JD.com Struggles to Convince Amid China's Economic Uncertainty

TL;DR Summary

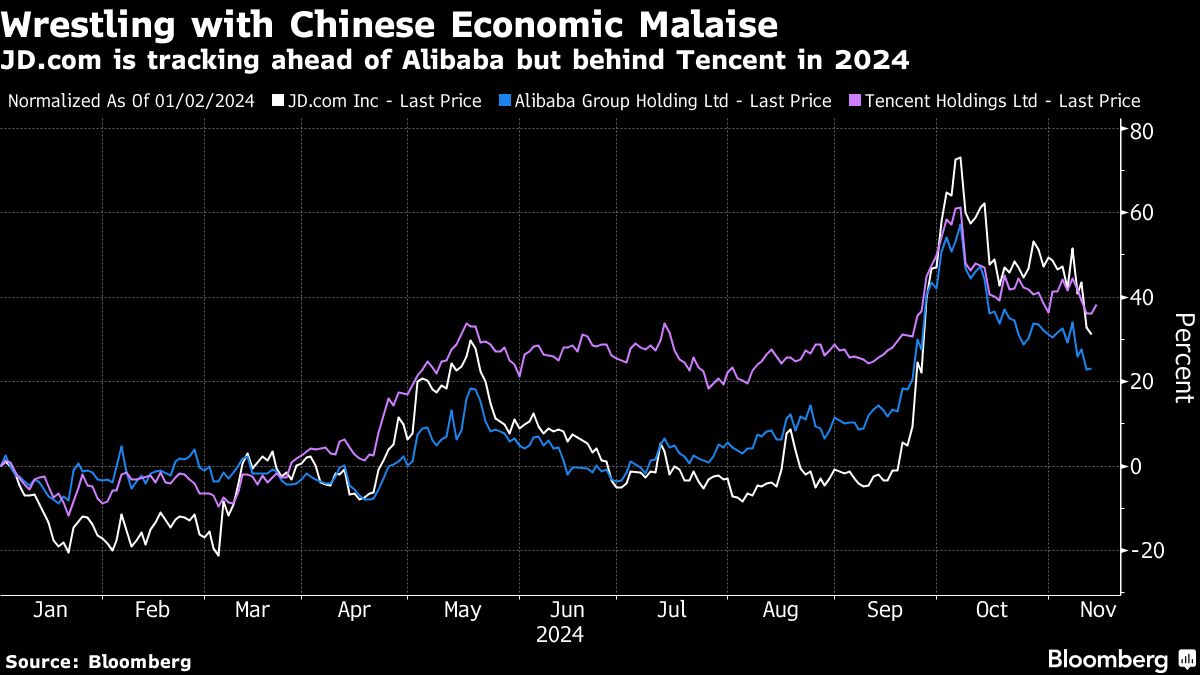

JD.com reported a 5.1% increase in quarterly revenue, indicating cautious consumer spending in China as the government implements economic stimulus measures. Despite a 48% rise in net income, the modest revenue growth reflects ongoing challenges in the Chinese consumer market post-Covid. JD.com and Alibaba are key indicators of consumer trends, with JD.com seeing increased shopper numbers during Singles Day. Analysts suggest JD.com may pursue more aggressive growth strategies, leveraging improved consumer sentiment and government support.

- JD’s Results Fail to Impress as Chinese Economic Fears Persist Yahoo Finance

- JD.com Stock Falls. Earnings Fail to Convince Investors China Economy Is on the Mend. Barron's

- JD.com (JD) Q3 2024 Earnings Call Transcript The Motley Fool

- China's JD.com misses revenue estimates as consumption weakness lingers Reuters

- JD’s Revenue Growth Quickens in Positive China Economy Signal Bloomberg

Reading Insights

Total Reads

0

Unique Readers

9

Time Saved

2 min

vs 2 min read

Condensed

81%

400 → 75 words

Want the full story? Read the original article

Read on Yahoo Finance