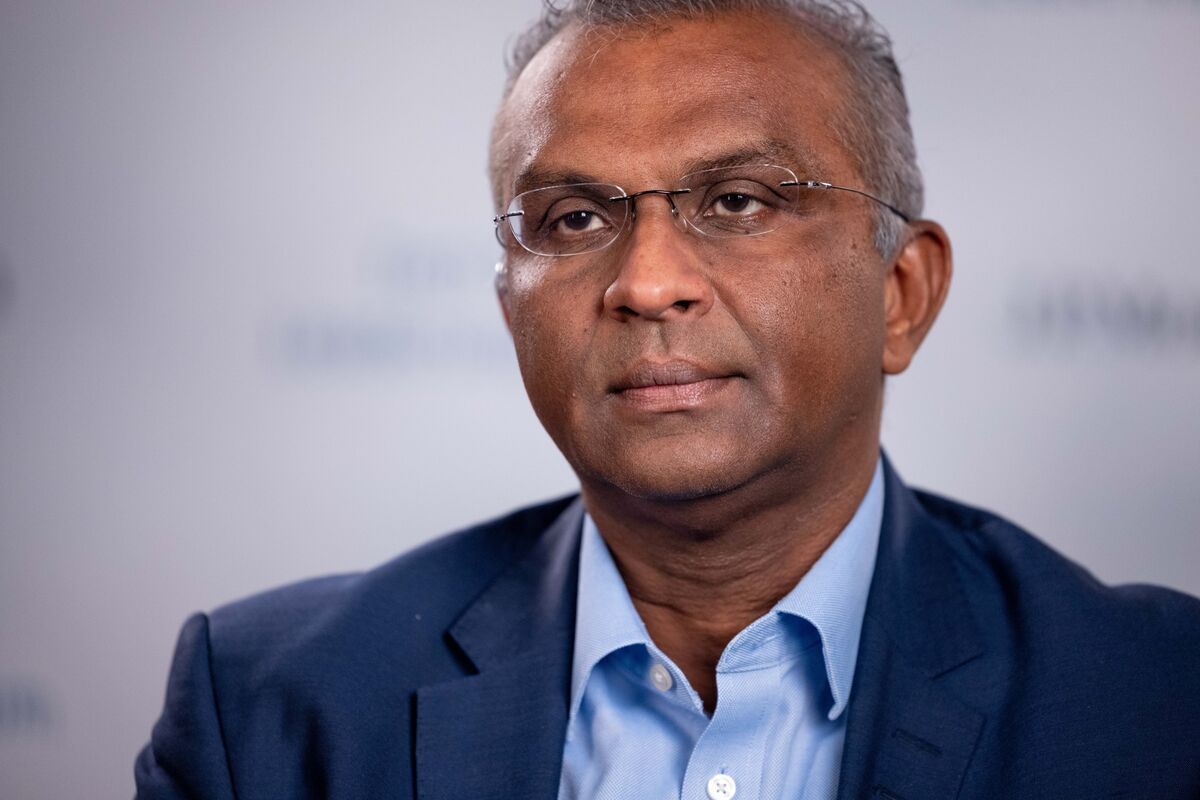

US banks slide as 10% credit-card rate cap deadline nears

U.S. bank stocks fell in morning trading as investors awaited the Trump administration’s January 20 deadline to implement a 10% cap on credit-card interest rates, with JPMorgan Chase, Citigroup and others down amid concerns about credit access and potential regulatory action.