Altman argues AI's energy use mirrors human learning, urges rapid move to renewables

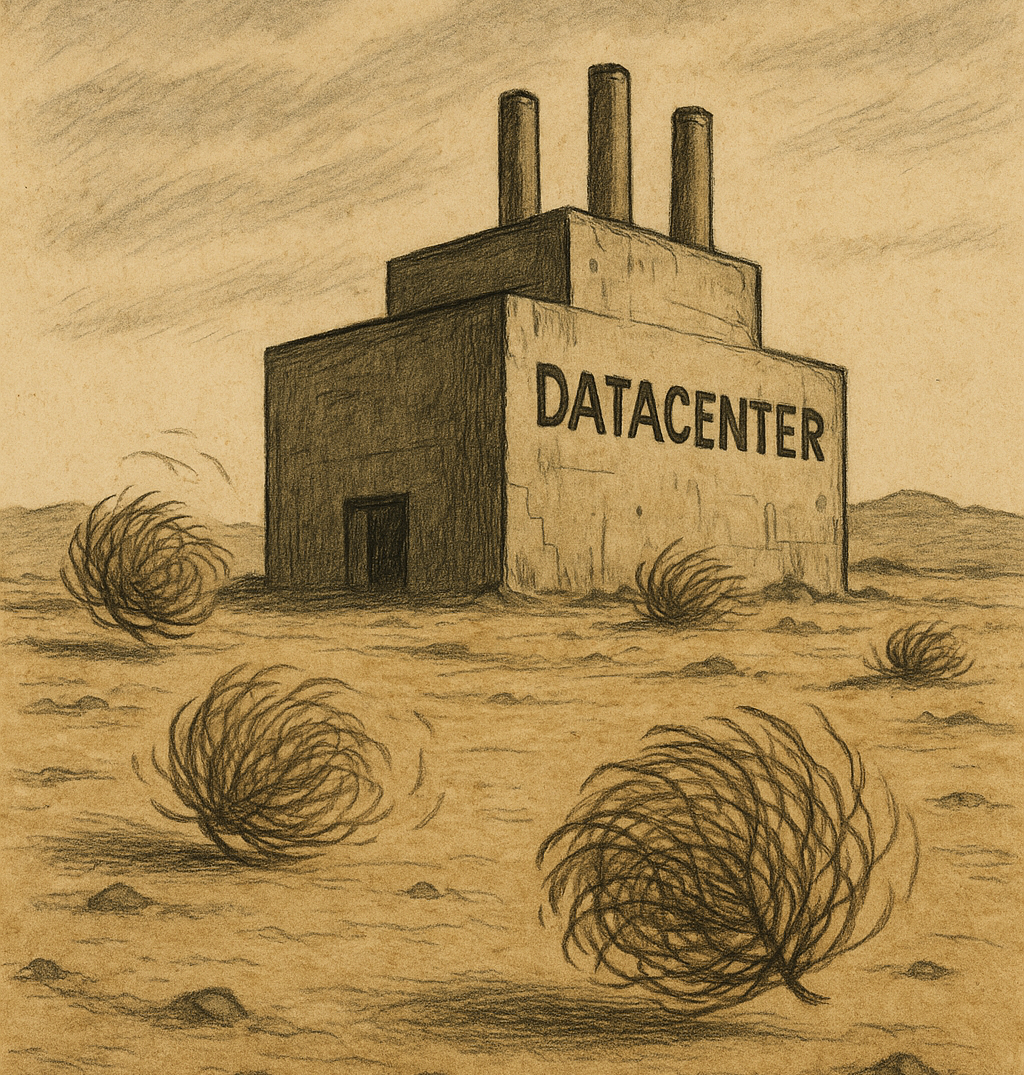

OpenAI CEO Sam Altman defended AI’s power usage by comparing it to the energy needed to raise a human, while urging a swift switch to nuclear and renewable power. The discussion comes amid rising concerns over datacenter electricity and water use, with IEA data showing growing datacenter energy demand and critics warning of climate and water security risks as datacenter expansion continues. Altman's remarks drew online backlash from skeptics who questioned the net societal benefits of the technology.