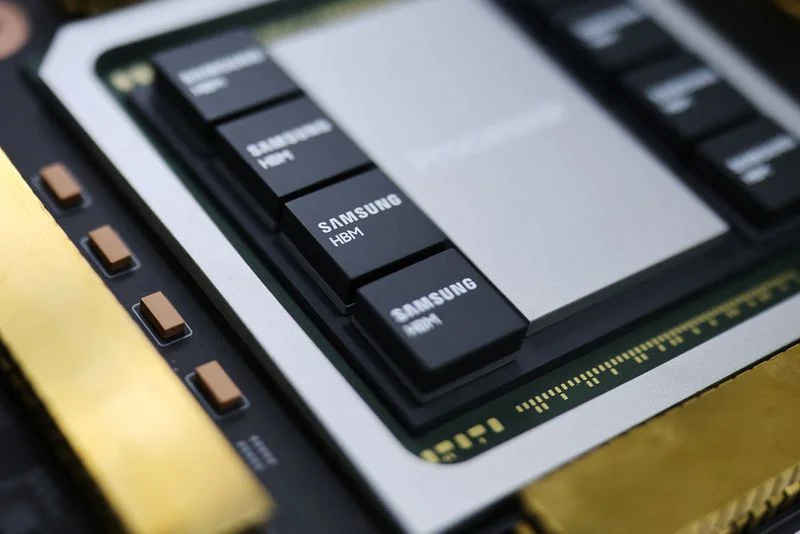

Samsung's HBM4 Chip Boosts Market Confidence and Rivalry

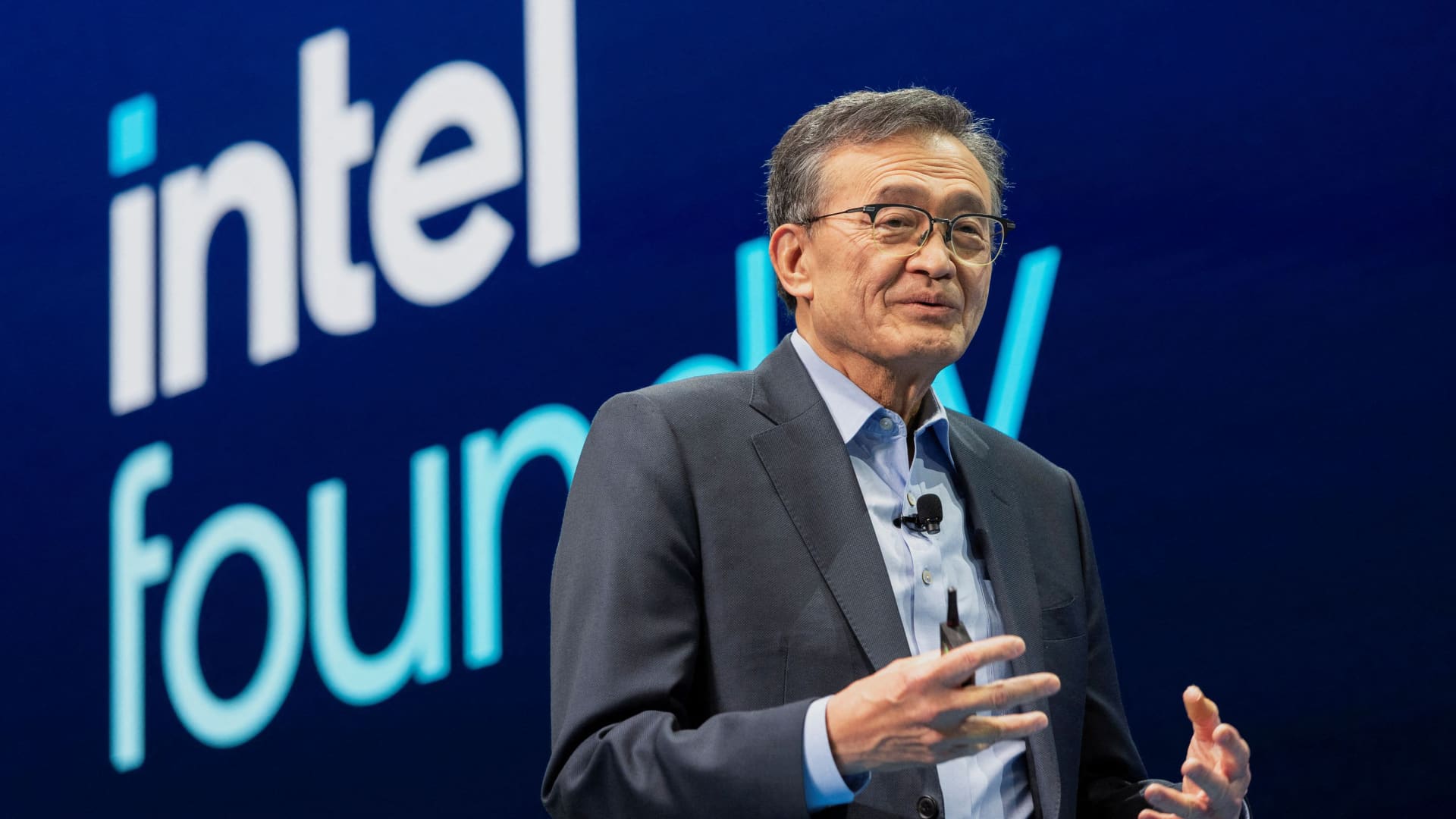

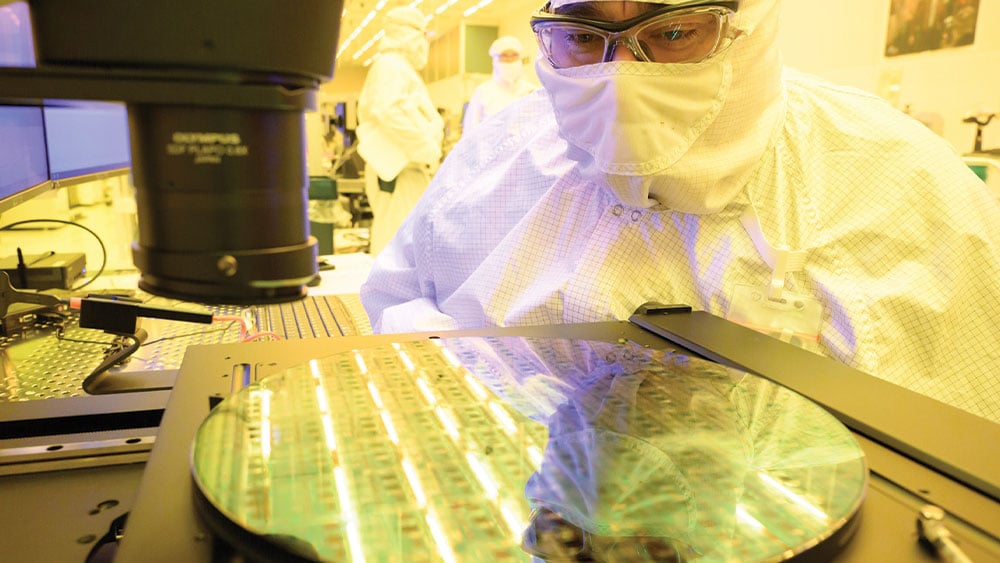

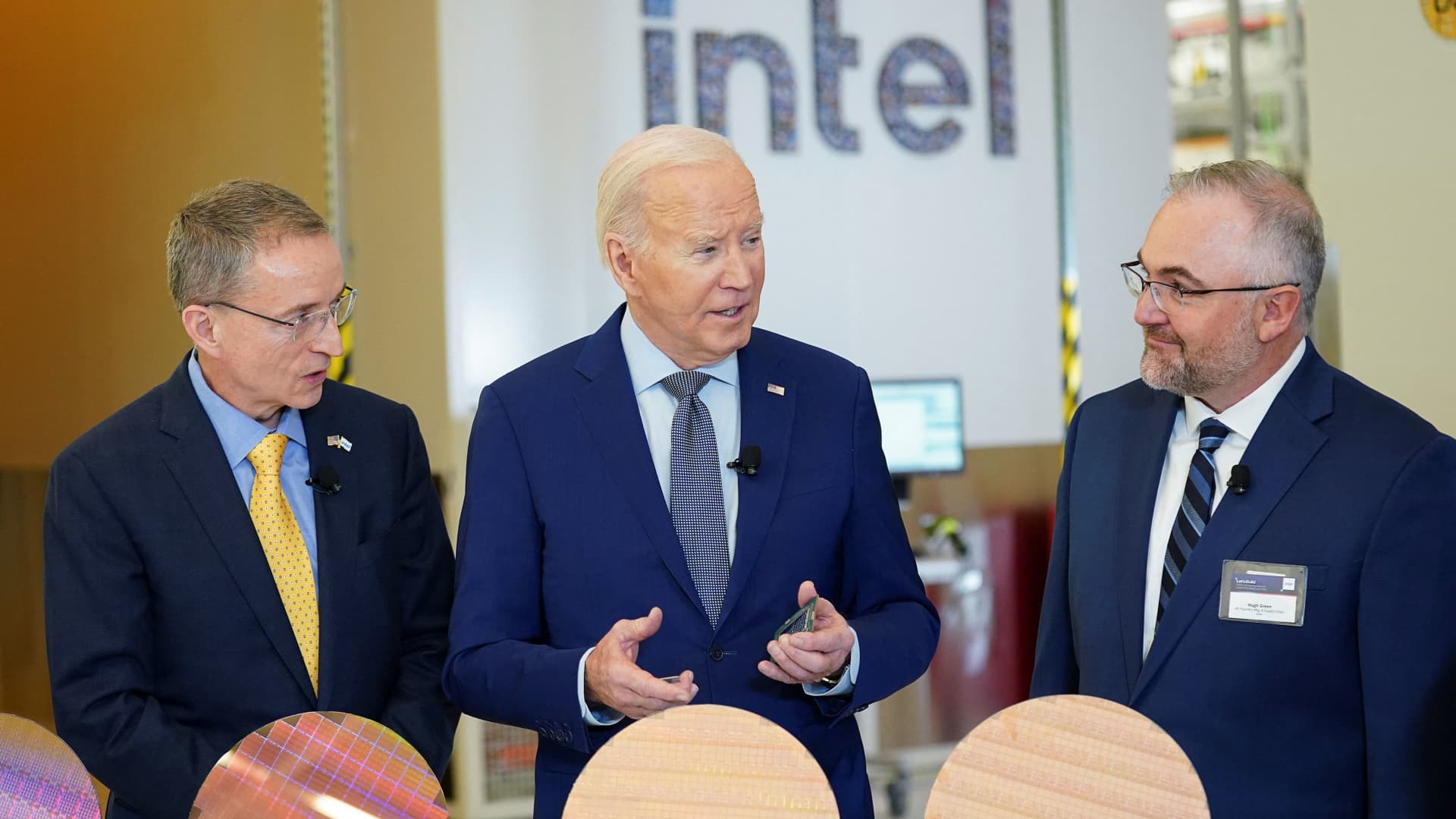

Samsung Electronics' customers have praised the competitiveness of its next-generation HBM4 chips, with the company aiming to catch up with rivals like SK Hynix in AI chip markets, while also expanding its foundry business through major deals such as with Tesla. Despite positive market performance and record highs, Samsung faces challenges from rising component costs and global trade risks as it seeks to maintain its competitive edge.