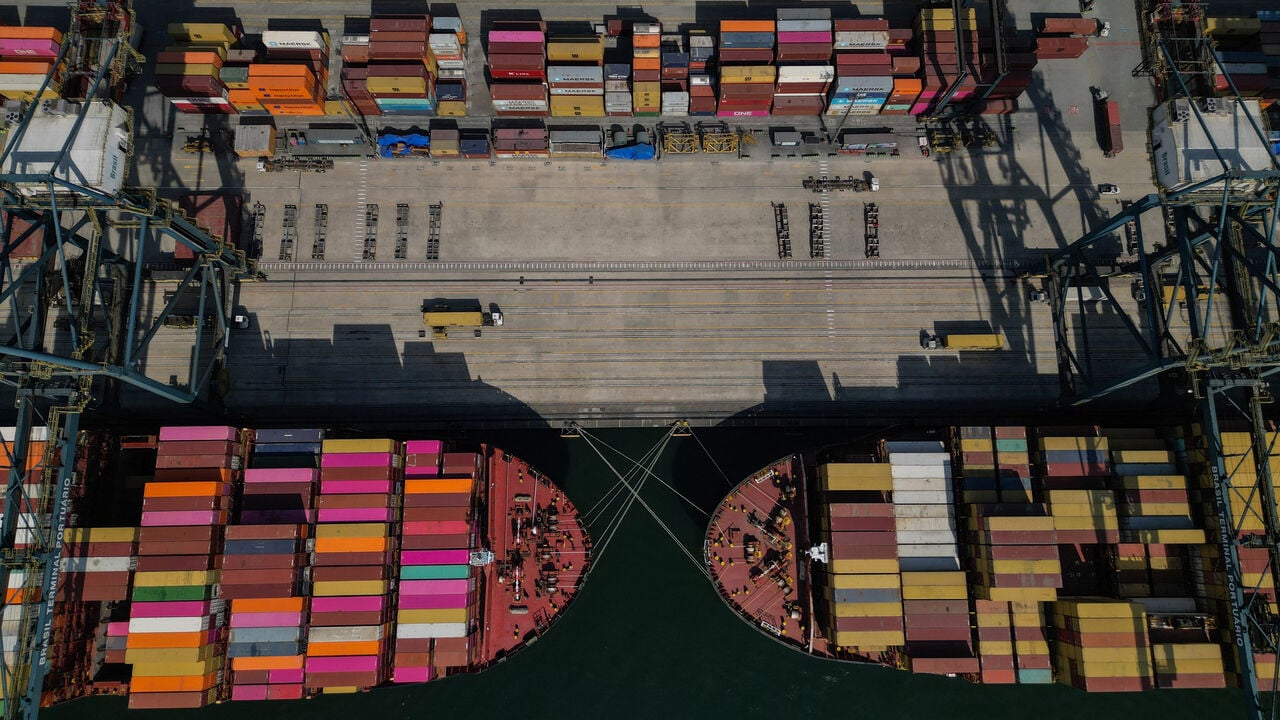

Paris tractors pressure EU to rethink Mercosur deal

French farmers blocked central Paris with tractors to pressure the government and the EU over the EU–Mercosur free-trade agreement, arguing it threatens French agriculture with cheaper South American imports. Organized by FNSEA and Jeunes Agriculteurs, protesters planned to stay overnight as talks continue, with a further demonstration planned at the European Parliament in Strasbourg on Jan 20 and government measures tied to the 2026 budget.