GLP-1 obesity drugs and pancreatitis: what the science actually shows

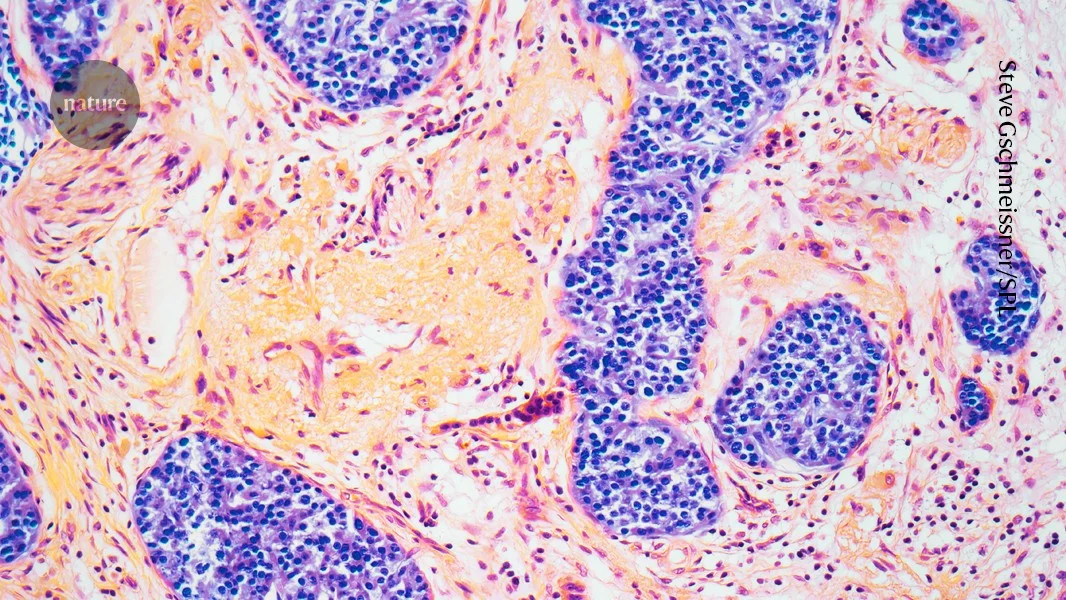

Regulators in the UK and Brazil warned of a possible link between GLP-1 weight‑loss drugs and pancreatitis, but causality remains unclear. With millions using GLP-1 therapies for obesity and related conditions, reported pancreatitis cases and deaths are very rare relative to use (UK: 19 pancreatitis deaths since 2007 and about 1,300 related reports among ~1.6 million users; Brazil: 6 deaths and 145 pancreatitis cases since 2020). Meta-analyses yield mixed results—some show a small risk, others none—while a large real‑world study found no difference in pancreatitis between GLP‑1 users and non‑users with similar risk factors. Ongoing pharmacovigilance and rigorous studies are needed to distinguish true signals from background risk.