Top Energy Stocks to Watch in 2026 Amid Market Challenges

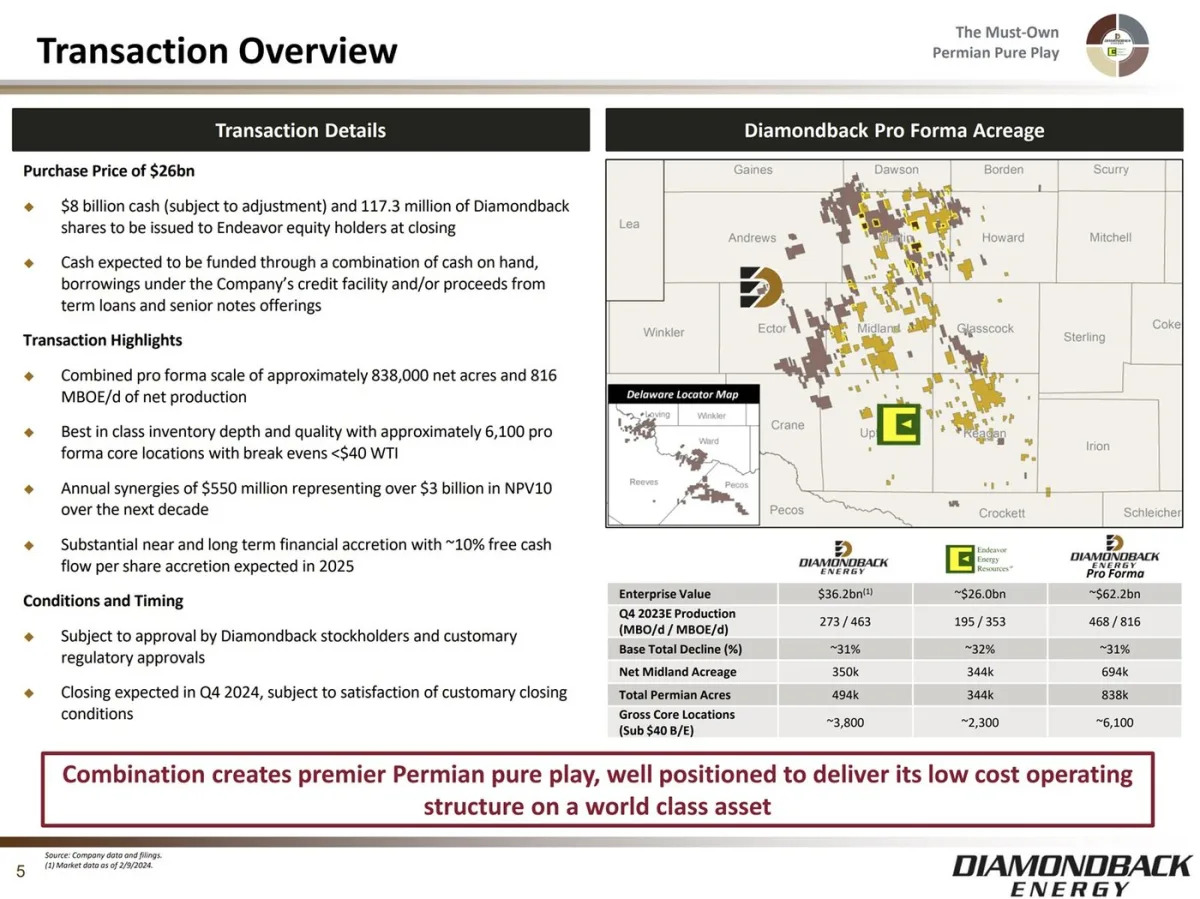

Piper Sandler's energy expert predicts a favorable outlook for gas equities over oil by 2026, highlighting top picks including Diamondback Energy, Expand Energy, and Coterra Energy, based on their strong asset bases, profitability, and growth potential amid a challenging oil market.