Business Politics News

The latest business politics stories, summarized by AI

Featured Business Politics Stories

"Oberweis Dairy Declares Bankruptcy"

Oberweis Dairy, a century-old North Aurora dairy known for its ice cream stores and Republican political aspirations by its owner, has filed for Chapter 11 bankruptcy protection. The family-owned dairy owes more than $4 million to its 20 largest unsecured creditors, with Bartlett-based Italian food service company Greco & Sons listed as the largest unsecured creditor. Despite its regional expansion and presence in grocery stores, financial challenges have led to this filing. Jim Oberweis, the grandson of the dairy's founder, pursued a career in Republican politics, with several unsuccessful bids for political office.

More Top Stories

Trump's Truth Social Stock Plummets, Erasing Billions in Value

Fortune•1 year ago

"Elon Musk's Clash in Brazil Sparks Debate on Social Media Controls"

Business Insider•1 year ago

More Business Politics Stories

"Trump's Truth Social Stock Plunge Removes Him from Bloomberg Billionaires Index"

Donald Trump has dropped off Bloomberg's list of the world's 500 wealthiest people as the value of his meme stock, TMTG, plummeted, causing his net worth to fall below the required threshold. Trump's wealth surged earlier this year due to his stake in Trump Media & Technology Group, but the stock's 53% decline in two weeks has led to a significant decrease in his net worth. This comes as Trump faces a $454 million judgment in a New York fraud case and a $175 million bond demand while he appeals the decision.

Minneapolis Prepares for Uber and Lyft Exit as New Rideshare Options Emerge

Uber and Lyft plan to exit the Minneapolis market on May 1 in response to a new city ordinance requiring them to pay drivers a higher rate. The ordinance mandates a minimum rate of $1.40 per mile and $0.51 per minute, which the companies argue is too high. The move has sparked debate, with some supporting the ordinance to ensure fair wages for drivers, while others oppose it due to concerns about losing access to ride-hailing services. The state government and city council are considering potential actions to address the situation, while residents and drivers are divided on the issue.

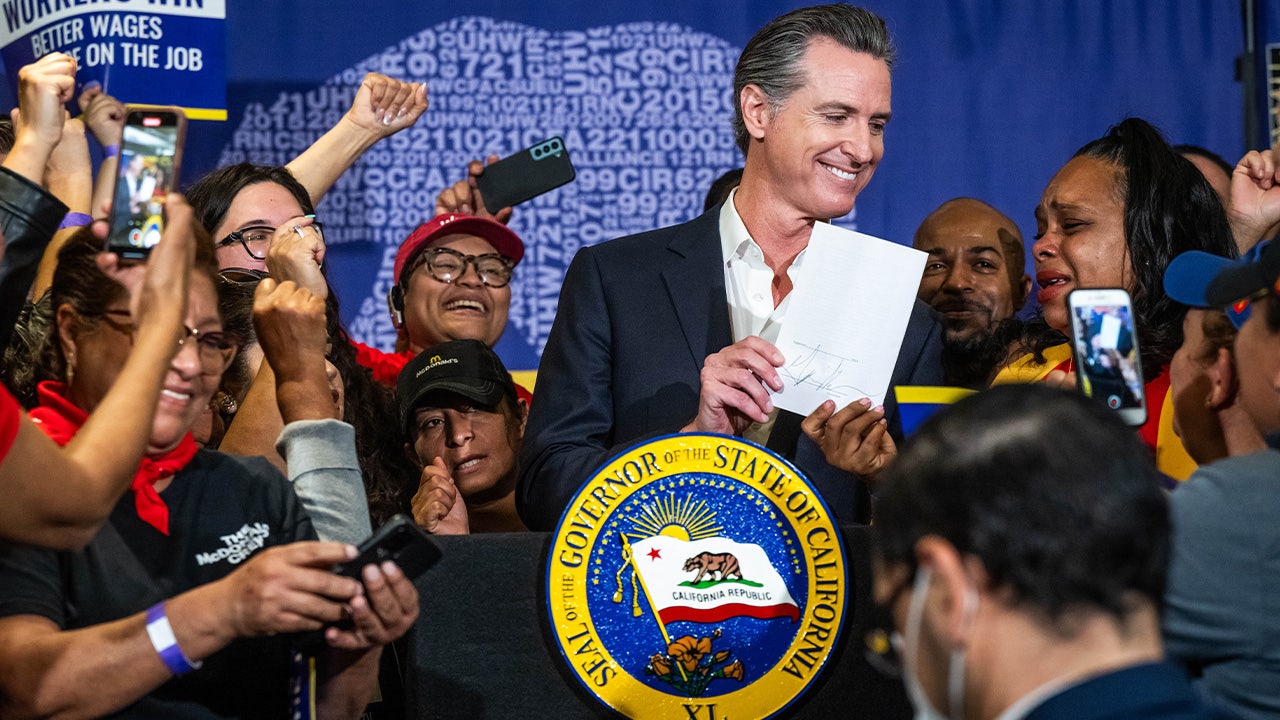

"California Fast-Food Fallout: Minimum Wage Mandate Sparks Controversy and Economic Shift"

California's new law mandating a $20 hourly minimum wage at quick-service restaurants has led to higher prices, job cuts, and shuttered businesses, despite warnings from business owners and trade groups. The compromise law eliminated joint employer liability but still poses challenges for small business owners. The Biden Administration's NLRB is pursuing a similar joint employer policy at the national level, and small business owners in California are facing an unfriendly climate, leading to job losses and business relocations. Politicians, influenced by labor unions, are pushing for even higher minimum wages, but voters are starting to push back against these policies.

