S&P 500 Might Have Hit Its Peak

Last week's market activity suggests a potential top in the S&P 500, highlighting the importance for investors to manage risk carefully as market tops are becoming less obvious and more complex to identify.

All articles tagged with #price action

Last week's market activity suggests a potential top in the S&P 500, highlighting the importance for investors to manage risk carefully as market tops are becoming less obvious and more complex to identify.

Analyst Markus Thielen predicts that Bitcoin will reach an all-time high before the week ends, citing bullish signs such as a decline in bitcoins held on exchanges, BlackRock's launch of a spot ETF in Brazil, and increased trading volumes in Korea. Thielen expects movement into BlackRock's product to resume strongly this week and suggests that if Grayscale's flows drop to less than a $100m outflow, Bitcoin will make a significant upward move.

Natural gas experienced a bearish decline, breaking key support levels and heading towards the 78.6% Fibonacci retracement at 2.48. The bearish momentum was confirmed by a wide-range red candlestick pattern and a weekly bearish reversal, indicating further weakness. The next potential support is at 2.48, followed by a minor swing low around 2.41. While the current outlook for natural gas is bearish, a countertrend move is expected after reaching support levels, with volatility remaining a key factor in price movements.

Natural gas failed to hold support at the 50-Day MA and instead tested the 200-Day MA as support, completing a 61.8% Fibonacci retracement and nearing the target for an extended declining ABCD pattern. The weekly chart shows support at the 50-Week MA, indicating potential for the current correction to complete. The price action suggests a failed upside move, with the long-term trend indicator, the 200-Day MA, being closely watched for signs of strength. A successful test of the 200-Day MA as support could signal a bullish reversal, while a break below 2.65 may lead to increased uncertainty and a potential decline to the next Fibonacci level at 2.48.

Natural gas shows signs of a possible bullish reversal as the current day's trading range exceeds the prior day's high, indicating strength within a downtrend. The relative strength index (RSI) has reached an extreme overbought condition, suggesting a potential continuation to the upside. Yesterday's low completes a significant correction, setting the stage for a potential rally. To advance higher, natural gas needs to recapture the weekly high key of 2.49 and test prior support areas as resistance. The minimal target price for a rally is the 38.2% Fibonacci retracement at 2.77. The completion of an extended falling ABCD pattern at 2.22 acts as support, making a rally the most likely scenario for natural gas.

Gold triggers a bullish reversal after a false bearish signal, surging to its strongest rally since October. The reaction off the bottom suggests the completion of the current retracement, with potential for a breakout to new record highs. Investors and traders are advised to watch retracements for new entry setups. Possible resistance areas include 2,040, 2,052, and 2,070 to 2,082. The failed bearish trend continuation and strong demand indicate bullish signs, but a short pullback or consolidation phase may be needed before sustaining upward momentum into new highs.

The US Dollar Index (DXY) is caught between the 100 and 200-day moving averages, indicating rangebound trade ahead of the weekend. A catalyst may be needed for a breakout in either direction. EUR/USD and GBP/USD are showing mixed signals, with potential opportunities for long positions if certain support levels hold. GBP/USD has a clear pattern of higher highs and higher lows, with potential for a push towards the 1.2600 handle. Retail traders are indecisive about USD pairs, as shown by the IG Client Sentiment data.

The co-founders of Glassnode, a crypto analytics firm, believe that once regulators approve a spot-based Bitcoin exchange-traded fund (ETF), a flood of institutional capital worth trillions of dollars will pour into Bitcoin. They estimate that over $15 trillion in assets from companies are waiting for BTC ETF approval. The introduction of Bitcoin Spot ETFs could reshape the financial landscape and potentially ignite a bull run in the crypto market. However, the co-founders also anticipate short-term "sell the news" events following ETF approvals due to market dynamics.

The Japanese yen's technical outlook against the US dollar, euro, and Australian dollar shows mixed signals. USD/JPY is facing resistance at the psychological 150 mark, but there is no sign of a reversal in the uptrend. EUR/JPY is struggling to extend gains as it is capped by strong resistance, but it continues to hold above key support. AUD/JPY is holding above strong converged support, indicating a broader upward bias, but the path of least resistance remains sideways unless it clears the June high.

