Sainsbury’s Negotiates Sale of Argos to Chinese Retailer JD.com

Sainsbury's is in talks to sell its Argos unit to Chinese e-commerce firm JD.com, aiming to accelerate Argos' growth with JD.com's expertise, though no deal has been finalized yet.

All articles tagged with #jdcom

Sainsbury's is in talks to sell its Argos unit to Chinese e-commerce firm JD.com, aiming to accelerate Argos' growth with JD.com's expertise, though no deal has been finalized yet.

JD.com reported strong Q2 earnings with a 22.4% sales increase driven by growth in core retail and new food delivery services, marking its best sales growth since late 2021, but its stock declined over 2% amid concerns about profitability and slower AI-driven growth compared to Alibaba.

JD.com founder Richard Liu announced a strategic turnaround focusing on overseas expansion, competing with Meituan in food delivery and travel, leveraging its logistics network, and planning to enter European markets by 2026, amid a period of stagnation since 2020.

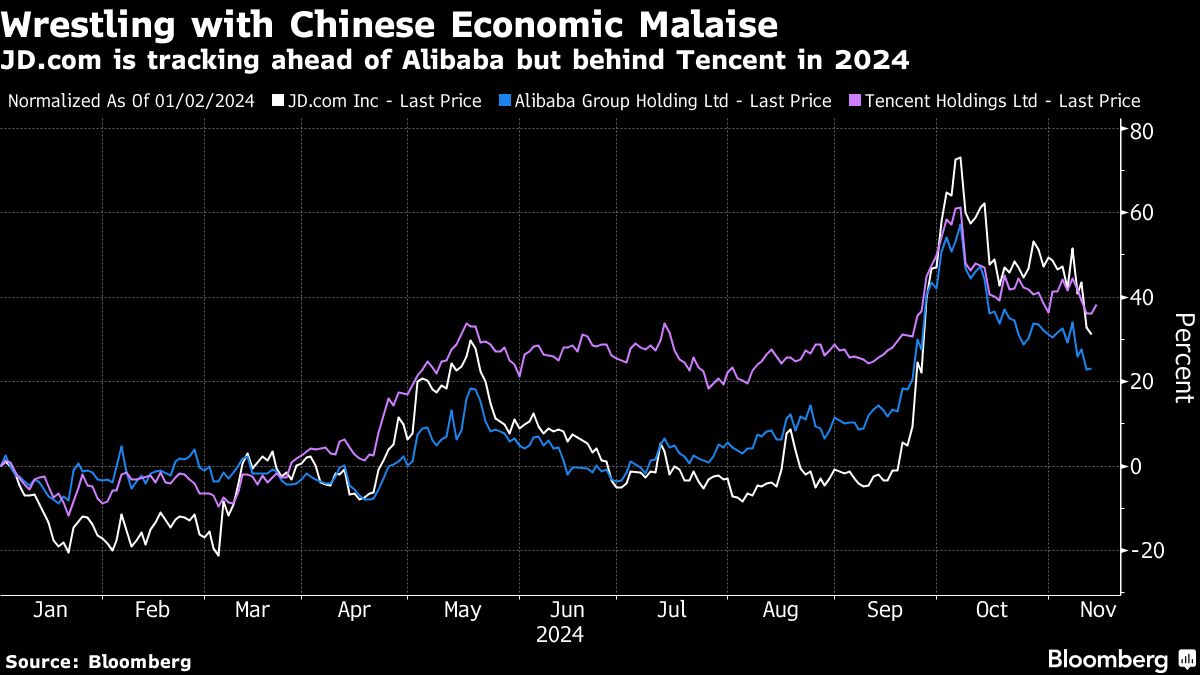

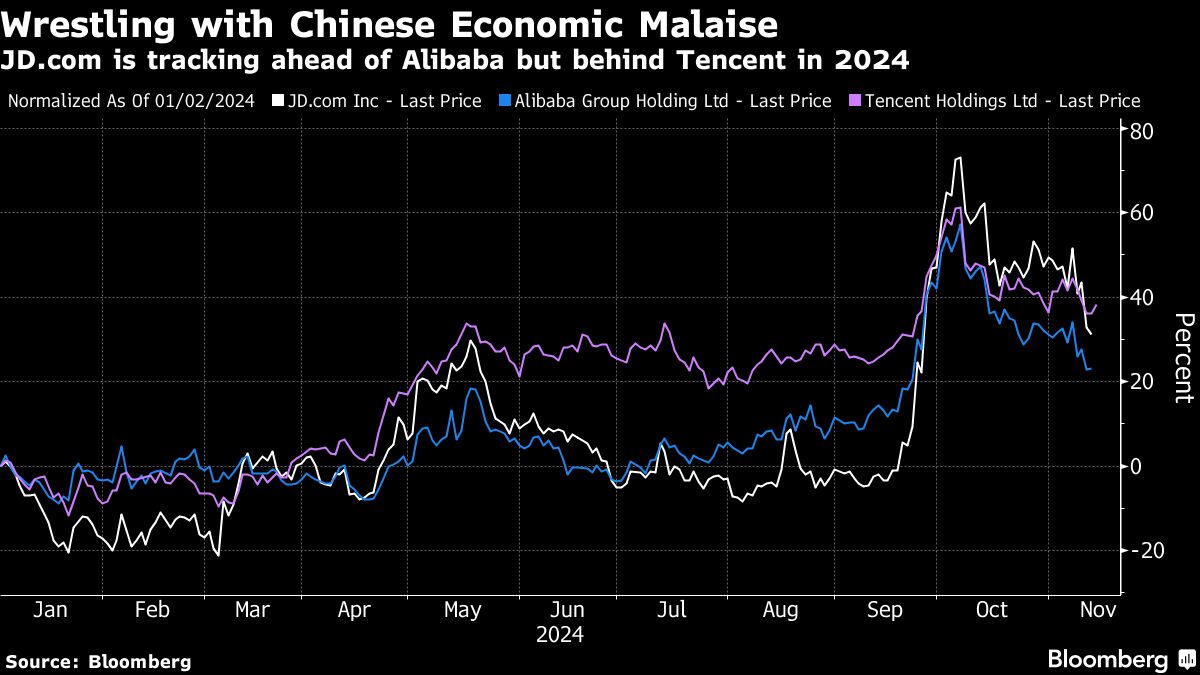

China's Politburo has announced plans for more proactive fiscal and looser monetary policies, boosting U.S.-traded Chinese stocks like JD.com, Trip.com, and Atour Lifestyle. This move has also lifted commodities, with copper and silver prices rising. However, investors should be cautious of volatility, as previous stimulus measures have seen gains reversed. The success of these policies may depend on China's ability to manage its economic challenges and potential U.S. tariff threats.

JD.com reported better-than-expected Q3 earnings with a 5.1% revenue growth, but its stock fell 4% due to revenue slightly missing consensus estimates. Despite a 29.5% increase in earnings per ADS, concerns over China's economic growth and potential U.S. tariffs under Donald Trump's presidency have affected investor sentiment. JD's stock has fluctuated, rising 27% year-to-date but dropping 12% in November. The company saw a rebound in electronics and appliances sales and received positive consumer response to its promotions during China's Singles Day.

JD.com reported a 5.1% increase in quarterly revenue, indicating cautious consumer spending in China as the government implements economic stimulus measures. Despite a 48% rise in net income, the modest revenue growth reflects ongoing challenges in the Chinese consumer market post-Covid. JD.com and Alibaba are key indicators of consumer trends, with JD.com seeing increased shopper numbers during Singles Day. Analysts suggest JD.com may pursue more aggressive growth strategies, leveraging improved consumer sentiment and government support.

JD.com reported a 5.1% increase in quarterly revenue, indicating cautious consumer spending in China as the government implements economic stimulus measures. Despite a 48% rise in net income, the modest revenue growth reflects ongoing challenges in the Chinese consumer market post-Covid. JD.com and Alibaba are key indicators of consumer trends, with JD.com seeing increased shopper numbers during the Singles Day shopping season. Analysts suggest JD.com may pursue more aggressive growth strategies, leveraging improved consumer sentiment and government support.

Shares of Chinese tech giants Alibaba, Baidu, and JD.com fell due to disappointing economic data from China, which reported only 4.7% growth in Q2, below expectations. Retail sales growth was also weak, indicating a sluggish consumer market. This has raised concerns about the companies' upcoming earnings and the broader economic outlook, despite recent measures by China to stimulate growth.

