Shadow Banking Surges Past $250 Trillion, Raising Global Risks

The article discusses how traditional banks' asset growth is being surpassed by non-traditional financial institutions, highlighting a shift in the financial industry landscape.

All articles tagged with #financial industry

The article discusses how traditional banks' asset growth is being surpassed by non-traditional financial institutions, highlighting a shift in the financial industry landscape.

Morgan Stanley has surpassed Goldman Sachs to become the leading firm in equities trading, highlighting a shift in market dynamics and competition within the financial industry.

Wall Street investment banking revenues are expected to exceed $9 billion, highlighting strong performance in the financial sector.

Intercontinental Exchange (ICE) has taken a $2 billion stake in prediction markets platform Polymarket, valuing the company at around $8 billion, signaling growing mainstream acceptance of prediction markets and potential industry expansion by 2030.

The article reports on a significant raid by Citi on JPMorgan's investment banking division, involving double-digit personnel changes or disruptions, highlighting ongoing competition and restructuring within the financial industry.

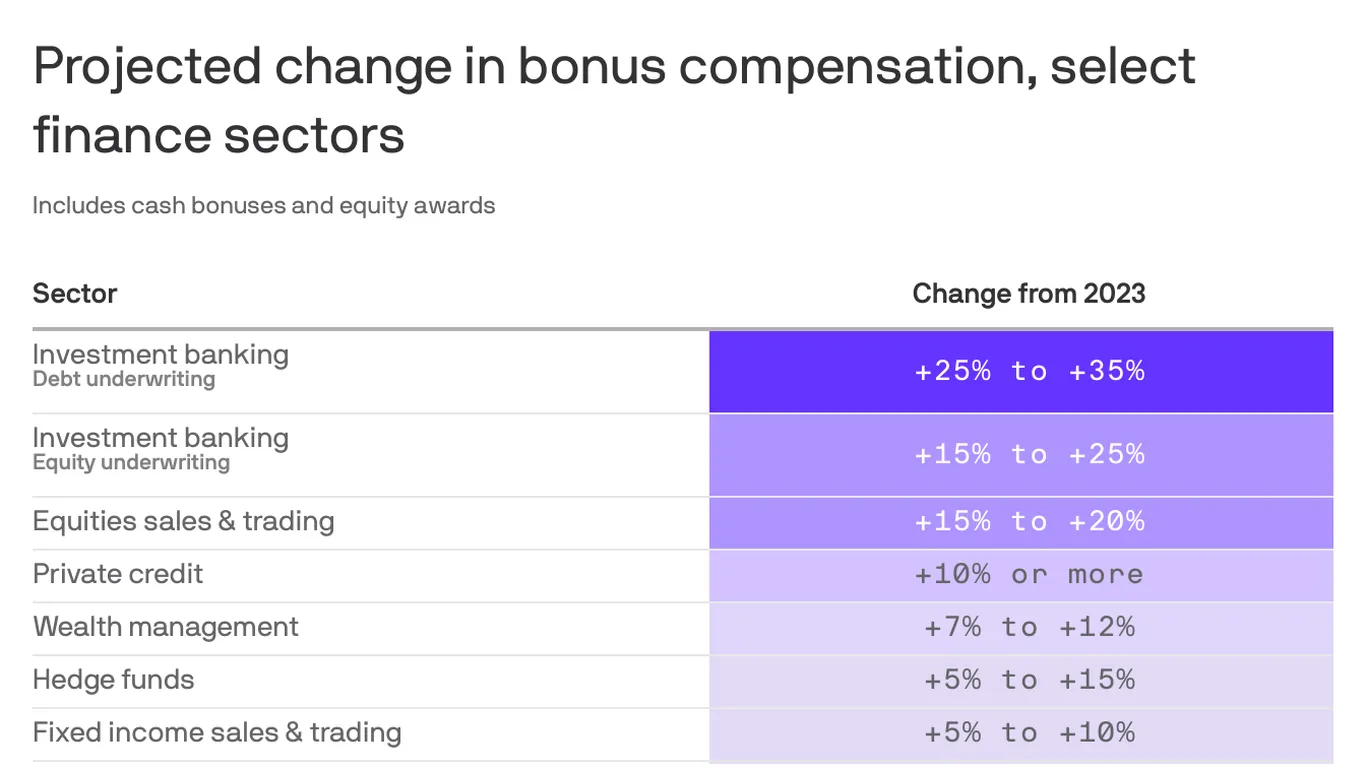

Wall Street bonuses are expected to increase in 2025 across most sectors due to a market rebound and increased trading activity, despite ongoing tariff uncertainties. Investment banking, trading, and asset management are seeing positive outlooks, with bonuses potentially rising significantly, although some areas like M&A and corporate finance may see modest gains or declines due to economic and geopolitical challenges. Firms are also focusing on cost management and automation to improve efficiency.

The UK Supreme Court limited the potential compensation payouts for car finance mis-selling, ruling that most claims based on undisclosed commissions are invalid, though some cases with egregious misconduct may still lead to billions in redress. The industry has avoided a massive payout, but some claims remain possible, especially related to unfair agreements and discretionary commission deals, with estimates still reaching up to £13bn.

President Donald Trump signed the GENIUS Act, establishing a regulatory framework for dollar-pegged stablecoins, aiming to legitimize and mainstream their use for payments and transfers, with potential growth to $2 trillion by 2028, and boosting demand for U.S. Treasuries.

JPMorgan has announced it will terminate analysts who accept future-dated job offers from other companies, highlighting its strict employment policies in the financial sector.

