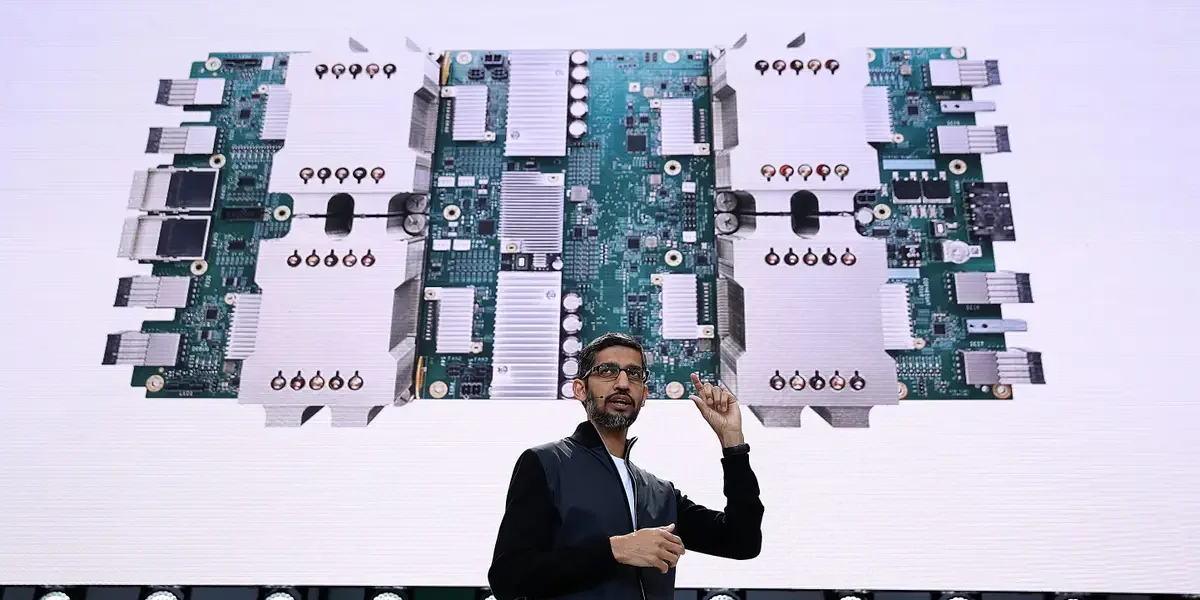

Big Tech bets record AI-driven capex for 2026 across Amazon, Alphabet, Meta and Microsoft

Big Tech unveils a record AI-driven capex surge for 2026, with Amazon planning about $200B, Alphabet $175–185B, Meta $115–135B, and Microsoft around $97–98B; investors reacted with stock declines for Amazon, Alphabet, and Meta, while Microsoft posted a modest gain, as analysts warn the ROI on massive infrastructure spending will be key and AI initiatives like Google's Gemini backlogs support the spending rationale.