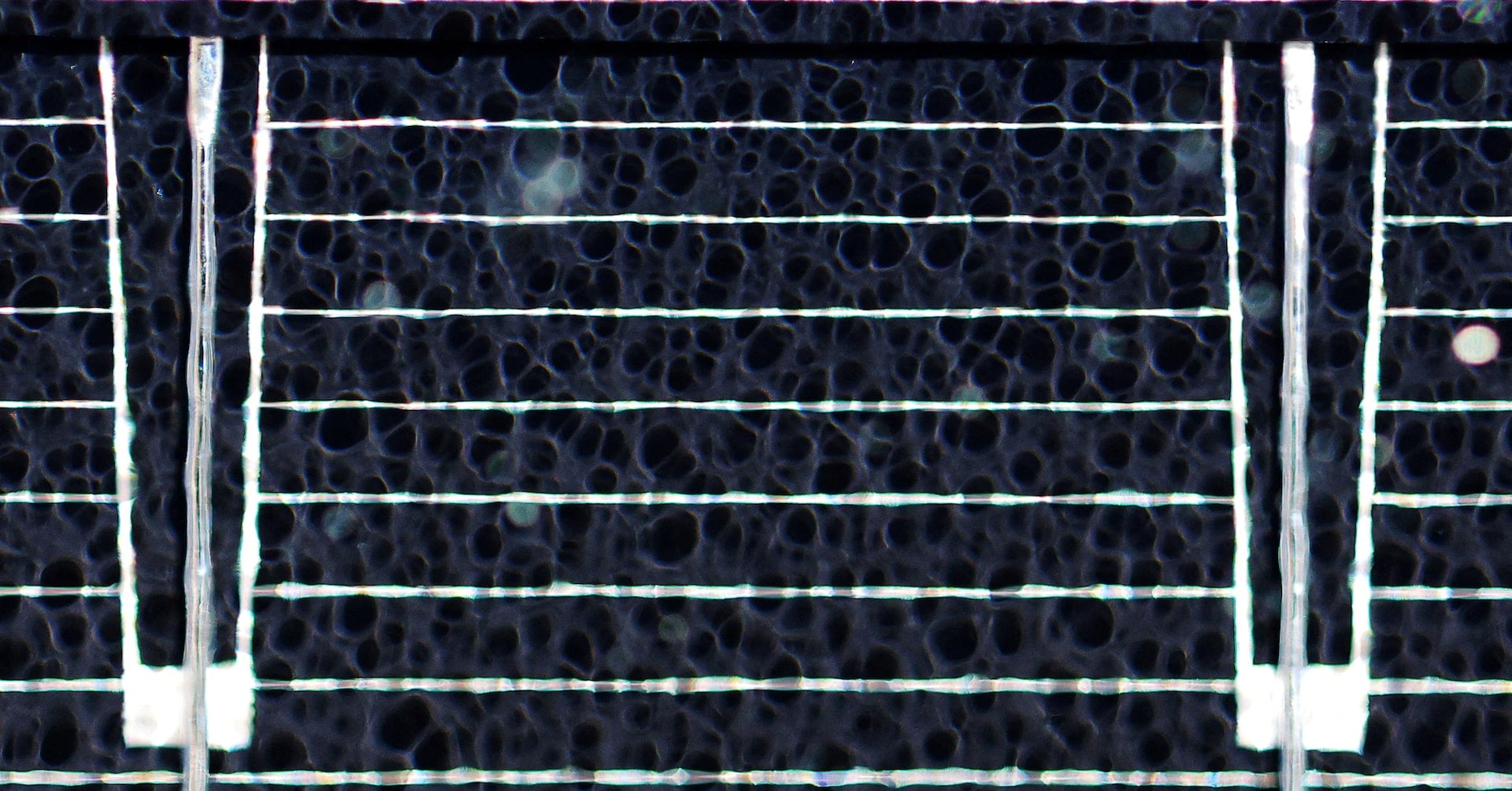

"US Considers Reinstating Tariffs on Solar Technology, Impact on Industry"

The Biden administration is expected to reverse a two-year-old trade exemption that allowed imports of a dominant solar panel technology from China and other countries to avoid tariffs, in response to a request by South Korea’s Hanwha Qcells. This decision is aimed at protecting a pledged $2.5 billion expansion of Qcells' U.S. solar manufacturing presence against competition from cheaper Asian-made products. The move has caused shares of solar manufacturers, including U.S.-based First Solar, to rise. The decision is part of the administration's efforts to address threats posed by China's massive investment in clean energy goods and to ensure a level playing field for U.S. companies and workers in the solar industry.