The House Judiciary Committee has released an interim report alleging that a "climate cartel" consisting of financial firms and climate activists engaged in collusion and anticompetitive behavior to enforce ESG goals on U.S. companies. The report claims that this group attempted to replace Exxon Mobil board members in 2021 after the company refused to commit to certain climate pledges.

Elon Musk has called for the elimination of the Consumer Financial Protection Bureau (CFPB), aligning with President-elect Donald Trump's broader agenda to reduce federal regulatory agencies. Musk's statement comes as the CFPB finalizes regulations that could impact his X platform's payment services. While Trump has not explicitly called for the CFPB's abolition, he is expected to ease its regulatory agenda. Eliminating the CFPB would require congressional action, a challenging prospect given past unsuccessful attempts by Republicans to dismantle the agency.

Wall Street is set to see a significant increase in year-end bonuses after two years of decline, with projections indicating a rise of up to 35% for investment bankers in debt underwriting and 15-25% for those in equity underwriting. This surge is attributed to a strong year for the financial industry, marked by record highs in the S&P 500 and a booming private credit market. However, retail and commercial bankers may see smaller bonuses due to weaker loan demand and tighter standards, while commercial real estate remains stagnant. The impact of upcoming policy changes from the new administration remains uncertain.

American Express exceeded profit expectations in the first quarter, driven by increased spending from its affluent customer base, particularly Gen Z and millennial customers. The company reported a profit of $3.33 a share, surpassing analysts' average expectation of $2.96 a share. Despite concerns over the financial well-being of lower-income consumers impacting other lenders, AmEx's clientele shielded the company from significant impact. The company maintained revenue growth expectations of 9% to 11% for the full year.

Citigroup is set to complete the first phase of its 20,000 job cuts this week, with CEO Jane Fraser announcing the largest round of cuts yet. Meanwhile, Barclays' top trader, Carl Scott, has left after complaints about bonuses, raising concerns about potential departures of other recent hires. Additionally, other news in the financial industry includes HSBC's investment banking team leader leaving, the FCA's controversial hiring decision, and Bridgewater's response to discrimination accusations.

Tim Buckley, the chief executive of Vanguard, is set to leave the $9 trillion asset manager later this year. Buckley has been with Vanguard for over 30 years and has served as CEO since 2018. The company has not yet announced a successor, but Buckley's departure marks a significant leadership change in the financial industry.