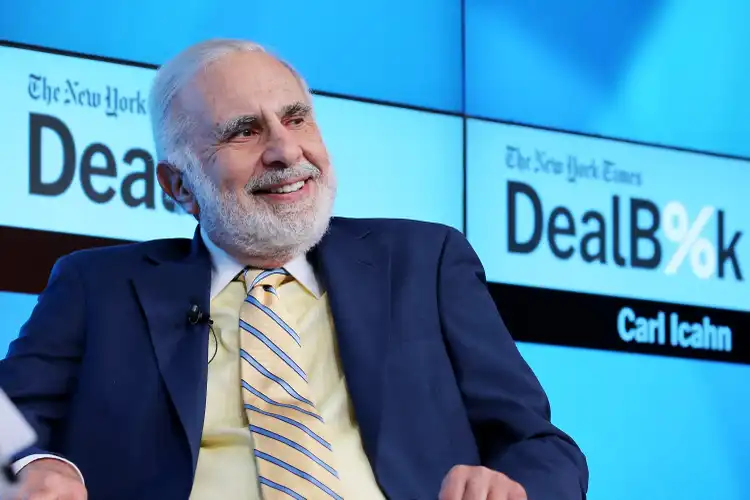

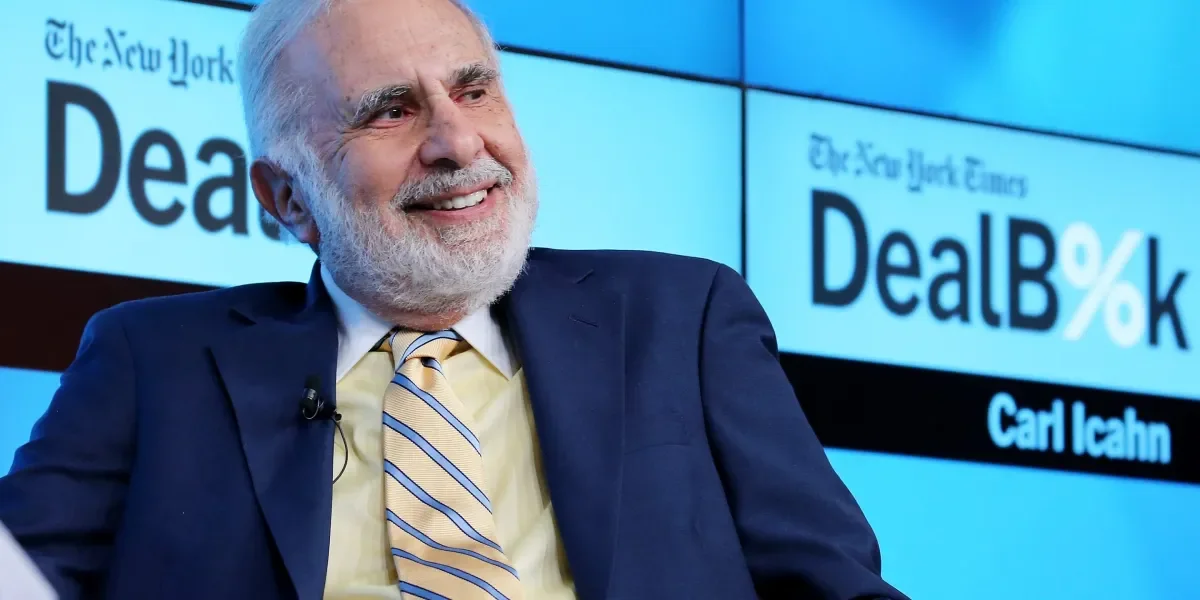

Icahn Enterprises Faces Challenges Amid Dividend Cuts and Strategic Shifts

Carl Icahn's conglomerate, Icahn Enterprises, is facing financial strain as it grapples with operational issues and declining asset values, leading to a halved dividend and a 38% stock drop this year. The company is attempting to stabilize by selling a valuable scrapyard in Nashville and increasing its stake in CVR Energy, despite recent losses. Icahn's heavy borrowing against his shares adds pressure, but he remains optimistic about future cash flow improvements and potential regulatory relief for CVR Energy.