UK Markets Drop Amid Rising Debt and Borrowing Costs

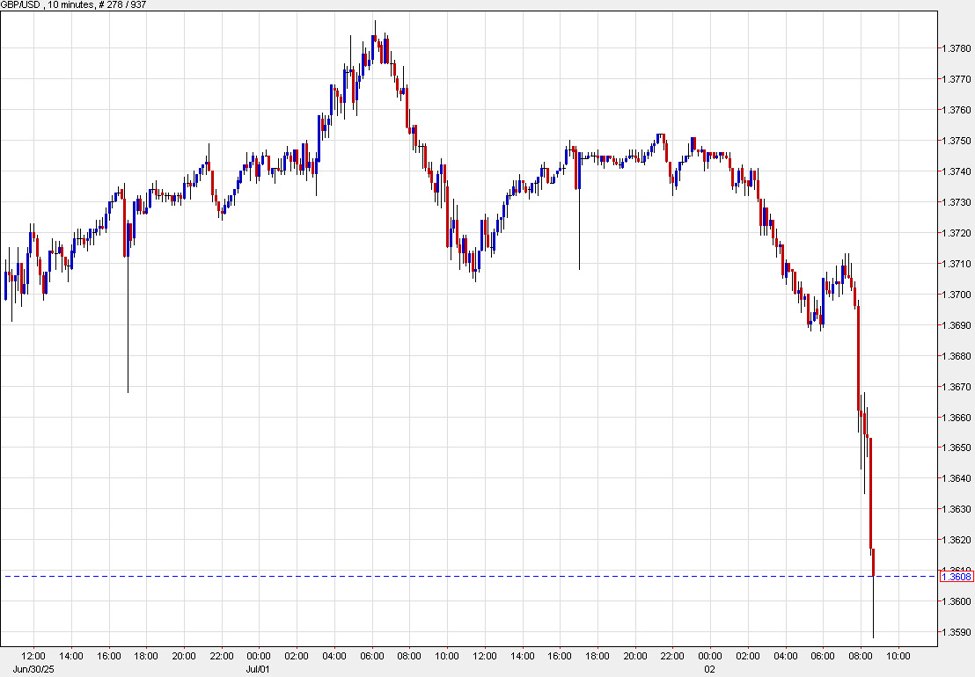

UK long-term bond yields reached their highest since 1998, driven by debt concerns and inflation fears, causing the pound to weaken and putting pressure on the government to address a significant budget deficit amid rising borrowing costs.