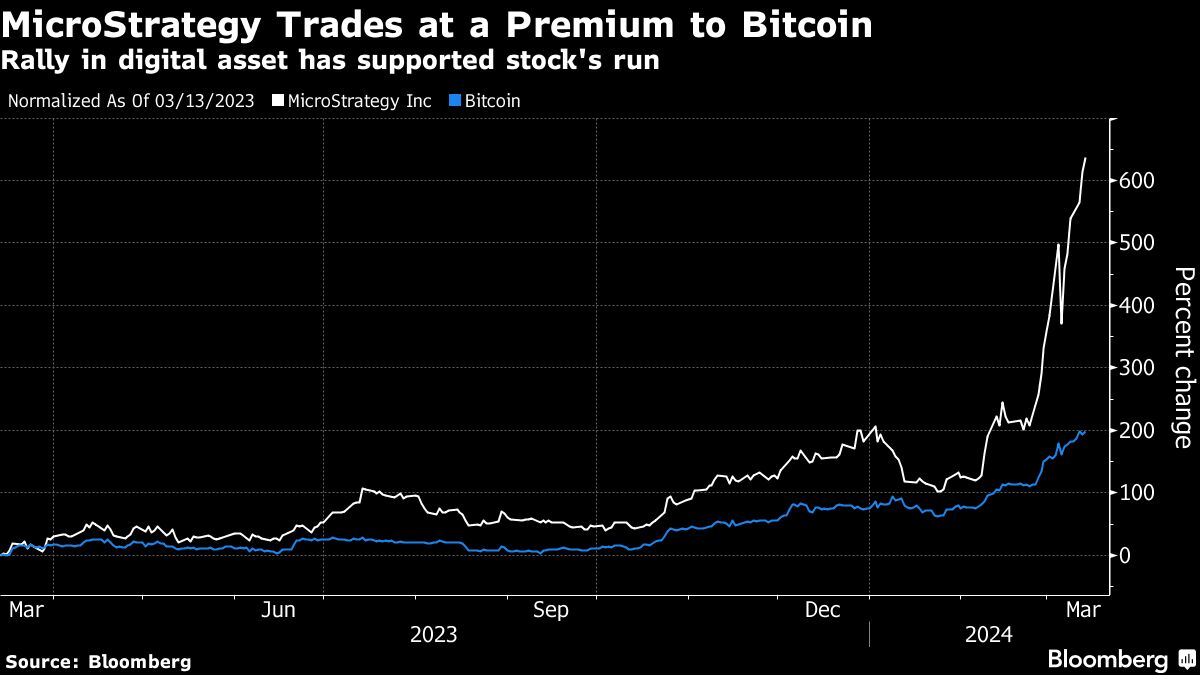

MicroStrategy's shares have surged over 170% this year, fueled by Bitcoin's rally, causing significant losses for short sellers. The company's recent purchase of more Bitcoin has further boosted its stock, leading to increased price targets from Wall Street analysts. With a high float and potential for a short squeeze, the stock remains attractive for investors seeking exposure to Bitcoin.

Beyond Meat's stock surged by as much as 61% in intraday trading, causing significant losses for short sellers and setting up a potential short squeeze. The company's strong rally, combined with a crowded short position and high stock borrow costs, has left short sellers at risk. Despite a positive earnings report and a path to profitability, some analysts remain bearish on the stock, with no buy ratings and an average price target implying a 31% downside from current levels.