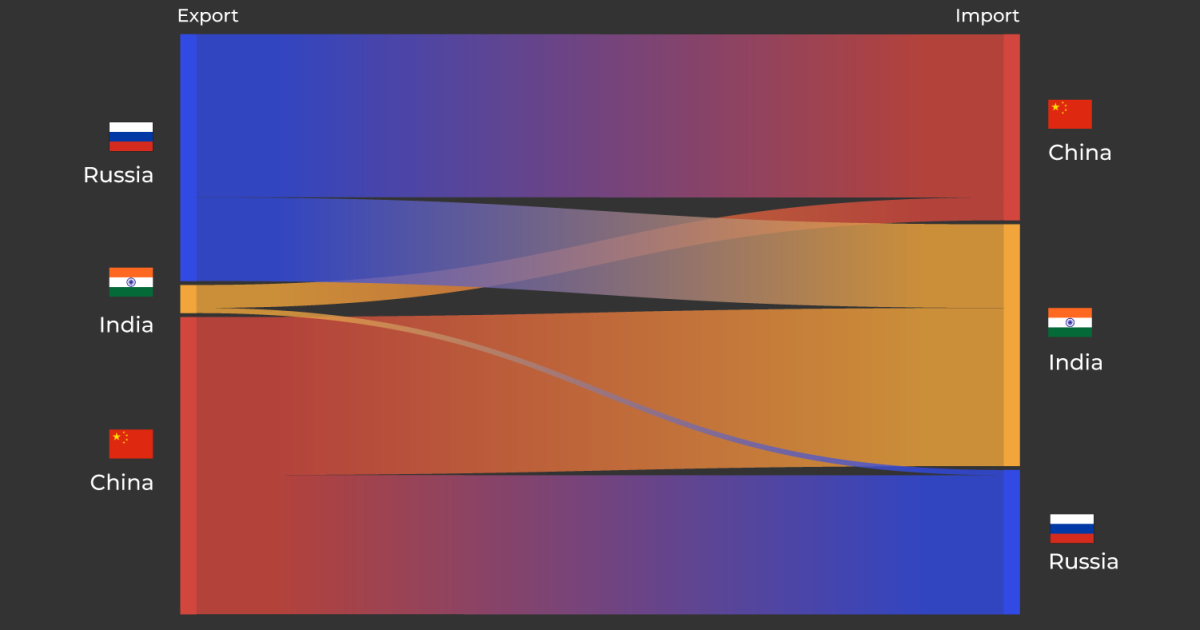

Global Power Shifts: India, Russia, and China’s Trade Dynamics and Political Messages

The article discusses the trade relationships among India, Russia, and China, highlighting their trade volumes, main exported and imported goods, and recent shifts due to geopolitical tensions and sanctions, with China and Russia increasing their bilateral trade and India maintaining significant trade deficits with both countries.