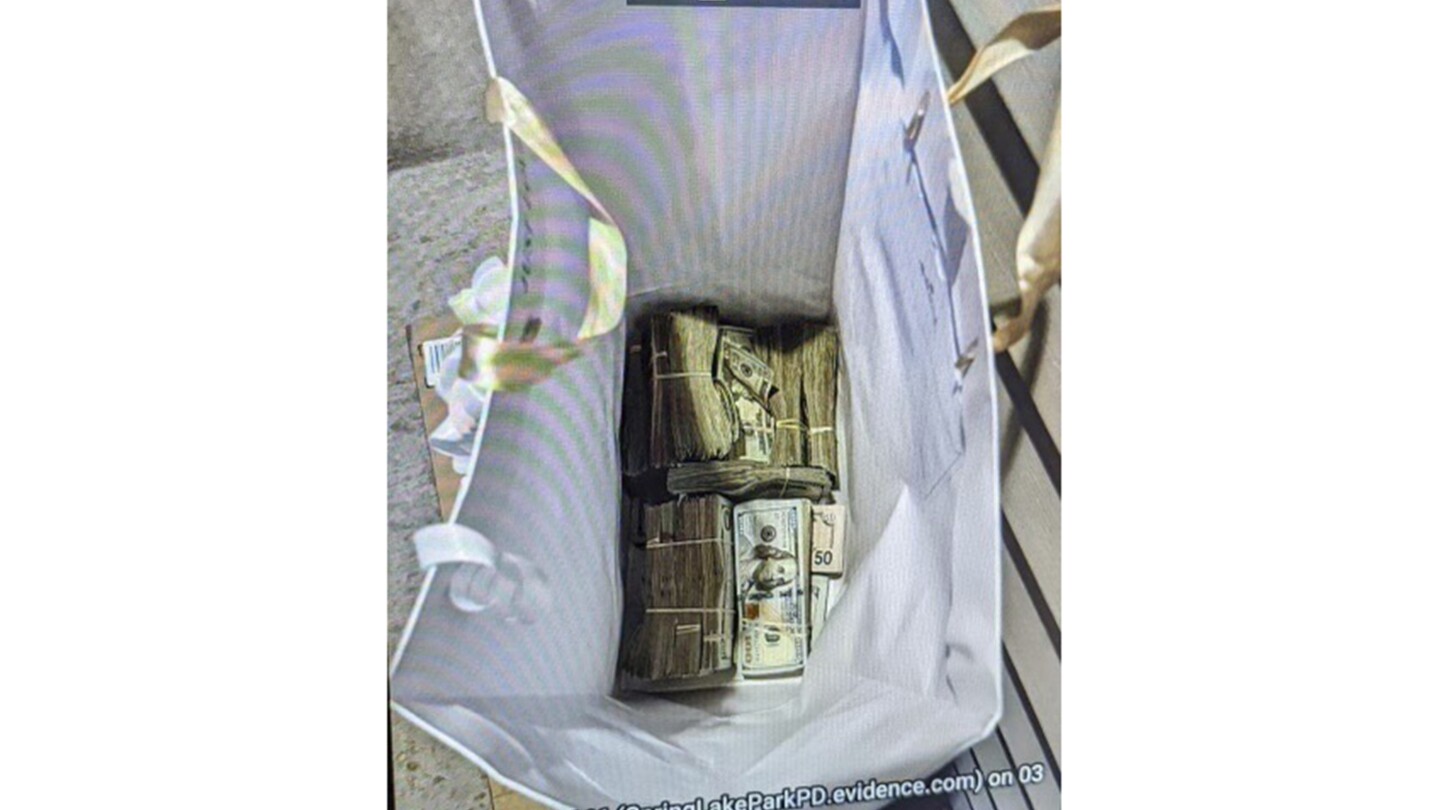

$120K Bribe Disrupts Feeding Our Future Fraud Trial

Authorities in Minnesota are investigating an attempted bribery of a juror with $120,000 in cash to acquit defendants accused of stealing over $40 million from a pandemic food aid program. The juror reported the bribe, leading to her dismissal and the sequestering of the jury. The seven defendants, part of a larger group facing trial for the $250 million fraud, have been detained, and their phones confiscated as the investigation continues.