Fed Officials Downplay Inflation Concerns Amid Measurement Challenges

Stephen Miran argues that the Federal Reserve's decisions are being influenced by 'phantom inflation,' which may distort monetary policy and economic outlooks.

All articles tagged with #economic analysis

Stephen Miran argues that the Federal Reserve's decisions are being influenced by 'phantom inflation,' which may distort monetary policy and economic outlooks.

Since ChatGPT's launch, the US stock market has surged while job openings have fallen sharply, but economist Derek Thompson argues that the primary causes are monetary policy, trade and immigration policies, rather than AI itself. The decline in jobs is more linked to interest rate hikes and trade restrictions, with AI-related sectors showing less decline than others, and AI stocks contributing significantly to market gains. The situation highlights a divided economy: a booming AI-driven sector and a sluggish broader job market.

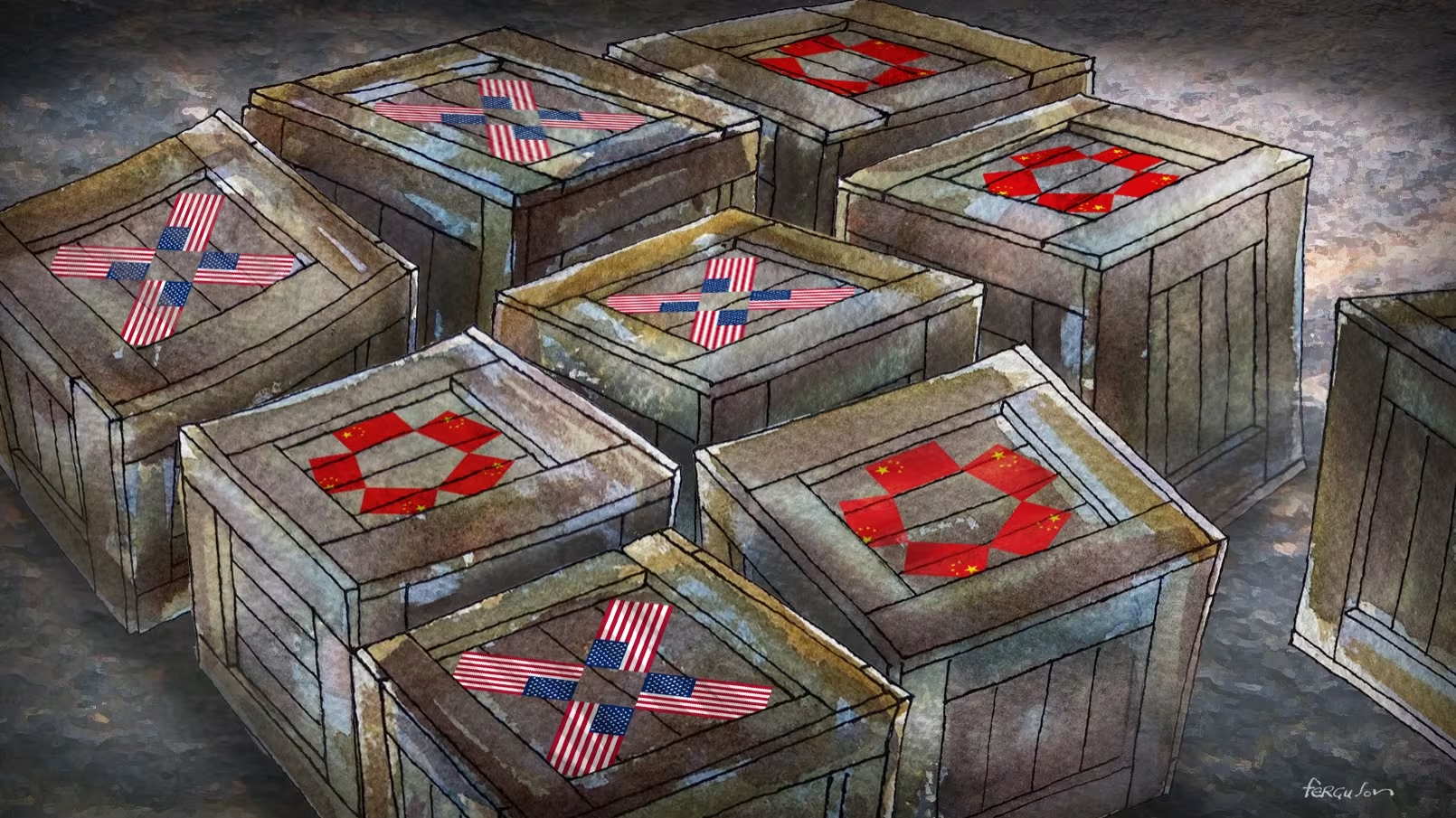

An S&P Global report estimates that President Trump's tariffs will cost companies and consumers around $1.2 trillion in 2025, with most of the burden falling on consumers through higher prices, especially affecting lower- and middle-income households, while corporate profits decline and output decreases.

The article discusses the current state of the global economy amid disorder, emphasizing the importance of quality financial journalism provided by the Financial Times, which offers various subscription plans for digital access.

The article discusses how labour markets are currently stuck in a 'low-hire, low-fire' cycle, indicating a sluggish employment environment with limited hiring and firing activity, which may impact economic growth and flexibility.

The Federal Reserve's preferred inflation measure, the core PCE Price Index, rose to an annual rate of 2.8% in October, driven by strong consumer spending. This increase challenges the Fed's efforts to control inflation, despite a stable labor market and rising personal incomes. The data release led to a decline in U.S. stocks and a slight increase in bond yields. Analysts express concerns over potential inflationary pressures from trade policies and debate the likelihood of a Fed rate cut next month.

The U.S. trade deficit in goods and services rose to $84.4 billion in September 2024, a 19.2% increase from August. Exports decreased by 1.2% to $267.9 billion, while imports increased by 3.0% to $352.3 billion. The goods deficit grew by $14.2 billion, while the services surplus increased by $0.6 billion. Year-to-date, the trade deficit has risen by 11.8% compared to 2023, with exports up 3.7% and imports up 5.3%. The next report is scheduled for December 5, 2024.