"SEC Inquiry and Dividend Cut: Icahn Enterprises Stock Plummets"

TL;DR Summary

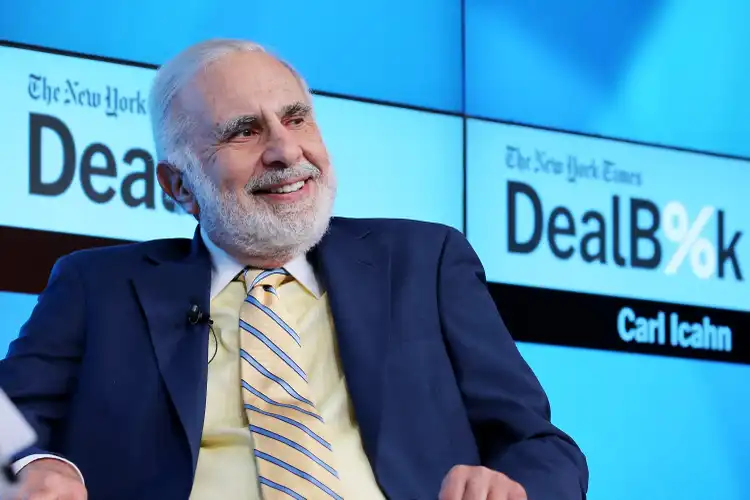

Icahn Enterprises (NASDAQ:IEP) saw its shares drop 4% in after-hours trading and 23% in regular trading after disclosing that the Securities & Exchange Commission (SEC) had contacted the company regarding various aspects of its operations. This follows a similar inquiry by the U.S. Attorney's office in May. Icahn Enterprises also announced a 50% reduction in its quarterly distribution, prompting criticism from Hindenburg Research, which had previously issued a short report on the company. The SEC and U.S. Attorney's office have not made any claims or allegations against Icahn Enterprises or its owner, Carl Icahn.

- Icahn Enterprises stock drops in after hours amid disclosure of SEC inquiry Seeking Alpha

- Carl Icahn's Firm Slashes Dividend in Half After Activist Pressure; Stock Slides The Wall Street Journal

- Nikola's Abrupt CEO Transition, Carl Icahn Led Icahn Enterprises Cuts Dividend Payout, FDA Rejects Mesoblast's Cell Therapy For Kids: Today's Top Stories Yahoo Finance

- CARL C. ICAHN - Icahn Enterprises (NASDAQ:IEP) Benzinga

- Icahn Enterprises' bonds see buying after bond-friendly halving of distribution MarketWatch

Reading Insights

Total Reads

0

Unique Readers

6

Time Saved

1 min

vs 2 min read

Condensed

59%

229 → 94 words

Want the full story? Read the original article

Read on Seeking Alpha