Billionaire CEO Don Hankey's Role in Trump's $175 Million Bond Under Scrutiny

Don Hankey, CEO of the company that helped Donald Trump pay his civil fraud bond, is under scrutiny due to his ongoing relationship with the Trump family and his company's links to controversial entities. Hankey, who heads Knight Specialty Insurance Company and Axos Bank, has faced criticism for his business practices, including high-interest rates and alleged dubious lending practices. The company's involvement in financing real estate transactions with Jared Kushner's Kushner Companies and lawsuits against it have also drawn attention. Hankey, a Trump supporter, defended his decision to help Trump pay the bond, while Trump's attorney expressed confidence in overturning the verdict on appeal.

Trump's Truth Social Plunge Wipes Out Billions

Shares for Trump Media fell by 26% after reporting a net loss of $58 million, causing Trump's net worth on paper to decrease by over a billion dollars. The stock's performance has been questioned due to the lackluster performance of its core product, Truth Social, which has far fewer users than major social media platforms. This setback comes at a time when Trump is facing significant legal debts, including a $175 million appeal bond in a civil fraud case and $83.3 million in defamation damages to E. Jean Carroll.

"Trump Media's Truth Social Reports $58 Million Loss, Stock Plunges Over 25%"

Former President Donald Trump's social media company, Truth Social, reported a loss of over $58 million in 2023, causing its stock to plummet by more than 25%. The company's revenue was just over $4 million, significantly lower than its investor-driven valuation. Trump, who owns about 57% of the firm, saw a substantial decrease in his wealth due to the stock's decline. Truth Social has struggled to gain a broad audience and faces financial challenges, including doubts about its ability to pay debts. Despite this, the company aims to invest in marketing, advertising, and technology to expand its user base.

"Jim Cramer Warns of Potential 95% Drop in Trump's Truth Social Stock"

Trump Media & Technology Group Corp, trading under the DJT ticker, has drawn attention as a "meme stock" with its valuation being flagged as "overvalued" by CNBC's Jim Cramer. The company's market cap far exceeds its modest revenue and operational losses, and its stock price is being driven by a mix of Trump's supporters and speculative traders, detached from traditional financial metrics. The stock's status as a meme stock is further magnified by significant short interest and its association with the 2024 election cycle. Despite the company's positive stock performance, former president Donald Trump faces constraints on liquidating his shares due to market regulations, and the necessity to post a reduced $175 million bond in his New York fraud case.

"Trump's Media Company Soars 50% in Wall Street Debut"

Donald Trump's media company, Trump Media & Technology Group, saw its stock surge over 50% on its first day of trading on the Nasdaq, with the ticker name DJT. Trump's majority stake in the company raised his value to around $5.9 billion, earning him a spot on the Bloomberg Billionaires Index. The surge in stock price was fueled by news of a reduced bond in his civil fraud case, allowing him to avoid immediate financial ruin. However, lock-up restrictions prevent him from accessing the wealth for six months. The company's debut comes after a merger with Digital World Acquisition Corp, and Trump has pledged to post the reduced bond to prevent the state from seizing his assets while he appeals the civil case.

"Trump's Net Worth Soars to $6.4 Billion, Enters Top 500 Richest People Worldwide"

Donald Trump's net worth has surged to $6.4 billion after Digital World Acquisition shareholders voted to merge with his Truth Social platform, making him one of the world's 500 richest people. Despite facing a $175 million court judgment, Trump claims to have nearly $500 million in cash and has 10 days to come up with the amount. The surge in his net worth is attributed to the stock price of the merged company, which will be publicly traded on the NASDAQ. However, restrictions may prevent him from using his stake to pay the judgment, and Forbes estimates his net worth at $2.6 billion.

"Trump's Truth Social: A Rollercoaster Ride of Wealth and Influence"

Donald Trump expressed his love for Truth Social after Digital World Acquisition Corp.'s stock plunged nearly 14% following shareholder approval of a merger with Trump's social media company. The decline in stock price raises concerns about the new company's revenue potential and Trump's legal troubles, including civil judgments and mounting legal bills. Trump's ownership stake in the newly merged company could be affected, and there are worries that he may try to sell shares to cover his legal costs, further impacting the share price. Trump Media will use the ticker symbol DJT when it begins trading on the NASDAQ stock market, but concerns about the company's financial prospects persist given Trump's history with publicly traded companies.