Crypto analyst DonAlt, who accurately predicted the 2022 market bottom, is excited about Bitcoin's current price action, which he finds more exhilarating than the "garbage" action that preceded it. Despite BTC's recent breakdown, DonAlt believes the rally from $15,000 still has fuel left and could be invalidated with a close above $27,000. He previously called the $25,000 range "the line in the sand," but now says it has lost its relevance as BTC is chopping right below it. Bitcoin is currently trading at $26,772, a 2.11% gain in the last 24 hours.

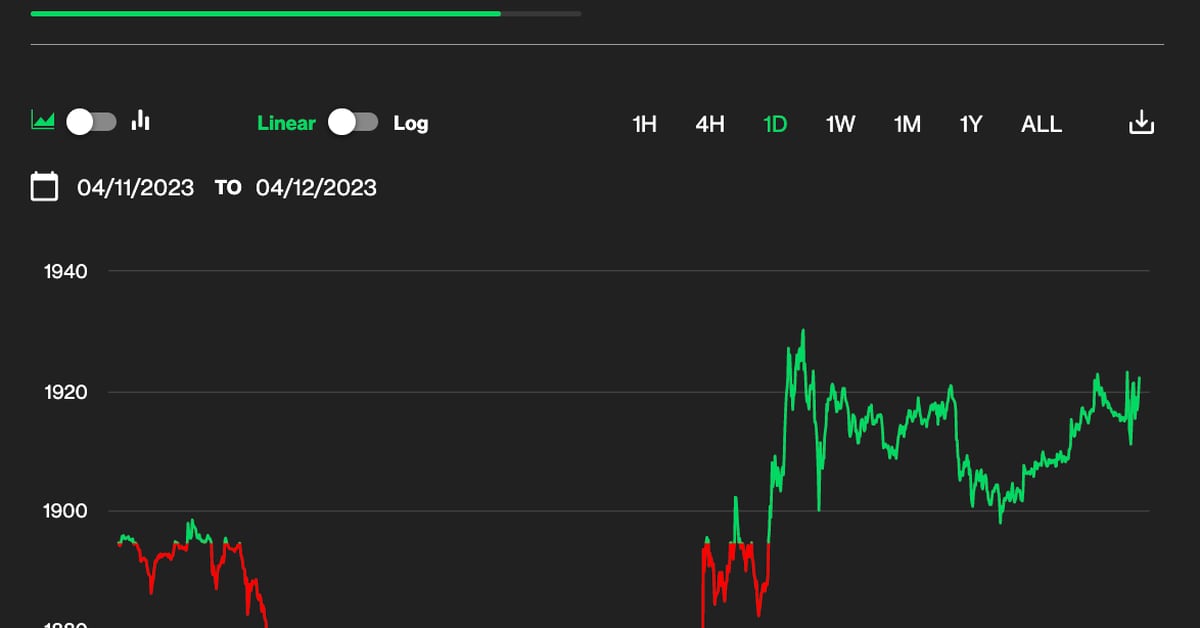

Ethereum's native cryptocurrency, ether (ETH), remains unchanged after the highly anticipated Shanghai upgrade, with trading around $1,914, up 1.1% versus 24 hours earlier. Analysts were divided on potential price action, with some predicting increased sell pressure from fresh supply while others believed it may become a psychological battle. Brent Xu, CEO of cross-chain decentralized finance (DeFi) protocol Umee, stated that he didn't expect a big decline for ETH or related LSTs in the near future due to the momentum being too powerful and institutions holding ETH and LSTs.

Bitcoin (BTC) reached new nine-month highs, spiking to $29,170 on Bitstamp, but market participants dismissed it as a "deviation" at range highs and called it a "fakeout." Traders remained cautious, with shorts currently having the upper hand, and Bitcoin and crypto analyst Lukasz Wydra noting that current trading volumes were at their lowest for 2023, similar to what was observed in June 2022 before the drop from $30,000. Despite the FUD, some traders remain optimistic and hope that the short-term range high could still be flipped to new support.

Crypto strategist Benjamin Cowen predicts that Bitcoin will experience choppy price action between $15,500 and $29,000 this year, following the Federal Reserve's interest rate hike. Cowen believes that Bitcoin will eventually recover after trading in the range between its 2022 low and 2023 high, and that the 84% rally since the 2022 low is still sideways price action. He compares Bitcoin's current price action to that of 2015, which also saw an 80% move from the bottom to the top.