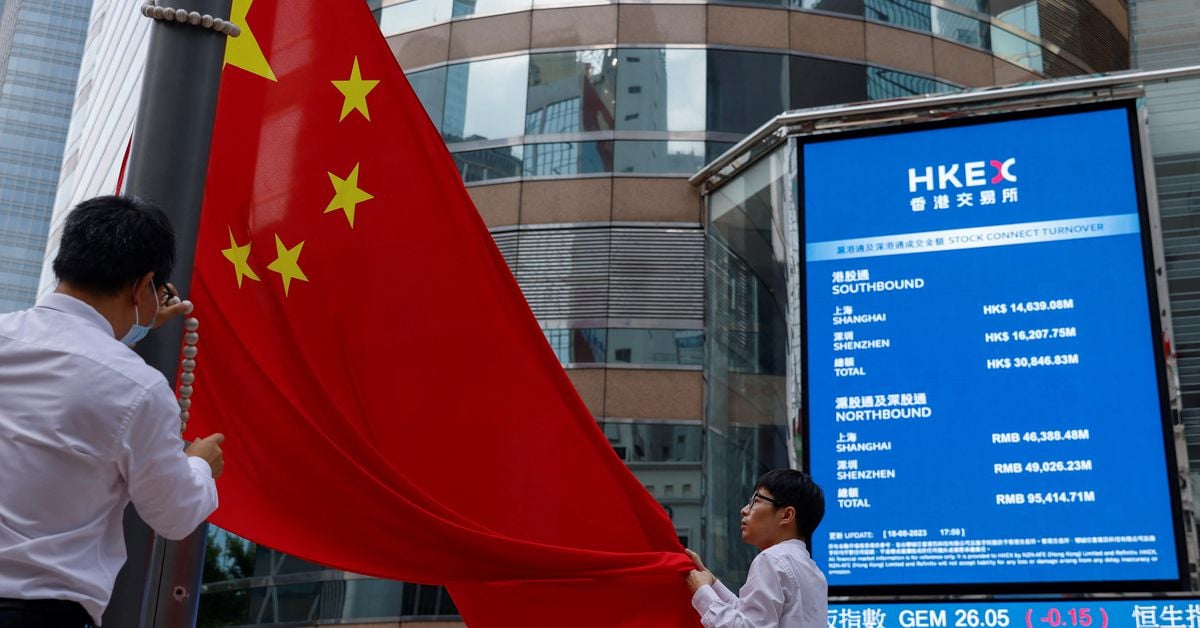

Asian Markets Hit Record High Amid Trade Deal Optimism

Asian stocks reached record highs on optimism over a potential US-China trade deal, with major indices like Nikkei crossing 50,000 and MSCI Asia-Pacific hitting a peak, amid hopes of easing trade tensions and upcoming central bank meetings. Investors are also focused on US megacap earnings and global economic signals, while safe-haven assets like gold declined.