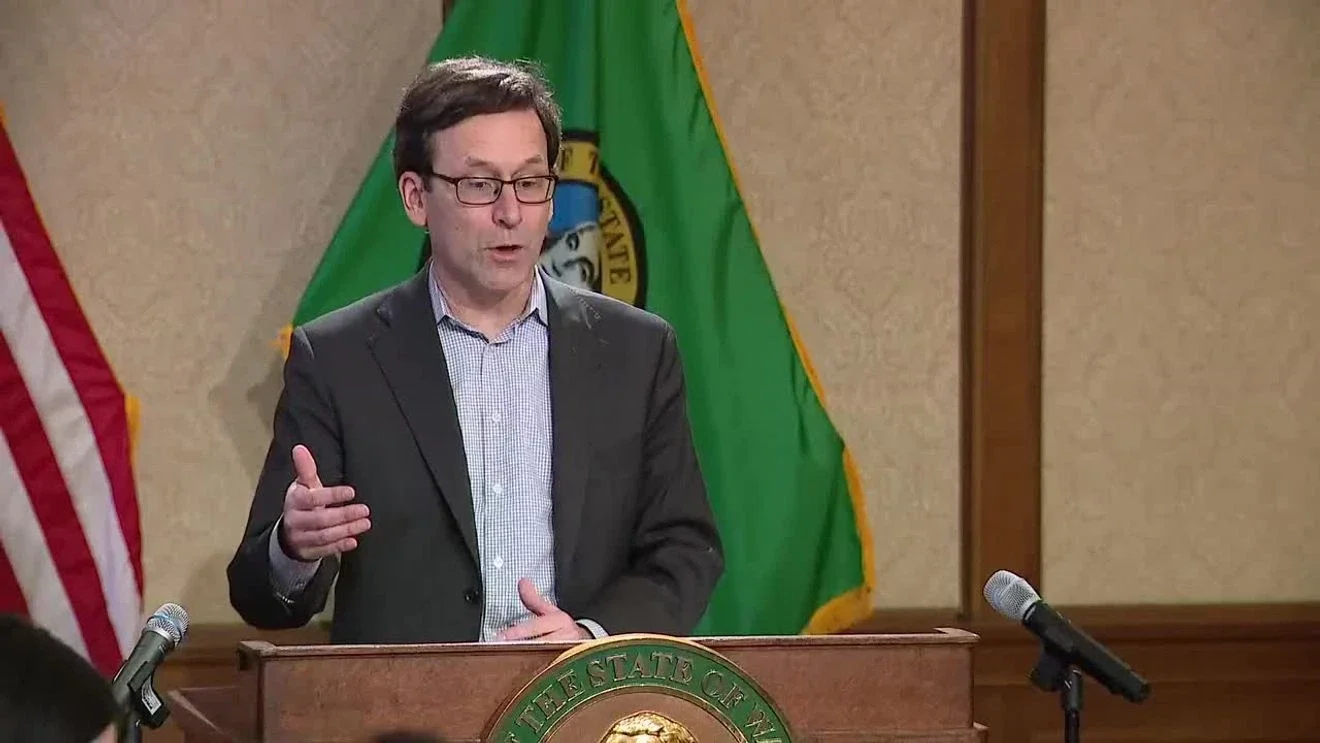

Washington governor backs millionaires tax with family rebates, rejects under-$1M income tax

Gov. Bob Ferguson signaled support for a 9.9% tax on income over $1 million but would not back any income tax for individuals earning less than $1 million, insisting any bill must return significant revenue to Washington families and small businesses. He urged expanding the Working Families Tax Credit, broadening essential-item sales exemptions, and adding a biannual sales-tax holiday as the millionaire’s tax progresses from the Senate to the House; he did not commit to veto scenarios and highlighted the need for affordability measures as the session nears its March 12 deadline.