Prediction Markets Enter a High-Stakes Regulatory War

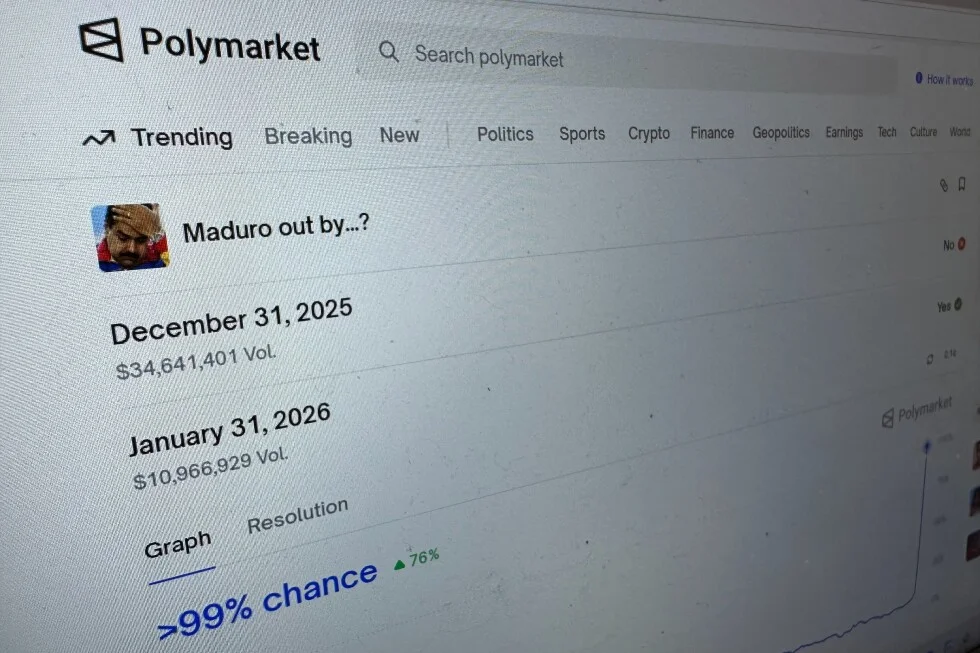

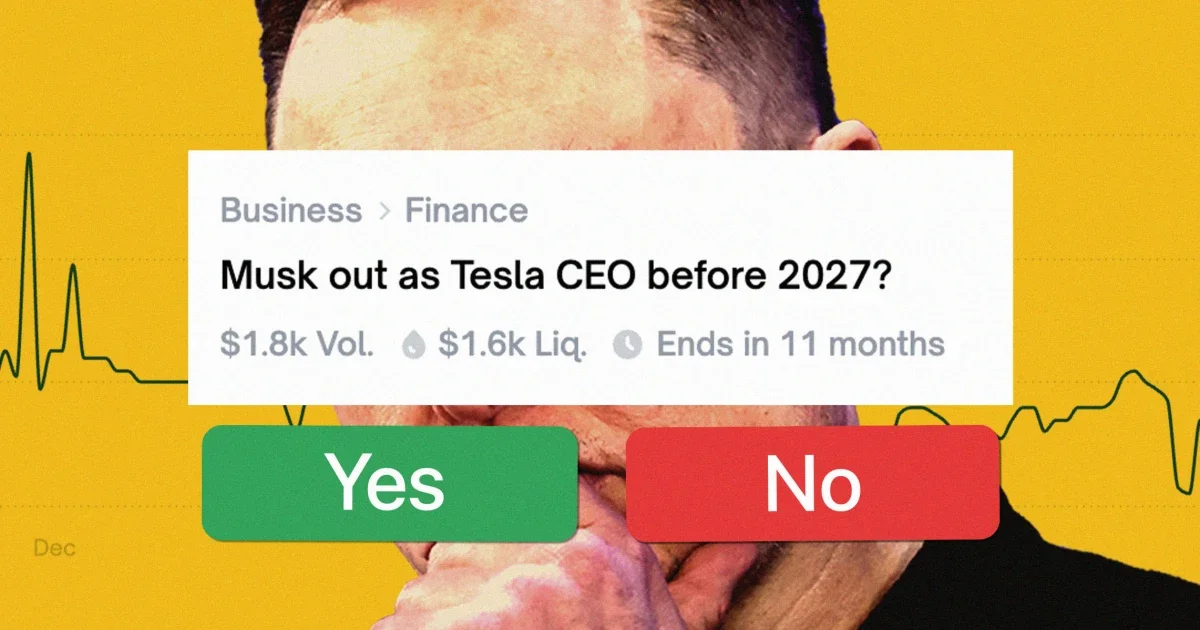

The U.S. regulatory fight over prediction markets such as Kalshi and Polymarket is intensifying, with advocates arguing the platforms offer fair, investor-driven markets and regulators pressing for state-agnostic gambling laws; Kalshi operates nationwide while Polymarket, banned in 2022, has returned in a limited form. Dozens of lawsuits target Kalshi, the CFTC asserts exclusive authority, and lawmakers on both sides of the aisle are weighing actions—signaling a long, contentious battle rather than a quick resolution.