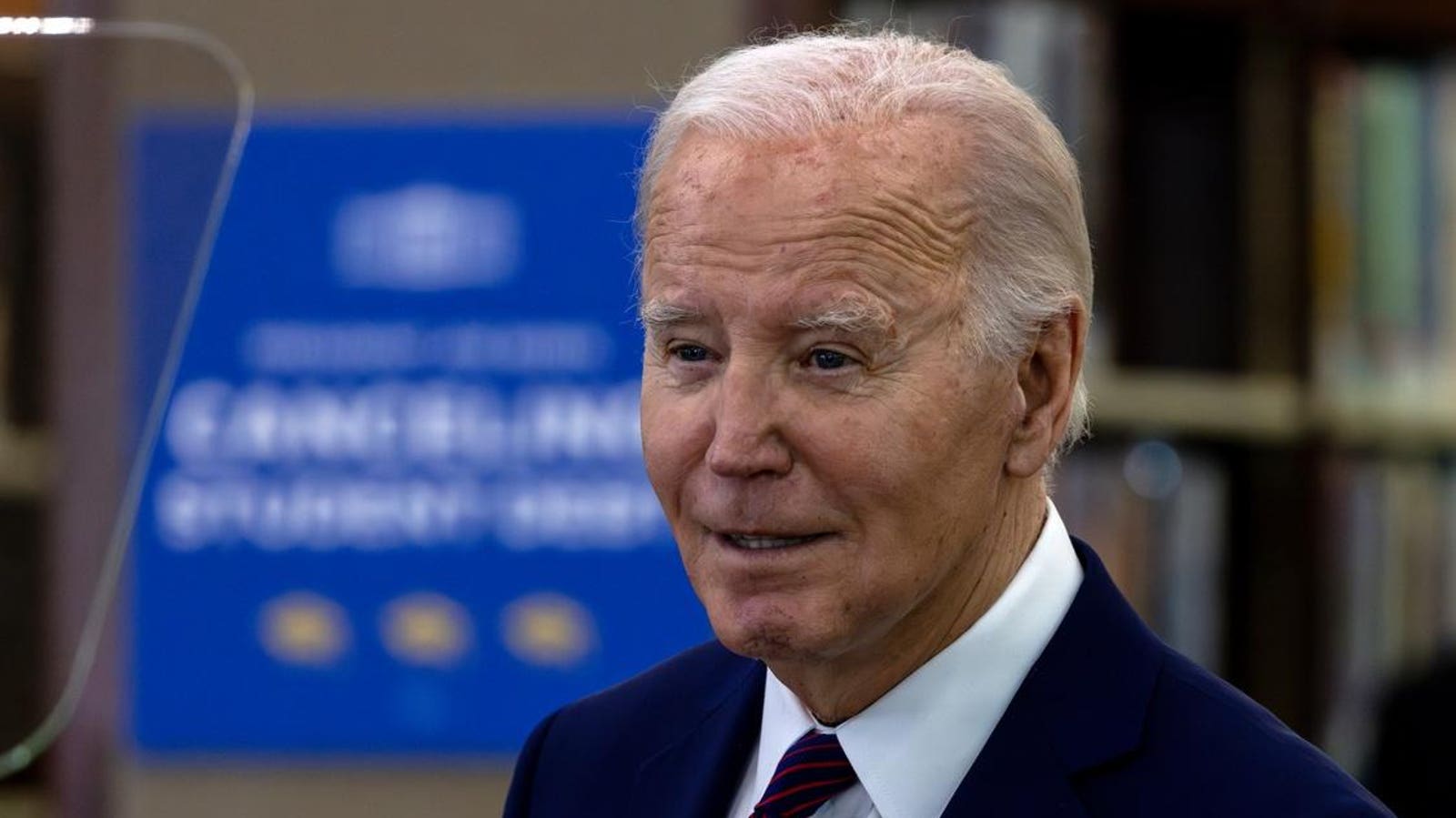

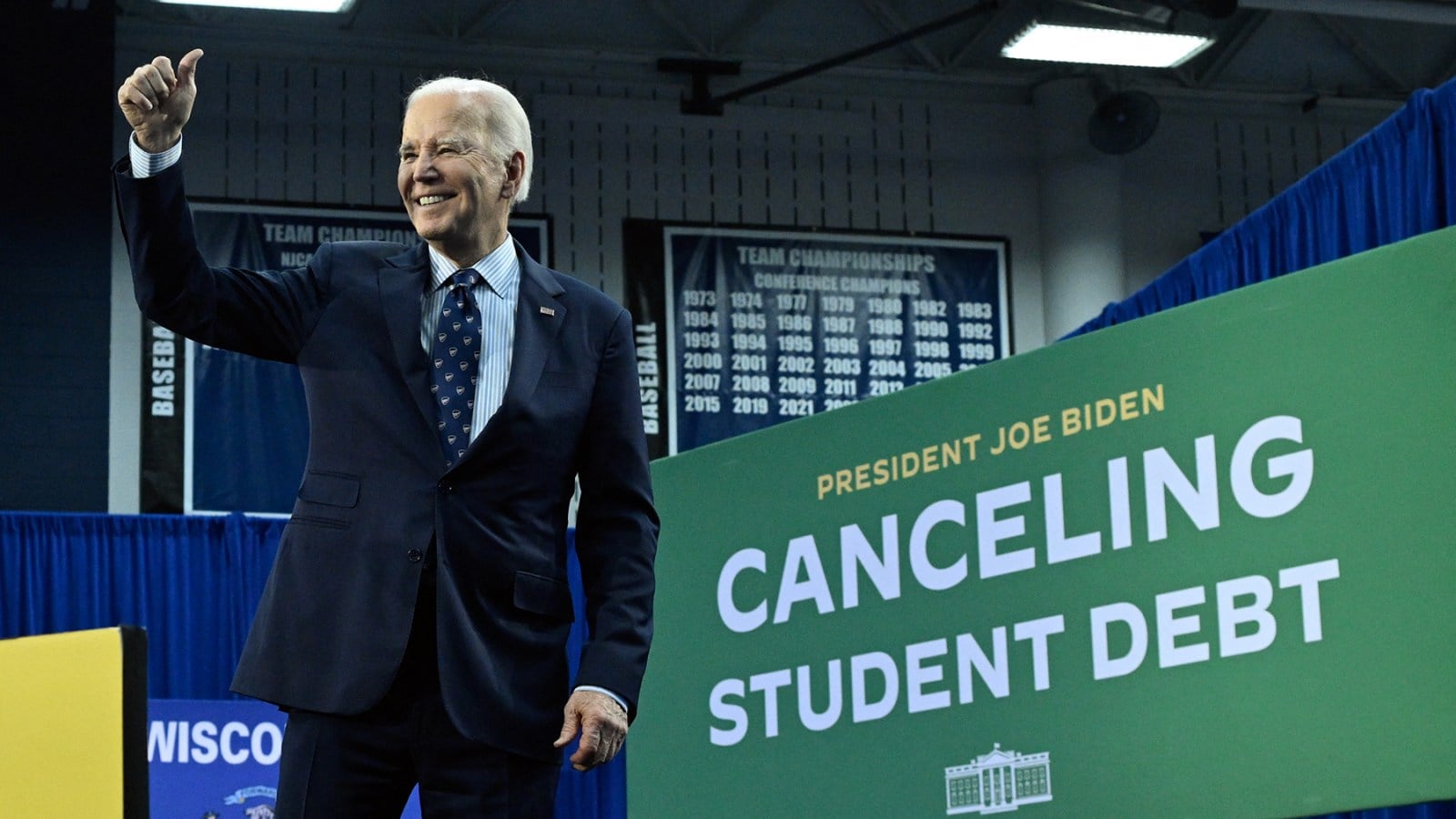

"Biden's $7.4 Billion Student Loan Forgiveness: Who Qualifies and What You Need to Know"

President Biden's administration has announced $7.4 billion in student loan debt forgiveness for 277,000 borrowers through the SAVE program, income-driven repayment adjustments, and fixes to the Public Service Loan Forgiveness program. Notifications will be sent via email, and applications are still open for eligible borrowers. The administration faces legal challenges from Republican states, but continues to unveil new plans for student loan forgiveness, including waiving interest, automatically discharging debt, and assisting borrowers facing hardship.