Shares of Chinese tech giants Alibaba, Baidu, and JD.com fell due to disappointing Q2 economic growth data from China, which reported only 4.7% growth, below expectations. The lackluster performance in consumer spending and retail sales, coupled with a focus on industrial production and exports, has raised concerns about the companies' upcoming earnings and overall market sentiment. Despite recent interest rate cuts and housing sector measures, more stimulus may be needed to revive China's consumer economy.

Chinese stocks, including Alibaba, JD.com, and PDD Holdings, slid as China's exports fell more than expected in March, signaling weakness in the world's No. 2 economy. The export report underscores the struggles of the Chinese economy, impacting the performance of these companies. While PDD Holdings stands out with rapid growth and market share gains, the challenges facing Chinese stocks suggest caution for investors considering investment in these companies.

Chinese stocks, including Alibaba, JD.com, and PDD Holdings, rallied after China's annual parliamentary meeting and promising economic data. Beijing's plans to support the economy and its target of 5% economic growth for the year also boosted investor confidence. Despite recent struggles, these stocks saw gains, with JD.com leading the way with a 5.5% increase. However, the Chinese economy still faces challenges, and the intense competition in e-commerce will lead to winners and losers.

Chinese stocks, including Alibaba, JD.com, and PDD Holdings, rallied after China's annual parliamentary meeting and promising economic data. Beijing's plans to support the economy and its target of 5% economic growth for the year also boosted investor confidence. Despite challenges, such as a crackdown on the tech sector and weak economic recovery, these stocks saw gains, with PDD Holdings outperforming its peers. However, the Chinese economy still faces struggles, and the intense e-commerce competition will determine winners and losers.

JD.com's U.S.-listed stock surged 16% after the Chinese online retailer announced a $3 billion share buyback plan through March 2027 and reported better-than-expected fourth-quarter net revenue of 306.1 billion yuan ($42.5 billion), up 3.6% from the previous year, as Chinese e-commerce groups engage in a price war amid an economic downturn.

JD.com Inc. has approved a $3 billion stock buyback program after reporting a 3.6% increase in revenue, surpassing analyst expectations. The company's revenue growth was attributed to a wider product range and price reductions targeting cost-conscious Chinese consumers. The move aims to address concerns about the company's growth potential. JD.com's net income for the December quarter fell short of estimates, amid challenges in China's economic landscape. The e-commerce giant is also considering overseas expansion, including a potential acquisition of UK electronics retailer Currys Plc.

Chinese stocks surged today following reports that China's sovereign wealth fund would inject cash into the stock market, with Alibaba, PDD Holdings, and JD.com among the winners. Alibaba has faced challenges due to Beijing's crackdown, while PDD Holdings has seen strong growth driven by its social commerce model and international e-commerce site. JD.com, on the other hand, has struggled with slow growth and competition. Investors are hopeful for a turnaround in Chinese stocks, with Alibaba set to report its quarterly earnings tomorrow.